INDO-NATIONAL LTD (NSE: NIPPONIND) 🚀

Weekly Chart Analysis – Potential Swing Opportunity!

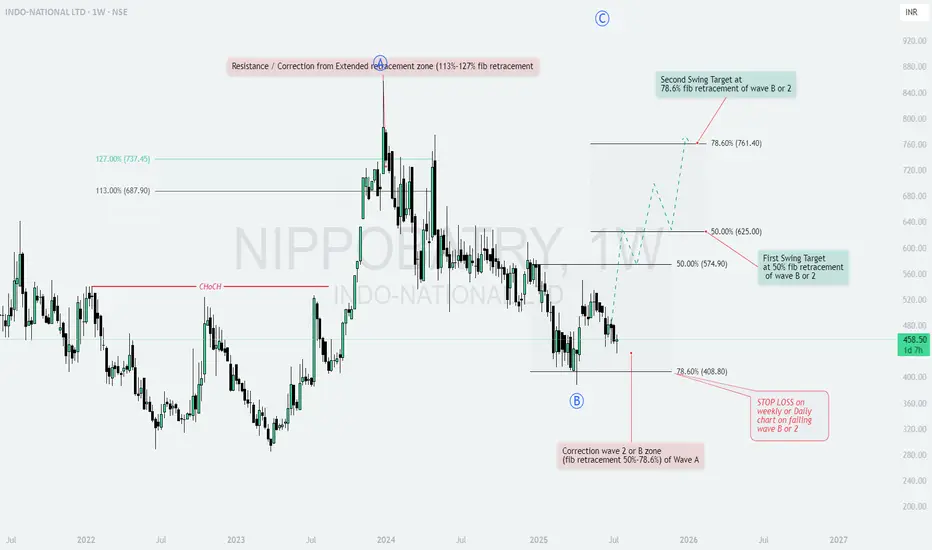

1. Structure & Setup

The stock has completed a major correction in the zone of 50%-78.6% Fibonacci retracement of Wave A (408.80–458.50).

Wave B or 2 seems to be in place, setting up for a potential bullish move.

Previous resistance and correction occurred from the extended retracement zone (113%-127% fib).

2. Key Levels & Targets

First Swing Target: 50% fib retracement of Wave B or 2 at ₹574.90–625.00 🥇

Second Swing Target: 78.6% fib retracement of Wave B or 2 at ₹761.40 🥈

Support: 78.6% fib retracement of Wave A at ₹408.80

3. Risk Management

STOP LOSS: On weekly or daily close below the correction zone (failing Wave B or 2), i.e., below ₹408.80 🚨

4. Observations & Strategy

1️⃣ Chances of a bullish reversal are high from the current zone, supported by fib retracement confluence.

2️⃣ Watch for a breakout above ₹500 for confirmation of momentum.

3️⃣ Risk/Reward is favorable for positional swing traders.

Summary:

A strong setup for a multi-month swing! Monitor price action near support and trail your stop as the move unfolds. 📈

Like & Follow for more setups! 👍✨

#NIPPONIND #SwingTrade #TechnicalAnalysis #Fibonacci #TradingView #Stocks #NSE

Weekly Chart Analysis – Potential Swing Opportunity!

1. Structure & Setup

The stock has completed a major correction in the zone of 50%-78.6% Fibonacci retracement of Wave A (408.80–458.50).

Wave B or 2 seems to be in place, setting up for a potential bullish move.

Previous resistance and correction occurred from the extended retracement zone (113%-127% fib).

2. Key Levels & Targets

First Swing Target: 50% fib retracement of Wave B or 2 at ₹574.90–625.00 🥇

Second Swing Target: 78.6% fib retracement of Wave B or 2 at ₹761.40 🥈

Support: 78.6% fib retracement of Wave A at ₹408.80

3. Risk Management

STOP LOSS: On weekly or daily close below the correction zone (failing Wave B or 2), i.e., below ₹408.80 🚨

4. Observations & Strategy

1️⃣ Chances of a bullish reversal are high from the current zone, supported by fib retracement confluence.

2️⃣ Watch for a breakout above ₹500 for confirmation of momentum.

3️⃣ Risk/Reward is favorable for positional swing traders.

Summary:

A strong setup for a multi-month swing! Monitor price action near support and trail your stop as the move unfolds. 📈

Like & Follow for more setups! 👍✨

#NIPPONIND #SwingTrade #TechnicalAnalysis #Fibonacci #TradingView #Stocks #NSE

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.