Good Afternoon,

Hope all is well. Here is a review on NPWR

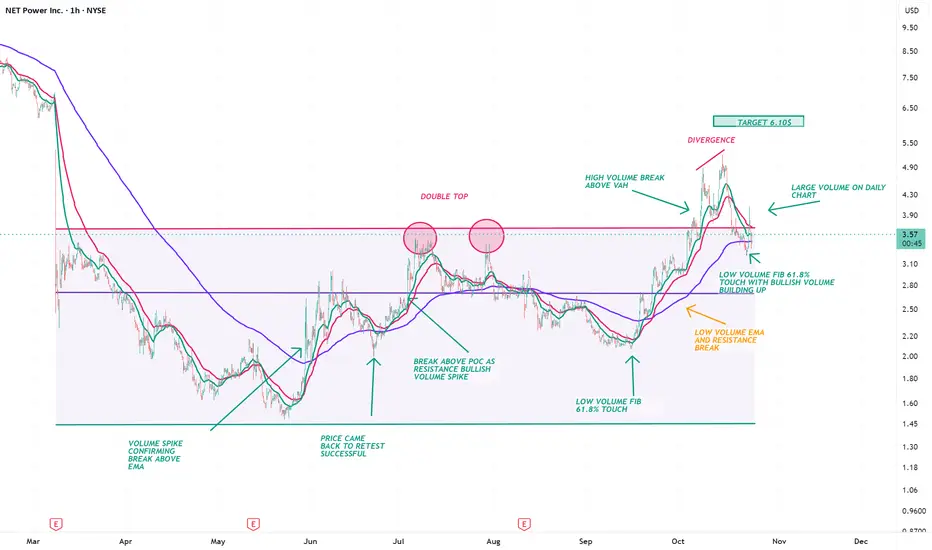

As a clean energy technology company, NET Power has received mixed ratings from analysts, and its stock has experienced volatility. A major shareholder, NPEH, recently sold $1.68 million worth of shares between October 20 and October 22, 2025, amid a 12% drop in the stock price the previous week.

Other factors impacting the company include:

Project Permian (SN1): Progress is being made on the company's first commercial-scale facility to identify potential cost savings.

Feasibility Studies: Studies for a standardized, modular multi-unit plant are underway to reduce future project costs and meet larger generation capacity demands.

High Capital Expenditure: The initial capital expenditure for the first plant remains high, estimated between $1.6 and $1.9 billion.

Technology Concerns: The NET Power cycle requires a significant auxiliary load, and full commercialization of the core cycle is not expected until 2030.

Trade Safely!

Enjoy!

Hope all is well. Here is a review on NPWR

As a clean energy technology company, NET Power has received mixed ratings from analysts, and its stock has experienced volatility. A major shareholder, NPEH, recently sold $1.68 million worth of shares between October 20 and October 22, 2025, amid a 12% drop in the stock price the previous week.

Other factors impacting the company include:

Project Permian (SN1): Progress is being made on the company's first commercial-scale facility to identify potential cost savings.

Feasibility Studies: Studies for a standardized, modular multi-unit plant are underway to reduce future project costs and meet larger generation capacity demands.

High Capital Expenditure: The initial capital expenditure for the first plant remains high, estimated between $1.6 and $1.9 billion.

Technology Concerns: The NET Power cycle requires a significant auxiliary load, and full commercialization of the core cycle is not expected until 2030.

Trade Safely!

Enjoy!

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.