📊 Technical Analysis – NQ1! | NASDAQ 100 E-mini Futures

📅 05/20/2025 | 🧠 Based on the NEXUS Method

⏱️ Timeframe: 30 minutes

🧠 Market Context

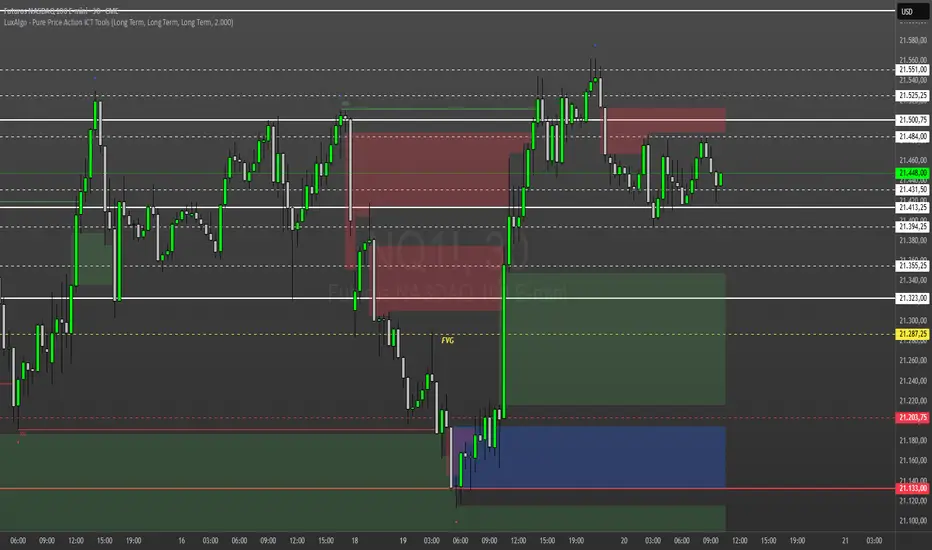

The market reacted strongly after reaching the 21,133.00 region, an institutional defense zone marked by a high concentration of buying orders. From there, a significant expansion occurred with partial mitigation of the Fair Value Gap (FVG) at 21,287.25, followed by a strategic retraction.

Currently, the price is consolidating below a mitigated supply zone (21,484–21,525), showing signs of possible redistribution.

🧭 Relevant Technical Points

🔵 Supply Region – 21,484.00 to 21,525.25

Critical zone where the price was rejected after the last upward movement.

📌 Importance: Area of institutional interest for selling.

🧨 If it breaks with a full candle, it can seek 21,551.00 and 21,560.00.

❗ If it rejects again, it is a sign that liquidity was used to reposition sell orders.

⚪ Neutral Zone – 21,431.50 to 21,413.25

Post-BOS consolidation range, acting as a recent structure level.

📌 Importance: Trend confirmation.

👉 Loss of this zone can return the price to FVG below.

🟨 FVG (Fair Value Gap) – 21,287.25

Unmitigated region of the gap generated by the institutional rally.

📌 Importance: Target of technical pullback or possible institutional buying entry.

📈 If there is a clear rejection here, it could be a point of continuation of the rally.

🔴 Reactive Liquidity Zone – 21,203.75 to 21,133.00

Previous institutional defense region where the rally began.

📌 Importance: If the price returns, this area will act as the last buying defense before the structure is reversed.

🔄 Structure Reading

✅ BOS confirmed with breakout of the previous structure during the bullish explosion;

❗ MSS (Market Structure Shift) has already occurred in the rejection of the premium zone — the market may be redistributing before a new drop;

🔍 Still no break of the main structure (21,413) — full attention zone.

🎯 Strategic Scenarios

📈 Bullish Continuation Scenario

Rejection of FVG (21,287);

Retest of the 21,413 zone with a strong candle;

Target: 21,484 and then 21,551.

📉 Bearish Reversal Scenario

Clear rejection in the 21,484–21,525 region;

Loss of structure at 21,413 and 21,394;

Target: full mitigation of FVG and possible extension to 21,203 and 21,133.

📌 Operational Summary – Technical Levels

Region Technical Function Relevant Action

21,525–21,484 Institutional Offer Sell or Final Buy Target

21,413–21,394 Neutral Structure Trend Confirmation

21,287.25 FVG Technical Entry or Defensive Pullback

21,203–21,133 Institutional Support Last Defense Before Reversal

🔍 Conclusion

We are between two worlds: the market awaits definition.

FVG's defense will be decisive. Rejected and rose? Buyers in control.

Lost structure and returned? Redistribution confirmed.

📅 05/20/2025 | 🧠 Based on the NEXUS Method

⏱️ Timeframe: 30 minutes

🧠 Market Context

The market reacted strongly after reaching the 21,133.00 region, an institutional defense zone marked by a high concentration of buying orders. From there, a significant expansion occurred with partial mitigation of the Fair Value Gap (FVG) at 21,287.25, followed by a strategic retraction.

Currently, the price is consolidating below a mitigated supply zone (21,484–21,525), showing signs of possible redistribution.

🧭 Relevant Technical Points

🔵 Supply Region – 21,484.00 to 21,525.25

Critical zone where the price was rejected after the last upward movement.

📌 Importance: Area of institutional interest for selling.

🧨 If it breaks with a full candle, it can seek 21,551.00 and 21,560.00.

❗ If it rejects again, it is a sign that liquidity was used to reposition sell orders.

⚪ Neutral Zone – 21,431.50 to 21,413.25

Post-BOS consolidation range, acting as a recent structure level.

📌 Importance: Trend confirmation.

👉 Loss of this zone can return the price to FVG below.

🟨 FVG (Fair Value Gap) – 21,287.25

Unmitigated region of the gap generated by the institutional rally.

📌 Importance: Target of technical pullback or possible institutional buying entry.

📈 If there is a clear rejection here, it could be a point of continuation of the rally.

🔴 Reactive Liquidity Zone – 21,203.75 to 21,133.00

Previous institutional defense region where the rally began.

📌 Importance: If the price returns, this area will act as the last buying defense before the structure is reversed.

🔄 Structure Reading

✅ BOS confirmed with breakout of the previous structure during the bullish explosion;

❗ MSS (Market Structure Shift) has already occurred in the rejection of the premium zone — the market may be redistributing before a new drop;

🔍 Still no break of the main structure (21,413) — full attention zone.

🎯 Strategic Scenarios

📈 Bullish Continuation Scenario

Rejection of FVG (21,287);

Retest of the 21,413 zone with a strong candle;

Target: 21,484 and then 21,551.

📉 Bearish Reversal Scenario

Clear rejection in the 21,484–21,525 region;

Loss of structure at 21,413 and 21,394;

Target: full mitigation of FVG and possible extension to 21,203 and 21,133.

📌 Operational Summary – Technical Levels

Region Technical Function Relevant Action

21,525–21,484 Institutional Offer Sell or Final Buy Target

21,413–21,394 Neutral Structure Trend Confirmation

21,287.25 FVG Technical Entry or Defensive Pullback

21,203–21,133 Institutional Support Last Defense Before Reversal

🔍 Conclusion

We are between two worlds: the market awaits definition.

FVG's defense will be decisive. Rejected and rose? Buyers in control.

Lost structure and returned? Redistribution confirmed.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.