- Key Insights: Nasdaq Futures are off to a strong start with a 1.4% gain,

bolstered by optimism in the tech sector and risk-on sentiment. However,

caution is advised as mid-week reversals could emerge, driven by

macroeconomic events and Federal Reserve commentary. Traders should monitor

yields, tech earnings, and sector tailwinds closely.

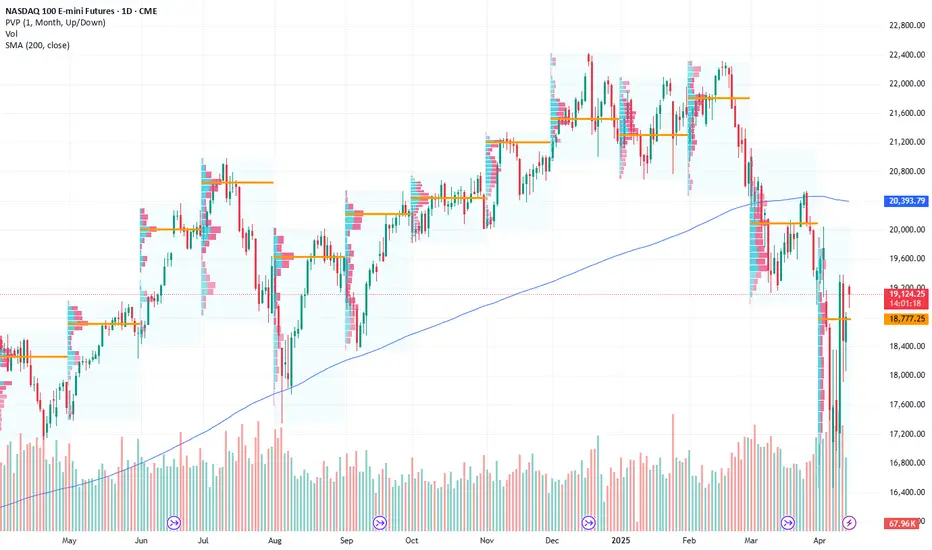

- Price Targets:

- Target Level 1 (T1): 19,400 (~3.2% higher), indicating a breakout

opportunity tied to bullish sentiment.

- Target Level 2 (T2): 19,800 (~5.3% higher), representing extended upside

momentum if T1 is breached.

- Stop Level 1 (S1): 18,200 (~3.2% lower), key downside protection in case of

a midweek reversal.

- Stop Level 2 (S2): 17,700 (~5.9% lower), deeper support for risk control

against volatility.

- Recent Performance: Nasdaq Futures gained 260 points, up 1.4% amidst strong

market sentiment, buoyed significantly by technology stocks. Weekend Wall

Street Futures also rallied 2-3%, signaling robust market positioning and

optimism leading into the new trading week.

- Expert Analysis: Analysts attribute current bullishness to the technology

sector’s leadership, strong earnings outlook, and broader risk-on appetite

reflected in correlated assets like Bitcoin. However, higher Treasury yields

(4.5%) could temper growth stocks later in the week as borrowing costs rise.

Investors are urged to monitor inflation data and sector developments for

recalibration.

- News Impact: Apple options activity hints at potential upcoming catalysts,

while Nasdaq ETF trends in QQQ suggest sustained bullishness with resistance

levels aligning to Futures analysis. Federal Reserve commentary and

inflation data may pose key risks, especially for rate-sensitive tech

stocks.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.