Once in a Lifetime Opportunity and the Psychology behind it

Once in a Lifetime Opportunity and the Psychology behind it

There are moments in the market that happen so rarely, they feel almost mythical when they finally arrive. Novo Nordisk NVO has just given us one of those moments.

NVO has just given us one of those moments.

If you’ve been following my work, you might remember my previous article where I warned that NVO was approaching a historically significant long-term yellow channel, a structure that has been respected for decades.

In fact, the lower bound of this channel has only been touched less than once per decade. And here we are again…

When price recently dipped into this “Ideal Buy Zone,” it wasn’t just touching the bottom of the yellow channel. It was also colliding with a red historical support level and the last significant VRVP volume area.

That’s triple confluence, and as traders, we live for these rare alignments.

I personally had the privilege (and yes, a bit of luck) to buy at $45.8, on what turned out to be NVO’s worst single day in years. Seeing the double support, I didn’t hesitate. And judging by the market reaction, I wasn’t alone, many others seemed to spot the same opportunity.

The Easy Part Is Over, Now Comes the Hardest Decision in Trading

I might look like a genius for catching the bottom, but let’s be honest: buying was the easy part. The true challenge now?

Deciding when to sell.

Here are the main paths forward in my head:

1. The Short-Term Quick Win

The stock rallied about 10% in just two days.

Annualized, that return is insane. Selling would lock in a solid, risk-free gain and free up capital for the next opportunity. The downside? You might watch it keep climbing without you, and you know, that's SO HARD.

✅ Guarantees an amazing annualized return (about millions %!).

❌ You lose a once in a life-time potential upside with LOW risk.

2. The Split Strategy

Sell half the position for a clean 10% profit, and let the other half ride. Set a tight stop-loss at $43.5 to protect the remaining capital.

✅ Guarantees a win on the trade while you keep upside exposure.

❌ Halves your potential upside.

3. The Long-Term Hold

Hold the full position and see where it goes, perhaps for years.

✅ Maximum potential absolute gain if the channel continues to hold and trend upwards.

❌ Keeps capital locked and will test your nerves through constant ups and downs.

And here’s the truth: whether I sell too early or too late, I will regret it one way or another. Nobody times the absolute top.

The Risk of Doing Nothing

There’s another factor that can’t be ignored: event risk. Without a stop-loss, a bad headline could turn a +10% gain into -10%, -20%, or worse. In trading, protecting capital is priority number one.

So, What’s the Play?

If similar opportunities exist elsewhere, ones with comparable risk/reward profiles, short-term exits can make a lot of sense. By rotating capital through multiple high-probability setups in a year, the annualized return potential is astonishing.

Other Short-term ideas shared recently:

I’ll share 3 examples of how I apply this rotation strategy to consistently generate strong annualized returns. For now, I’ll just say: rare touches of a decades-long channel are gifts… but the exit and the long term strategy is where traders are truly tested.

3,5% in 1 day in Sartorius

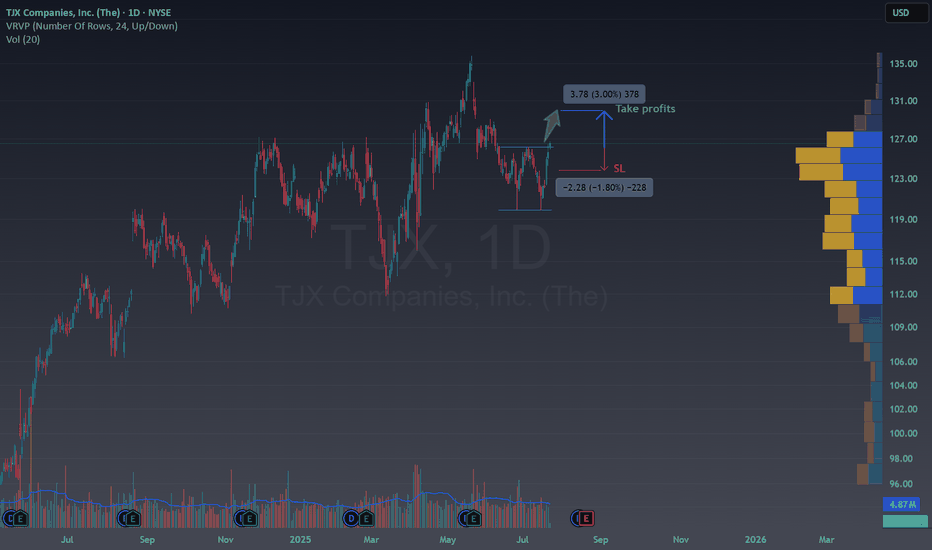

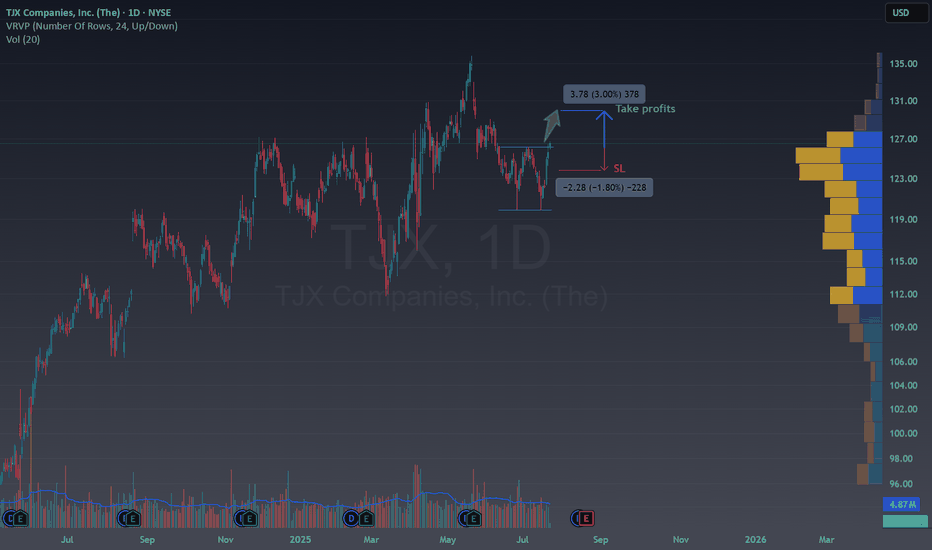

3% in 10 days in TJX

2,5% in 9 days

But sometimes trades do not work as expected and then SL is crucial to avoid large loses, like EURUSD that yielded a-0,5% in few days:

So, what do you think I'm doing with my "once in a life time" NVO position?

NVO position?

💬 Does this setup align with your view on NVO?

NVO?

🚀 Hit the rocket if this helped you spot the opportunity and follow for more easy, educational trade ideas!

There are moments in the market that happen so rarely, they feel almost mythical when they finally arrive. Novo Nordisk

If you’ve been following my work, you might remember my previous article where I warned that NVO was approaching a historically significant long-term yellow channel, a structure that has been respected for decades.

In fact, the lower bound of this channel has only been touched less than once per decade. And here we are again…

When price recently dipped into this “Ideal Buy Zone,” it wasn’t just touching the bottom of the yellow channel. It was also colliding with a red historical support level and the last significant VRVP volume area.

That’s triple confluence, and as traders, we live for these rare alignments.

I personally had the privilege (and yes, a bit of luck) to buy at $45.8, on what turned out to be NVO’s worst single day in years. Seeing the double support, I didn’t hesitate. And judging by the market reaction, I wasn’t alone, many others seemed to spot the same opportunity.

The Easy Part Is Over, Now Comes the Hardest Decision in Trading

I might look like a genius for catching the bottom, but let’s be honest: buying was the easy part. The true challenge now?

Deciding when to sell.

Here are the main paths forward in my head:

1. The Short-Term Quick Win

The stock rallied about 10% in just two days.

Annualized, that return is insane. Selling would lock in a solid, risk-free gain and free up capital for the next opportunity. The downside? You might watch it keep climbing without you, and you know, that's SO HARD.

✅ Guarantees an amazing annualized return (about millions %!).

❌ You lose a once in a life-time potential upside with LOW risk.

2. The Split Strategy

Sell half the position for a clean 10% profit, and let the other half ride. Set a tight stop-loss at $43.5 to protect the remaining capital.

✅ Guarantees a win on the trade while you keep upside exposure.

❌ Halves your potential upside.

3. The Long-Term Hold

Hold the full position and see where it goes, perhaps for years.

✅ Maximum potential absolute gain if the channel continues to hold and trend upwards.

❌ Keeps capital locked and will test your nerves through constant ups and downs.

And here’s the truth: whether I sell too early or too late, I will regret it one way or another. Nobody times the absolute top.

The Risk of Doing Nothing

There’s another factor that can’t be ignored: event risk. Without a stop-loss, a bad headline could turn a +10% gain into -10%, -20%, or worse. In trading, protecting capital is priority number one.

So, What’s the Play?

If similar opportunities exist elsewhere, ones with comparable risk/reward profiles, short-term exits can make a lot of sense. By rotating capital through multiple high-probability setups in a year, the annualized return potential is astonishing.

Other Short-term ideas shared recently:

I’ll share 3 examples of how I apply this rotation strategy to consistently generate strong annualized returns. For now, I’ll just say: rare touches of a decades-long channel are gifts… but the exit and the long term strategy is where traders are truly tested.

3,5% in 1 day in Sartorius

3% in 10 days in TJX

2,5% in 9 days

But sometimes trades do not work as expected and then SL is crucial to avoid large loses, like EURUSD that yielded a-0,5% in few days:

So, what do you think I'm doing with my "once in a life time"

💬 Does this setup align with your view on

🚀 Hit the rocket if this helped you spot the opportunity and follow for more easy, educational trade ideas!

Dagangan ditutup: sasaran tercapai

I closed the position at my first target, a quick 20% gain in just a few days, an incredible return when annualized! This stock remains a fantastic long-term value, still discounted for patient investors. But my style is to capture fast profits and move on to the next opportunity. Quick wins like this keep the portfolio growing efficiently without waiting for years and avoiding large neutral periods.⚡ Trading is not about luck or patience. Is about skills and knowledge. ⚡

I share my ideas, returns and knowledge here:

📚 👉 topchartpatterns.substack.com/subscribe 👈📚

🤝 Business contact: info@topchartpatterns.com

I share my ideas, returns and knowledge here:

📚 👉 topchartpatterns.substack.com/subscribe 👈📚

🤝 Business contact: info@topchartpatterns.com

Penerbitan berkaitan

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚡ Trading is not about luck or patience. Is about skills and knowledge. ⚡

I share my ideas, returns and knowledge here:

📚 👉 topchartpatterns.substack.com/subscribe 👈📚

🤝 Business contact: info@topchartpatterns.com

I share my ideas, returns and knowledge here:

📚 👉 topchartpatterns.substack.com/subscribe 👈📚

🤝 Business contact: info@topchartpatterns.com

Penerbitan berkaitan

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.