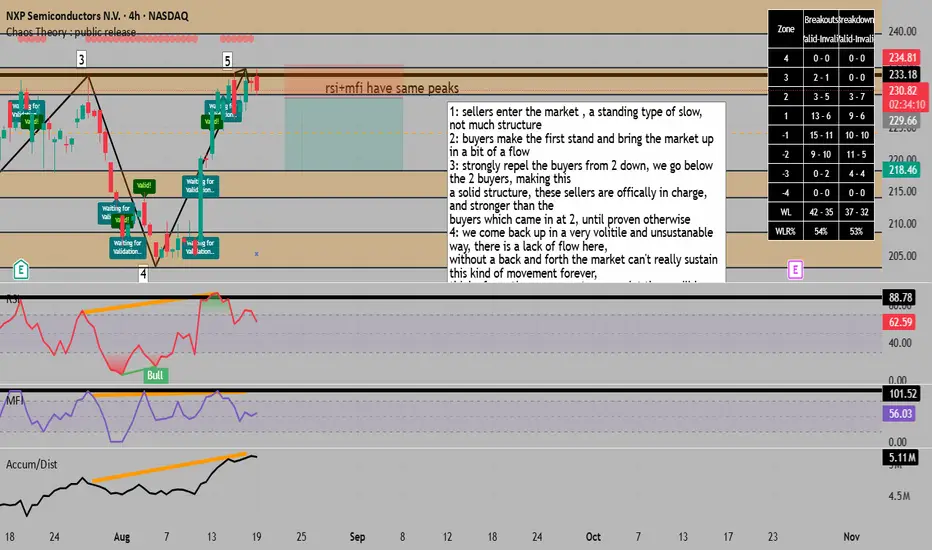

1: sellers enter the market , a standing type of slow,

not much structure

2: buyers make the first stand and bring the market up in a bit of a flow

3: strongly repel the buyers from 2 down, we go below the 2 buyers, making this

a solid structure, these sellers are offically in charge, and stronger than the

buyers which came in at 2, until proven otherwise

4: we come back up in a very volitile and unsustanable way, there is a lack of flow here,

without a back and forth the market can't really sustain this kind of movement forever,

think of exerting energy , at some point there will be exhaustion

5: a return to strong sellers with the appearance of our first selling bars

what do I think will happen :

* a return to the solid sellers at 3 signals to me a selling opportunity, especially as

on a lower fractal structure we had a bar clow below another, where this was lacking

and sellers non existant for the past while

* even if it is not a downtrend, it could be a correction and resting of buyers, as prices

increase, people are less enthusiastic to buy

* over the past 2,500 bars if price closed below a zone it has a 53% chance of reaching the

next zone below ( or the orange line for this zone specifically ) , this is not much better than

a coin flip, so not helpful, but we do have a good target given by the chaos theory zone

expansion, exiting before a potential resistance turned support.

* rsi+mfi+accum/dist have HH while price is equal or a bit lower high, this is a divergence mismatch

supporting the sell idea

* overbought can be safely ignored due to high volitlity,

it becomes unreliable and is therefore not a confirmation

* we have resistance lines in the RSI + MFI , at the peaks of price as well, this supports a peak in price and the sell idea.

not much structure

2: buyers make the first stand and bring the market up in a bit of a flow

3: strongly repel the buyers from 2 down, we go below the 2 buyers, making this

a solid structure, these sellers are offically in charge, and stronger than the

buyers which came in at 2, until proven otherwise

4: we come back up in a very volitile and unsustanable way, there is a lack of flow here,

without a back and forth the market can't really sustain this kind of movement forever,

think of exerting energy , at some point there will be exhaustion

5: a return to strong sellers with the appearance of our first selling bars

what do I think will happen :

* a return to the solid sellers at 3 signals to me a selling opportunity, especially as

on a lower fractal structure we had a bar clow below another, where this was lacking

and sellers non existant for the past while

* even if it is not a downtrend, it could be a correction and resting of buyers, as prices

increase, people are less enthusiastic to buy

* over the past 2,500 bars if price closed below a zone it has a 53% chance of reaching the

next zone below ( or the orange line for this zone specifically ) , this is not much better than

a coin flip, so not helpful, but we do have a good target given by the chaos theory zone

expansion, exiting before a potential resistance turned support.

* rsi+mfi+accum/dist have HH while price is equal or a bit lower high, this is a divergence mismatch

supporting the sell idea

* overbought can be safely ignored due to high volitlity,

it becomes unreliable and is therefore not a confirmation

* we have resistance lines in the RSI + MFI , at the peaks of price as well, this supports a peak in price and the sell idea.

for trading mentorship and community, message me on telegram : jacesabr_real

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

for trading mentorship and community, message me on telegram : jacesabr_real

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.