Analysis Overview:

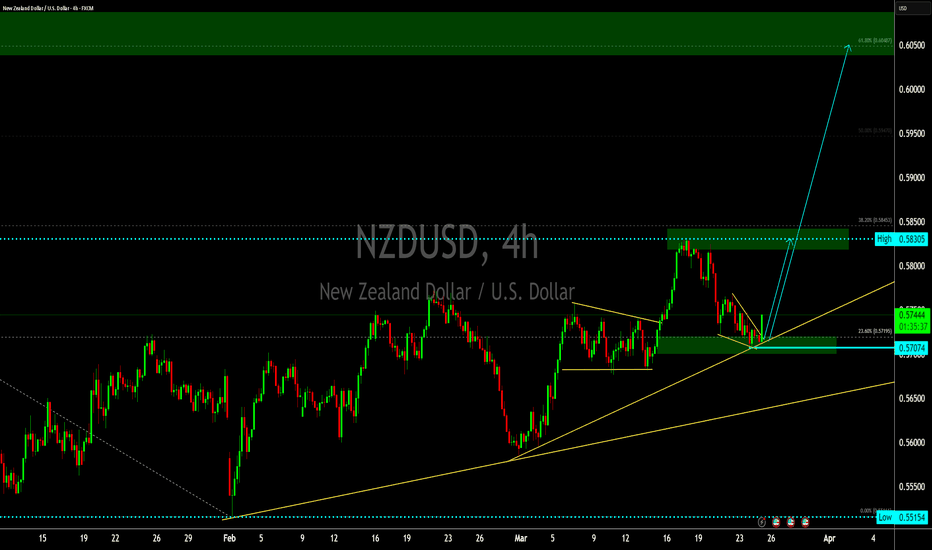

This daily chart of NZD/USD highlights a potential bullish breakout setup based on price action, trendlines, and Fibonacci retracement levels.

Key Technical Elements:

Descending Trendline Breakout:

The price is forming a contracting pattern with a descending trendline.

A breakout above this trendline could signal bullish momentum.

Ascending Support Trendline:

A yellow upward-sloping trendline indicates rising support, suggesting accumulation.

Buyers are stepping in at higher levels.

Fibonacci Retracement Levels:

The chart displays key Fibonacci retracement levels based on the previous downtrend.

The 61.8% Fibonacci retracement level at 0.6048 aligns with a strong resistance zone (marked in green).

Breakout Confirmation:

A label on the chart suggests "Watch for Breakout", indicating a potential bullish move.

If the price successfully breaks above the trendline and the 23.6% Fibonacci level (0.5719), a rally toward the 61.8% zone (0.6048) is likely.

Target Levels:

First target: 0.6048 (61.8% Fibonacci)

Final target: 0.6378 (previous high)

Trading Plan:

Entry: On breakout above the trendline, with confirmation from volume or a strong bullish candle.

Stop-loss: Below recent swing low (~0.5600 area).

Take-profit levels: 0.6048 (main resistance), with an extended target at 0.6378.

Conclusion:

This setup suggests a potential bullish reversal if the breakout is confirmed. Traders should wait for confirmation before entering, ensuring the price does not get rejected at resistance levels.

This daily chart of NZD/USD highlights a potential bullish breakout setup based on price action, trendlines, and Fibonacci retracement levels.

Key Technical Elements:

Descending Trendline Breakout:

The price is forming a contracting pattern with a descending trendline.

A breakout above this trendline could signal bullish momentum.

Ascending Support Trendline:

A yellow upward-sloping trendline indicates rising support, suggesting accumulation.

Buyers are stepping in at higher levels.

Fibonacci Retracement Levels:

The chart displays key Fibonacci retracement levels based on the previous downtrend.

The 61.8% Fibonacci retracement level at 0.6048 aligns with a strong resistance zone (marked in green).

Breakout Confirmation:

A label on the chart suggests "Watch for Breakout", indicating a potential bullish move.

If the price successfully breaks above the trendline and the 23.6% Fibonacci level (0.5719), a rally toward the 61.8% zone (0.6048) is likely.

Target Levels:

First target: 0.6048 (61.8% Fibonacci)

Final target: 0.6378 (previous high)

Trading Plan:

Entry: On breakout above the trendline, with confirmation from volume or a strong bullish candle.

Stop-loss: Below recent swing low (~0.5600 area).

Take-profit levels: 0.6048 (main resistance), with an extended target at 0.6378.

Conclusion:

This setup suggests a potential bullish reversal if the breakout is confirmed. Traders should wait for confirmation before entering, ensuring the price does not get rejected at resistance levels.

For Training visit.

Website wave-trader.com

Website techtradingacademy.com

Slack: wavetraders.slack.com

Telegram: t.me/Wavetraders

X: twitter.com/Wave__Trader

FB: facebook.com/WTimran

Website wave-trader.com

Website techtradingacademy.com

Slack: wavetraders.slack.com

Telegram: t.me/Wavetraders

X: twitter.com/Wave__Trader

FB: facebook.com/WTimran

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

For Training visit.

Website wave-trader.com

Website techtradingacademy.com

Slack: wavetraders.slack.com

Telegram: t.me/Wavetraders

X: twitter.com/Wave__Trader

FB: facebook.com/WTimran

Website wave-trader.com

Website techtradingacademy.com

Slack: wavetraders.slack.com

Telegram: t.me/Wavetraders

X: twitter.com/Wave__Trader

FB: facebook.com/WTimran

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.