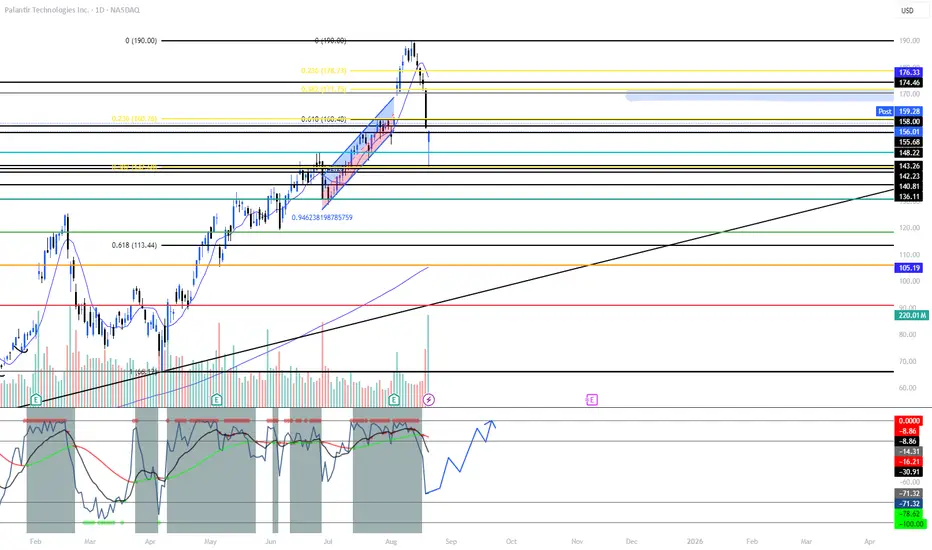

PLTR’s August dip looks nothing like February’s correction. In Feb, price unwound ~30% after insider-sale headlines + gov-spend fears and flushed to the 0.618 retrace, breaking key MAs. This time, the selloff paused at shallow fibs (0.236–0.382), held stacked support ($156 → $148 zone), and buyers stepped in before any trendline/50-DMA break. The catalyst is mostly valuation chatter, not fundamentals. With structure intact, a quick V-shape reclaim is on the table if we clear resistance levels in sequence.

What I’m watching

- Hold above $156 and build higher lows over $158 → momentum base.

- Trigger: reclaim $171.75 (0.382), then $178.7 (0.236) to re-ignite trend.

- Acceptance back over $186–$190 (prior ATH area) opens the 200s.

Why this isn’t Feb

- Depth: Feb = deep 0.618 wash; Aug = shallow 0.236/0.382 tag.

- Structure: Feb broke MAs/trend; Aug holds channel + MAs.

- Narrative: Feb = fundamental risk headlines; Aug = valuation noise while demand pipeline stays active.

Price Targets

- 171.50

- 178.70

- 186 - 190

- 205

- 217 - 235

Not financial advice.

What I’m watching

- Hold above $156 and build higher lows over $158 → momentum base.

- Trigger: reclaim $171.75 (0.382), then $178.7 (0.236) to re-ignite trend.

- Acceptance back over $186–$190 (prior ATH area) opens the 200s.

Why this isn’t Feb

- Depth: Feb = deep 0.618 wash; Aug = shallow 0.236/0.382 tag.

- Structure: Feb broke MAs/trend; Aug holds channel + MAs.

- Narrative: Feb = fundamental risk headlines; Aug = valuation noise while demand pipeline stays active.

Price Targets

- 171.50

- 178.70

- 186 - 190

- 205

- 217 - 235

Not financial advice.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.