📈 RAMCOCEM – Classic VCP Setup with Breakout Potential 🚀

🔍 Technical Structure: VCP (Volatility Contraction Pattern)

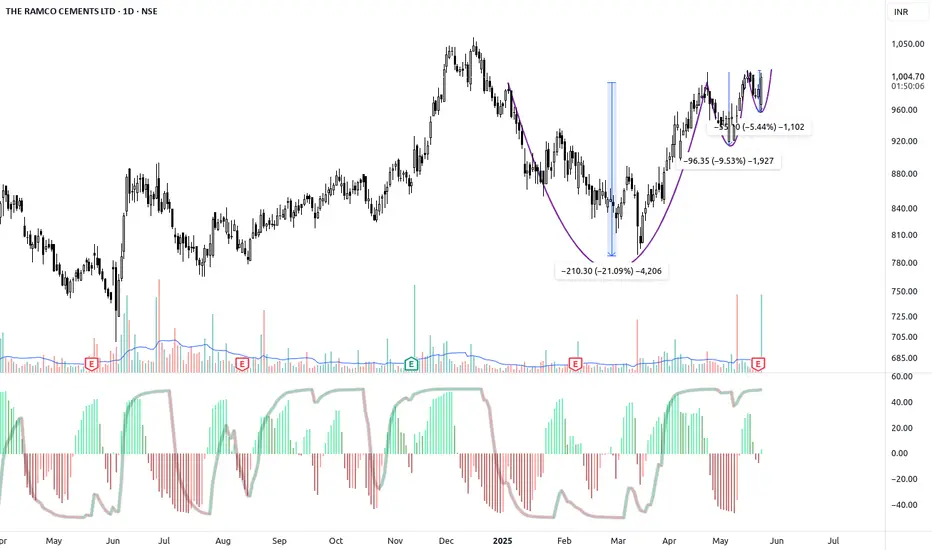

Ramco Cements is currently exhibiting a textbook Volatility Contraction Pattern (VCP) – a bullish continuation pattern popularized by Mark Minervini. This setup often precedes explosive breakouts, especially when accompanied by key technical confirmations.

✅ VCP Phases Observed:

Wave 1: Decline of ~21% (₹210) from swing high

Wave 2: Pullback of ~9.5% (₹96)

Wave 3: Most recent pullback ~5.4% (₹55)

Each contraction has been shallower and tighter — textbook VCP behavior.

The current base is tightening, and price is forming a mini-cup on the right side.

📊 Volume Action (Key to VCP)

Volume consistently drying up during each successive pullback — a sign of supply absorption.

Today’s session showed a spike in volume with a bullish candle, suggesting possible initiation of demand and interest at key resistance levels.

📈 Moving Averages Confirmation

Price is trading above all major moving averages:

🔹 20 EMA

🔹 50 EMA

🔹 100 SMA

🔹 200 SMA

All MAs are positively sloped, reinforcing a strong uptrend across short, medium, and long-term timeframes.

✅ Conclusion

Ramco Cements is forming a high-quality VCP setup supported by:

Strong volume contraction behavior,

Positive price action near breakout zone,

Clean structure above key MAs,

Bullish momentum and improving market sentiment.

📢 Keep this stock on high alert. A strong breakout above ₹1,020 could trigger a powerful upside rally.

🔍 Technical Structure: VCP (Volatility Contraction Pattern)

Ramco Cements is currently exhibiting a textbook Volatility Contraction Pattern (VCP) – a bullish continuation pattern popularized by Mark Minervini. This setup often precedes explosive breakouts, especially when accompanied by key technical confirmations.

✅ VCP Phases Observed:

Wave 1: Decline of ~21% (₹210) from swing high

Wave 2: Pullback of ~9.5% (₹96)

Wave 3: Most recent pullback ~5.4% (₹55)

Each contraction has been shallower and tighter — textbook VCP behavior.

The current base is tightening, and price is forming a mini-cup on the right side.

📊 Volume Action (Key to VCP)

Volume consistently drying up during each successive pullback — a sign of supply absorption.

Today’s session showed a spike in volume with a bullish candle, suggesting possible initiation of demand and interest at key resistance levels.

📈 Moving Averages Confirmation

Price is trading above all major moving averages:

🔹 20 EMA

🔹 50 EMA

🔹 100 SMA

🔹 200 SMA

All MAs are positively sloped, reinforcing a strong uptrend across short, medium, and long-term timeframes.

✅ Conclusion

Ramco Cements is forming a high-quality VCP setup supported by:

Strong volume contraction behavior,

Positive price action near breakout zone,

Clean structure above key MAs,

Bullish momentum and improving market sentiment.

📢 Keep this stock on high alert. A strong breakout above ₹1,020 could trigger a powerful upside rally.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.