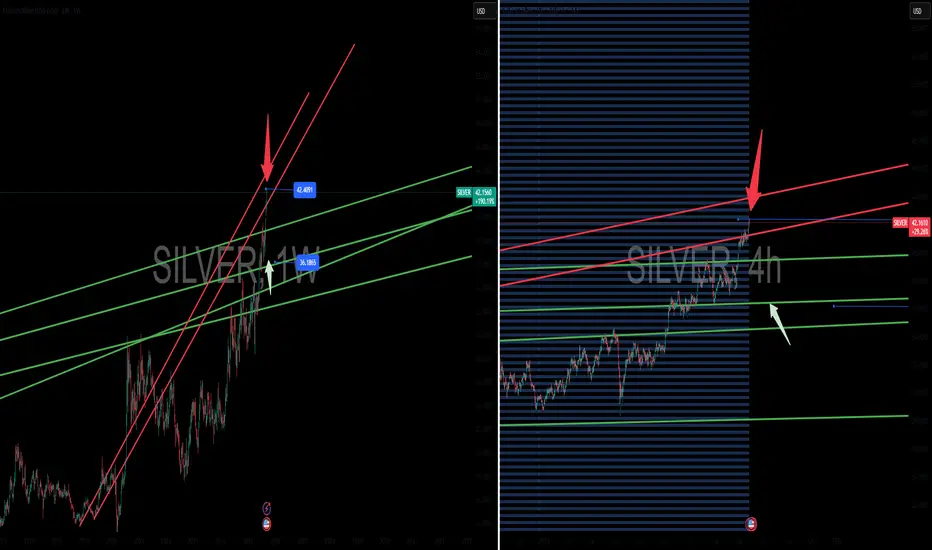

Based on a technical analysis of the silver market from a weekly and 4-hour perspective, here is a trade idea to short silver on a potential correction, mirroring the gold thesis.

Short Trade Thesis: Weekly Chart Analysis

The weekly chart for silver (XAG/USD) reveals an extended and overbought price action. The current rally, driven by a combination of safe-haven demand and robust industrial use, has been steep and rapid, pushing the price to new multi-year highs.

Extended Price Action: The weekly chart's Relative Strength Index (RSI) is signaling extremely overbought conditions, a classic indication that the upward momentum is likely unsustainable in the short term. The price has moved far from its key moving averages, creating a significant "extension" that often precedes a period of consolidation or a corrective pullback.

"Skipped" Support: During this powerful ascent, the price "shot through" a previous major resistance level around $41.00. According to classic technical analysis principles, a significant resistance level, once broken with conviction, becomes a new support level. The price has not yet retested this crucial level. A healthy correction would involve a retracement back to this zone to confirm its new role as support before any potential further move up.

Trade Idea: Short Silver

This trade idea is a counter-trend position, targeting a short-term correction within the broader bullish trend. The goal is to capitalize on the likely mean-reversion move back to the closest, most significant support level.

Entry: Short silver at the 4-hour chart resistance line at or near the recent multi-year high of $42.50. (Shown by Red arrow)

Take-Profit (Exit): The logical exit is at the immediate 4-hour support line and psychological level of $41.00. (Shown by Green arrow)

Short Trade Thesis: Weekly Chart Analysis

The weekly chart for silver (XAG/USD) reveals an extended and overbought price action. The current rally, driven by a combination of safe-haven demand and robust industrial use, has been steep and rapid, pushing the price to new multi-year highs.

Extended Price Action: The weekly chart's Relative Strength Index (RSI) is signaling extremely overbought conditions, a classic indication that the upward momentum is likely unsustainable in the short term. The price has moved far from its key moving averages, creating a significant "extension" that often precedes a period of consolidation or a corrective pullback.

"Skipped" Support: During this powerful ascent, the price "shot through" a previous major resistance level around $41.00. According to classic technical analysis principles, a significant resistance level, once broken with conviction, becomes a new support level. The price has not yet retested this crucial level. A healthy correction would involve a retracement back to this zone to confirm its new role as support before any potential further move up.

Trade Idea: Short Silver

This trade idea is a counter-trend position, targeting a short-term correction within the broader bullish trend. The goal is to capitalize on the likely mean-reversion move back to the closest, most significant support level.

Entry: Short silver at the 4-hour chart resistance line at or near the recent multi-year high of $42.50. (Shown by Red arrow)

Take-Profit (Exit): The logical exit is at the immediate 4-hour support line and psychological level of $41.00. (Shown by Green arrow)

GoldenTraders is a premier trading community dedicated to helping you navigate the complexities of the financial markets with confidence and clarity.

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

GoldenTraders is a premier trading community dedicated to helping you navigate the complexities of the financial markets with confidence and clarity.

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.