Hello everyone.

I hope you are all having a peaceful day.

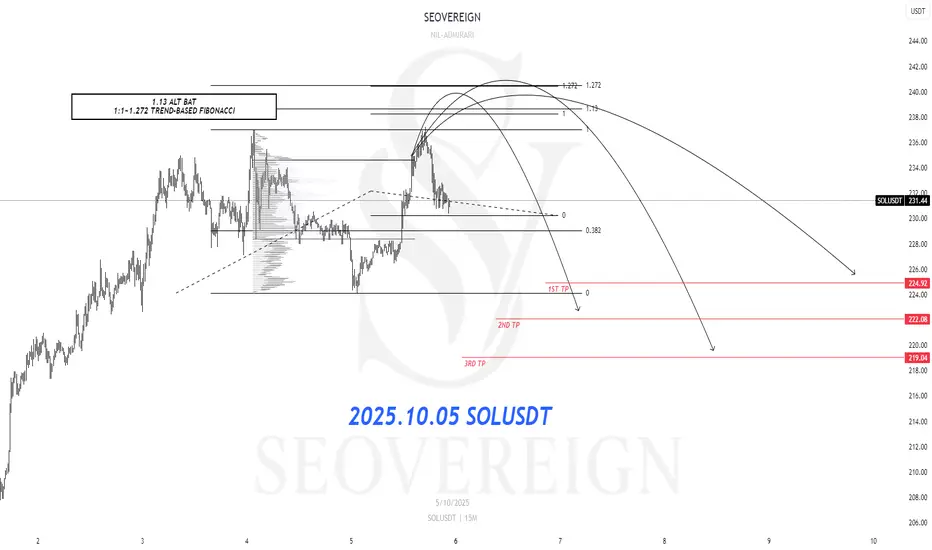

Today, I am writing to share my short position perspective on Solana as of October 5th.

The first basis is the 1.13 Alternate Bat (ALT BAT). The Alternate Bat is a variation of the harmonic pattern established by Scott Carney, and its core principle lies in defining the PRZ (Potential Reversal Zone) where point D is located at 1.13 times the XA leg (=1.13XA). The convergence of these ratios creates a relatively narrow and reliable retracement (or reversal) zone, so when D is positioned around 1.13XA, it is necessary to carefully observe the potential for a short- or mid-term reversal.

The second basis is that an arbitrary wave N forms a 1:1 length ratio with another arbitrary wave M. Among Fibonacci ratios, 1:1 is one of the representative standards used in Elliott Wave and harmonic analyses for measuring wave length and retracement. When one wave exhibits approximately a 1:1 length with another, that point tends to act as a natural retracement or termination zone, and the reliability increases especially when it overlaps with other technical grounds.

Accordingly, the average target price is set around 222 USDT.

As the chart movement unfolds, I will provide updates on position management through revisions to this idea.

Thank you for reading.

I hope you are all having a peaceful day.

Today, I am writing to share my short position perspective on Solana as of October 5th.

The first basis is the 1.13 Alternate Bat (ALT BAT). The Alternate Bat is a variation of the harmonic pattern established by Scott Carney, and its core principle lies in defining the PRZ (Potential Reversal Zone) where point D is located at 1.13 times the XA leg (=1.13XA). The convergence of these ratios creates a relatively narrow and reliable retracement (or reversal) zone, so when D is positioned around 1.13XA, it is necessary to carefully observe the potential for a short- or mid-term reversal.

The second basis is that an arbitrary wave N forms a 1:1 length ratio with another arbitrary wave M. Among Fibonacci ratios, 1:1 is one of the representative standards used in Elliott Wave and harmonic analyses for measuring wave length and retracement. When one wave exhibits approximately a 1:1 length with another, that point tends to act as a natural retracement or termination zone, and the reliability increases especially when it overlaps with other technical grounds.

Accordingly, the average target price is set around 222 USDT.

As the chart movement unfolds, I will provide updates on position management through revisions to this idea.

Thank you for reading.

🔴유튜브 (출시 완료)

🔗youtube.com/@seovereign?si=iJBnIrQcuMyYGZo4

🌐서버린 공식 텔레그램 토론방

🔗t.me/+Sd_TSg2IX3k4Njg1

📝서버린 공식 텔레그램 공지방

🔗t.me/seovereign_updates

📌FIFTH(전자책) 무료 배포-서버린 분석법 공개

🔗tinyurl.com/FIFTH-SAMPLE

🔗youtube.com/@seovereign?si=iJBnIrQcuMyYGZo4

🌐서버린 공식 텔레그램 토론방

🔗t.me/+Sd_TSg2IX3k4Njg1

📝서버린 공식 텔레그램 공지방

🔗t.me/seovereign_updates

📌FIFTH(전자책) 무료 배포-서버린 분석법 공개

🔗tinyurl.com/FIFTH-SAMPLE

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

🔴유튜브 (출시 완료)

🔗youtube.com/@seovereign?si=iJBnIrQcuMyYGZo4

🌐서버린 공식 텔레그램 토론방

🔗t.me/+Sd_TSg2IX3k4Njg1

📝서버린 공식 텔레그램 공지방

🔗t.me/seovereign_updates

📌FIFTH(전자책) 무료 배포-서버린 분석법 공개

🔗tinyurl.com/FIFTH-SAMPLE

🔗youtube.com/@seovereign?si=iJBnIrQcuMyYGZo4

🌐서버린 공식 텔레그램 토론방

🔗t.me/+Sd_TSg2IX3k4Njg1

📝서버린 공식 텔레그램 공지방

🔗t.me/seovereign_updates

📌FIFTH(전자책) 무료 배포-서버린 분석법 공개

🔗tinyurl.com/FIFTH-SAMPLE

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.