#spx #sp500 – Stocks closed down significantly again today which was expected in last night’s chart update after yesterday’s dud of an update from the coronavirus taskforce briefing. As long as traders remain uncertain as to whether or not to buy the dip due to lack of information on both the administrations plans for containing the coronavirus as well as how the proposed $1.7 trillion payroll tax cut will be funded, traders will remain fearful. Indecisive and fearful traders will continue to dominate the market until they have reason to be optimistic.

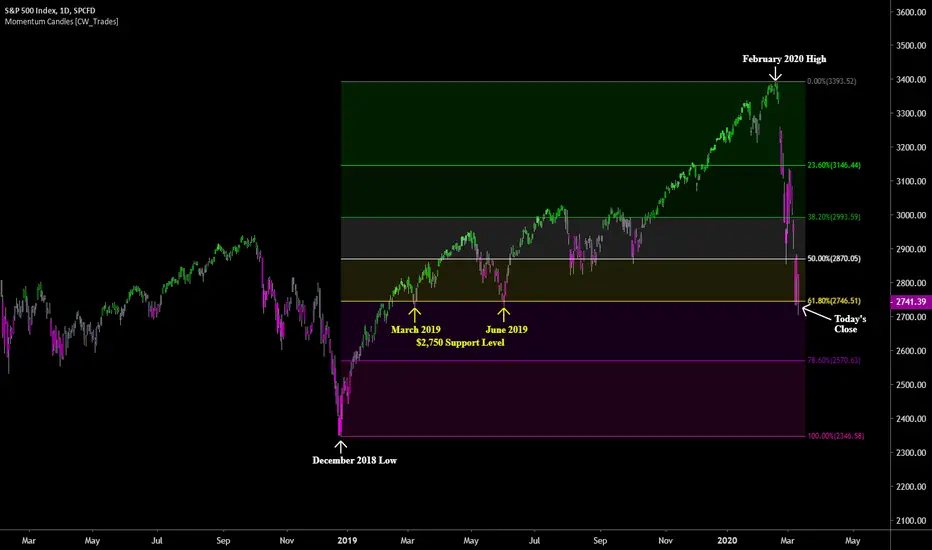

The S&P 500 closed down 140 points for a -4.89% loss, bringing to the total loss from all-time highs to just shy of -20%. Below 20% and the S&P 500 will officially be in a bear market meaning any rallies in price will be bear market rallies and should be viewed as bounces to sell in to rather than buy.

Today’s close was the third session to test the 61.8% Fibonacci retracement level within the December 2018 to February 2020 total Fib range from low to high. This 61.8% Fib level is also a previous level of support seen in March and June of 2019 at the $2,750 level. This was a price area previously viewed by traders as a valuable level to buy in 2019 so a hold here now is critical for the longer trend. Should price break down below this level it would indicate that traders no longer see value in the $2,750 price area and that they are likely going to continue selling for the foreseeable future until a new value level is found. This may prove difficult as traders are being left in the dark as to how much of an impact the coronavirus will have on economic activity as well as what to expect from company earnings going forward this year due to loss of business/revenue, especially if the administration takes a more direct approach to containing the outbreak such as city-wide or a national quarantines put in place.

President Trump is due to deliver an Oval Office address on the coronavirus pandemic tonight which indicates that he may be changing his tune regarding the severity of the outbreak seeing as how Oval Office addresses are the setting for more serious announcements.

Here are some of the latest news updates from today ahead of tonight’s Oval Office address:

W.H.O. declares the coronavirus an official pandemic:

cnbc.com/2020/03/11/who-declares-the-coronavirus-outbreak-a-global-pandemic.html

White House told federal agency to classify coronavirus deliberations. This indicates that the true severity of the outbreak has been classified:

reuters.com/article/us-health-coronavirus-secrecy-exclusive/exclusive-white-house-told-federal-health-agency-to-classify-coronavirus-deliberations-sources-idUSKBN20Y2LM

Seattle Public Schools closed for at least two weeks:

cnbc.com/2020/03/11/who-declares-the-coronavirus-outbreak-a-global-pandemic.html

Cases in U.S. surpass 1,000 mark:

npr.org/2020/03/11/814376780/coronavirus-cases-in-the-u-s-surpass-1-000-mark

Federal Reserve boosts money(REPO) to banks. After hitting record overnight bailouts this week, the record bailout amounts are now the new norm going forward:

cnbc.com/2020/03/11/fed-boosts-money-its-providing-to-banks-in-overnight-repo-lending-to-175-billion.html

Italian hospitals so overwhelmed doctors are being forced to choose which patients to save first. This is worrisome because US case numbers are lagging theirs by only two weeks:

theatlantic.com/ideas/archive/2020/03/who-gets-hospital-bed/607807/

Traders need to hear reassurance and a decisive plan tonight in the Oval Office address or more selling in markets is ahead.

The S&P 500 closed down 140 points for a -4.89% loss, bringing to the total loss from all-time highs to just shy of -20%. Below 20% and the S&P 500 will officially be in a bear market meaning any rallies in price will be bear market rallies and should be viewed as bounces to sell in to rather than buy.

Today’s close was the third session to test the 61.8% Fibonacci retracement level within the December 2018 to February 2020 total Fib range from low to high. This 61.8% Fib level is also a previous level of support seen in March and June of 2019 at the $2,750 level. This was a price area previously viewed by traders as a valuable level to buy in 2019 so a hold here now is critical for the longer trend. Should price break down below this level it would indicate that traders no longer see value in the $2,750 price area and that they are likely going to continue selling for the foreseeable future until a new value level is found. This may prove difficult as traders are being left in the dark as to how much of an impact the coronavirus will have on economic activity as well as what to expect from company earnings going forward this year due to loss of business/revenue, especially if the administration takes a more direct approach to containing the outbreak such as city-wide or a national quarantines put in place.

President Trump is due to deliver an Oval Office address on the coronavirus pandemic tonight which indicates that he may be changing his tune regarding the severity of the outbreak seeing as how Oval Office addresses are the setting for more serious announcements.

Here are some of the latest news updates from today ahead of tonight’s Oval Office address:

W.H.O. declares the coronavirus an official pandemic:

cnbc.com/2020/03/11/who-declares-the-coronavirus-outbreak-a-global-pandemic.html

White House told federal agency to classify coronavirus deliberations. This indicates that the true severity of the outbreak has been classified:

reuters.com/article/us-health-coronavirus-secrecy-exclusive/exclusive-white-house-told-federal-health-agency-to-classify-coronavirus-deliberations-sources-idUSKBN20Y2LM

Seattle Public Schools closed for at least two weeks:

cnbc.com/2020/03/11/who-declares-the-coronavirus-outbreak-a-global-pandemic.html

Cases in U.S. surpass 1,000 mark:

npr.org/2020/03/11/814376780/coronavirus-cases-in-the-u-s-surpass-1-000-mark

Federal Reserve boosts money(REPO) to banks. After hitting record overnight bailouts this week, the record bailout amounts are now the new norm going forward:

cnbc.com/2020/03/11/fed-boosts-money-its-providing-to-banks-in-overnight-repo-lending-to-175-billion.html

Italian hospitals so overwhelmed doctors are being forced to choose which patients to save first. This is worrisome because US case numbers are lagging theirs by only two weeks:

theatlantic.com/ideas/archive/2020/03/who-gets-hospital-bed/607807/

Traders need to hear reassurance and a decisive plan tonight in the Oval Office address or more selling in markets is ahead.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.