The end of a U.S. government shutdown is often interpreted as a mere political signal. Yet, from a financial perspective, this event can mark a major turning point for global liquidity. One of the most direct mechanisms through which this occurs is the Treasury General Account (TGA) — the U.S. Treasury’s main account at the Federal Reserve (Fed).

1) The TGA: a true liquidity reservoir

The TGA functions as the federal government’s current account.

When it receives revenues (taxes, bond issuance, etc.), funds are deposited there. When it spends — salaries, contractor payments, social programs — those amounts leave the TGA and flow toward commercial banks and households.

Each dollar spent by the Treasury exits the Fed and enters the private sector, increasing bank reserves and overall financial system liquidity.

Conversely, when the Treasury issues bonds and collects money from investors, bank reserves decline since those funds are transferred into the TGA.

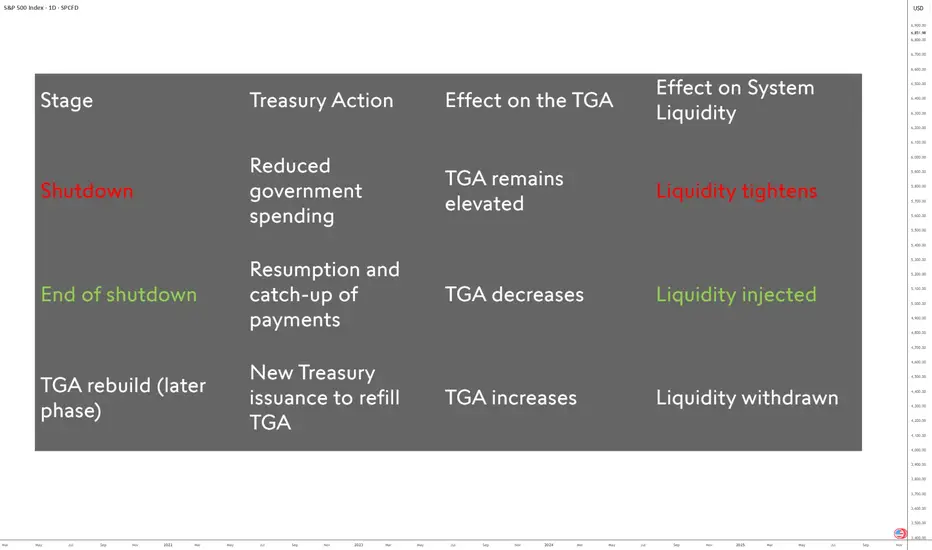

2) Shutdown: a period of silent contraction

During a shutdown, the government is largely paralyzed. Many payments are suspended or delayed, reducing cash outflows.

As a result, the TGA drains much more slowly, and available liquidity in the financial system decreases. It is worth noting that the TGA had just finished refilling in early October — exactly at the onset of the shutdown.

3) The end of the shutdown: a sharp reinjection

As soon as the shutdown ends, the U.S. Treasury must catch up on deferred spending — wages, contracts, and federal programs.

These large disbursements cause a rapid decline in the TGA, equivalent to a direct injection of liquidity into the economy.

Bank reserves increase mechanically, repo rates may ease, and risk assets — equities, high-yield bonds, crypto-assets — often experience a short-term rebound.

This liquidity surge is not sustainable: once payments are settled, the Treasury usually reissues debt to rebuild the TGA to its target level. This reverse phase then withdraws the excess liquidity from the market.

In the short term, however, the end of a shutdown acts as a positive liquidity pump, capable of influencing the trend of risk assets on financial markets.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

1) The TGA: a true liquidity reservoir

The TGA functions as the federal government’s current account.

When it receives revenues (taxes, bond issuance, etc.), funds are deposited there. When it spends — salaries, contractor payments, social programs — those amounts leave the TGA and flow toward commercial banks and households.

Each dollar spent by the Treasury exits the Fed and enters the private sector, increasing bank reserves and overall financial system liquidity.

Conversely, when the Treasury issues bonds and collects money from investors, bank reserves decline since those funds are transferred into the TGA.

2) Shutdown: a period of silent contraction

During a shutdown, the government is largely paralyzed. Many payments are suspended or delayed, reducing cash outflows.

As a result, the TGA drains much more slowly, and available liquidity in the financial system decreases. It is worth noting that the TGA had just finished refilling in early October — exactly at the onset of the shutdown.

3) The end of the shutdown: a sharp reinjection

As soon as the shutdown ends, the U.S. Treasury must catch up on deferred spending — wages, contracts, and federal programs.

These large disbursements cause a rapid decline in the TGA, equivalent to a direct injection of liquidity into the economy.

Bank reserves increase mechanically, repo rates may ease, and risk assets — equities, high-yield bonds, crypto-assets — often experience a short-term rebound.

This liquidity surge is not sustainable: once payments are settled, the Treasury usually reissues debt to rebuild the TGA to its target level. This reverse phase then withdraws the excess liquidity from the market.

In the short term, however, the end of a shutdown acts as a positive liquidity pump, capable of influencing the trend of risk assets on financial markets.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.