Chart Interpretation (Index Futures / Equity Index) SPX / S&P

Chart Interpretation (Index Futures / Equity Index)

TECHNICAL ANALYSIS

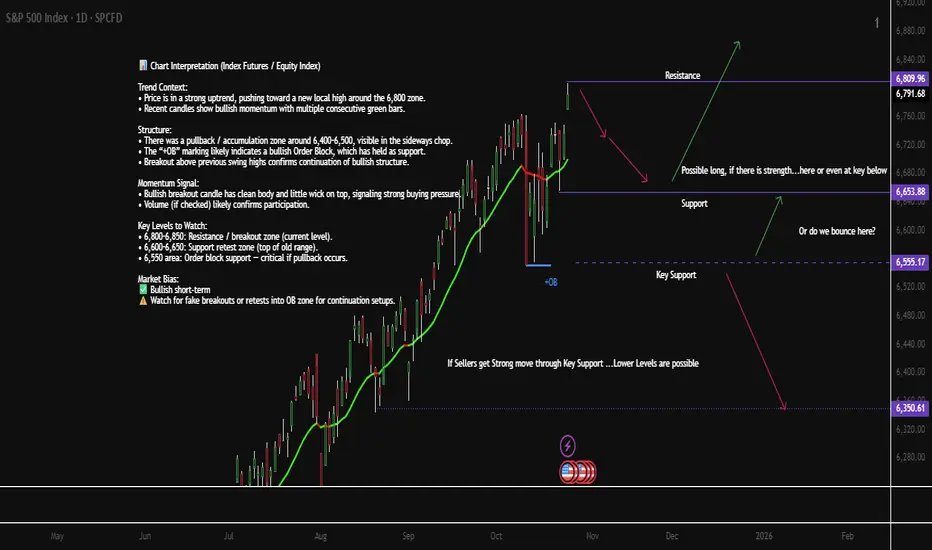

Trend Context:

• Price is in a strong uptrend, pushing toward a new local high around the 6,800 zone.

• Recent candles show bullish momentum with multiple consecutive green bars.

Structure:

• There was a pullback / accumulation zone around 6,400–6,500, visible in the sideways chop.

• The “+OB” marking likely indicates a bullish Order Block, which has held as support.

• Breakout above previous swing highs confirms continuation of bullish structure.

Momentum Signal:

• Bullish breakout candle has clean body and little wick on top, signaling strong buying pressure.

• Volume (if checked) likely confirms participation.

Key Levels to Watch:

• 6,800–6,850: Resistance / breakout zone (current level).

• 6,600–6,650: Support retest zone (top of old range).

• 6,450 area: Order block support — critical if pullback occurs.

Market Bias: Bullish short-term

Watch for fake breakouts or retests into OB zone for continuation setups.

FUNDEMENTAL ANALYSIS

U.S. Market Key Events — Week of Oct 27–31

Mon Oct 27

• 4:00 AM — 🇪🇺 German IFO Business Climate (watch EUR tone early session)

Tue Oct 28

• 9:00 AM — 🇺🇸 Richmond Manufacturing Index

• Tentative — 🇺🇸 CB Consumer Confidence

Wed Oct 29

• 9:00 AM — 🇺🇸 Pending Home Sales m/m

• 1:00 PM — 🇺🇸 Federal Funds Rate Decision (FOMC)

• 1:30 PM — 🇺🇸 FOMC Press Conference (high impact)

Thu Oct 30

• Tentative — 🇺🇸 Advance GDP q/q

• Tentative — 🇺🇸 Advance GDP Price Index

U.S.–China Trade Talks (market sensitivity risk)

Fri Oct 31

• Tentative — 🇺🇸 Core PCE Price Index m/m

• Tentative — 🇺🇸 Employment Cost Index q/q

📝 Focus on FOMC (Wed), GDP & Trade Talks (Thu), Core PCE (Fri) — high impact sessions for S&P / Dow / USD.

TECHNICAL ANALYSIS

Trend Context:

• Price is in a strong uptrend, pushing toward a new local high around the 6,800 zone.

• Recent candles show bullish momentum with multiple consecutive green bars.

Structure:

• There was a pullback / accumulation zone around 6,400–6,500, visible in the sideways chop.

• The “+OB” marking likely indicates a bullish Order Block, which has held as support.

• Breakout above previous swing highs confirms continuation of bullish structure.

Momentum Signal:

• Bullish breakout candle has clean body and little wick on top, signaling strong buying pressure.

• Volume (if checked) likely confirms participation.

Key Levels to Watch:

• 6,800–6,850: Resistance / breakout zone (current level).

• 6,600–6,650: Support retest zone (top of old range).

• 6,450 area: Order block support — critical if pullback occurs.

Market Bias: Bullish short-term

Watch for fake breakouts or retests into OB zone for continuation setups.

FUNDEMENTAL ANALYSIS

U.S. Market Key Events — Week of Oct 27–31

Mon Oct 27

• 4:00 AM — 🇪🇺 German IFO Business Climate (watch EUR tone early session)

Tue Oct 28

• 9:00 AM — 🇺🇸 Richmond Manufacturing Index

• Tentative — 🇺🇸 CB Consumer Confidence

Wed Oct 29

• 9:00 AM — 🇺🇸 Pending Home Sales m/m

• 1:00 PM — 🇺🇸 Federal Funds Rate Decision (FOMC)

• 1:30 PM — 🇺🇸 FOMC Press Conference (high impact)

Thu Oct 30

• Tentative — 🇺🇸 Advance GDP q/q

• Tentative — 🇺🇸 Advance GDP Price Index

U.S.–China Trade Talks (market sensitivity risk)

Fri Oct 31

• Tentative — 🇺🇸 Core PCE Price Index m/m

• Tentative — 🇺🇸 Employment Cost Index q/q

📝 Focus on FOMC (Wed), GDP & Trade Talks (Thu), Core PCE (Fri) — high impact sessions for S&P / Dow / USD.

Dagangan aktif

Free Signals Telegram t.me/+8lsEDuKCVPc4YzFhPenafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.