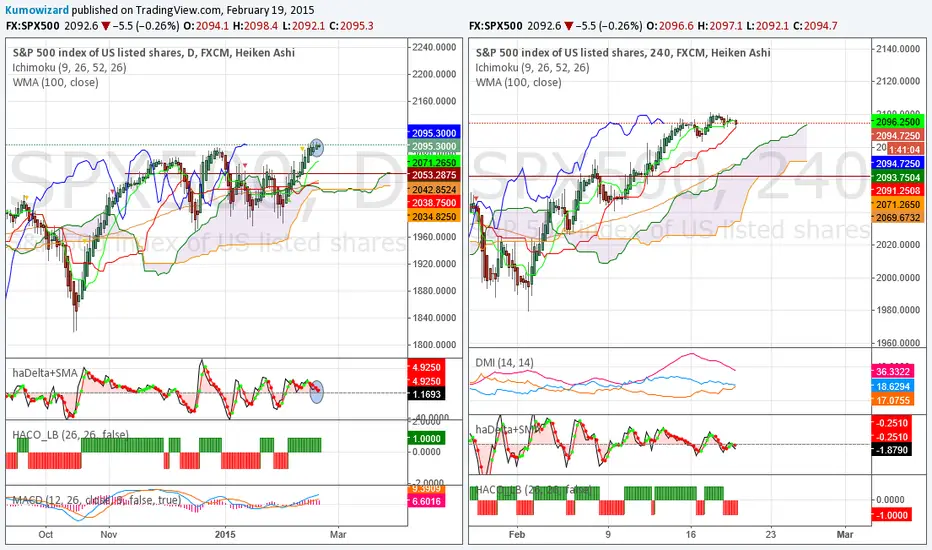

Daily:

- Ichimoku setup is bullish, but the Price action and the turnover seen in last two days suggest a local top may be around

- Watch today's HA candle, If it will be a doji, or changes colour, then with haDelta already decreasing, it will suggest a consolidation or pull back for the next few trading days

- Bullish supports are: 2070 / 2055 / 2037 (thin Kumo)

4H:

- price is above the Kumo, and the Kumo is thick. No real problem until Price holds above 2065-2070. However Chikou Span losing its open space, may hit Price candles soon.

- DMI/ADX shows bullish momentum is dropping, close to a bearish cross

- HA candles show hesitation, the Oscillator is red, but more importantly haDelta crosses back below SMA3, and the cross happens below zero line.

I think short term SP500 has chance to retest the 4H Kumo (to between 2065-2080) This can be played with a reasonable stop (above 2105) and with 0,5 unit trade size, but the really good swing short setup would come only below 2060-2070.

For those who are long in the index, some profit taking is recommended.

- Ichimoku setup is bullish, but the Price action and the turnover seen in last two days suggest a local top may be around

- Watch today's HA candle, If it will be a doji, or changes colour, then with haDelta already decreasing, it will suggest a consolidation or pull back for the next few trading days

- Bullish supports are: 2070 / 2055 / 2037 (thin Kumo)

4H:

- price is above the Kumo, and the Kumo is thick. No real problem until Price holds above 2065-2070. However Chikou Span losing its open space, may hit Price candles soon.

- DMI/ADX shows bullish momentum is dropping, close to a bearish cross

- HA candles show hesitation, the Oscillator is red, but more importantly haDelta crosses back below SMA3, and the cross happens below zero line.

I think short term SP500 has chance to retest the 4H Kumo (to between 2065-2080) This can be played with a reasonable stop (above 2105) and with 0,5 unit trade size, but the really good swing short setup would come only below 2060-2070.

For those who are long in the index, some profit taking is recommended.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.