📊  SPY Monthly Macro Outlook 📊

SPY Monthly Macro Outlook 📊

Key Observations:

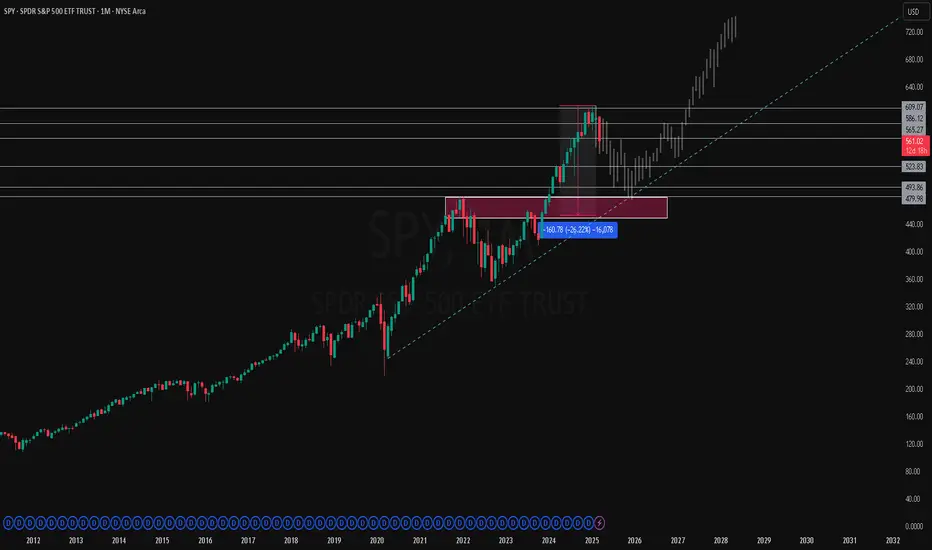

1️⃣ Long-Term Uptrend Intact – Despite corrections, SPY remains in a strong bullish trend, respecting the multi-year trendline since 2009.

SPY remains in a strong bullish trend, respecting the multi-year trendline since 2009.

2️⃣ Historical Pullback & Recovery – The 2022 market correction (-26%) found strong demand in the highlighted red zone (around $480-$500), leading to a powerful reversal.

3️⃣ Resistance Levels in Play – Price is currently testing key resistance levels at $565, $586, and $609. A rejection here could lead to a healthy pullback before continuation.

4️⃣ Future Outlook – If price consolidates and holds above $565, we could see an attempt to break $609, with the long-term trajectory targeting $700+ in coming years.

Trade Plan:

🔹 Bullish Scenario – A breakout above $609 could lead to price discovery, targeting $650-$700 in 2026-2027.

🔹 Bearish Scenario – A rejection at $565-$609 could trigger a retrace to $523 or $480, offering a buy-the-dip opportunity.

🔹 Invalidation – If SPY loses $480 support, the bullish thesis weakens, and deeper downside may be in play.

SPY loses $480 support, the bullish thesis weakens, and deeper downside may be in play.

📈 The trend is your friend, but expect volatility at these levels! Do you see a breakout coming or a healthy pullback first? Drop your thoughts below! 👇

#SPY #StockMarket #Investing #Trading #MacroAnalysis

Socials: KennyTrades52

Key Observations:

1️⃣ Long-Term Uptrend Intact – Despite corrections,

2️⃣ Historical Pullback & Recovery – The 2022 market correction (-26%) found strong demand in the highlighted red zone (around $480-$500), leading to a powerful reversal.

3️⃣ Resistance Levels in Play – Price is currently testing key resistance levels at $565, $586, and $609. A rejection here could lead to a healthy pullback before continuation.

4️⃣ Future Outlook – If price consolidates and holds above $565, we could see an attempt to break $609, with the long-term trajectory targeting $700+ in coming years.

Trade Plan:

🔹 Bullish Scenario – A breakout above $609 could lead to price discovery, targeting $650-$700 in 2026-2027.

🔹 Bearish Scenario – A rejection at $565-$609 could trigger a retrace to $523 or $480, offering a buy-the-dip opportunity.

🔹 Invalidation – If

📈 The trend is your friend, but expect volatility at these levels! Do you see a breakout coming or a healthy pullback first? Drop your thoughts below! 👇

#SPY #StockMarket #Investing #Trading #MacroAnalysis

Socials: KennyTrades52

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.