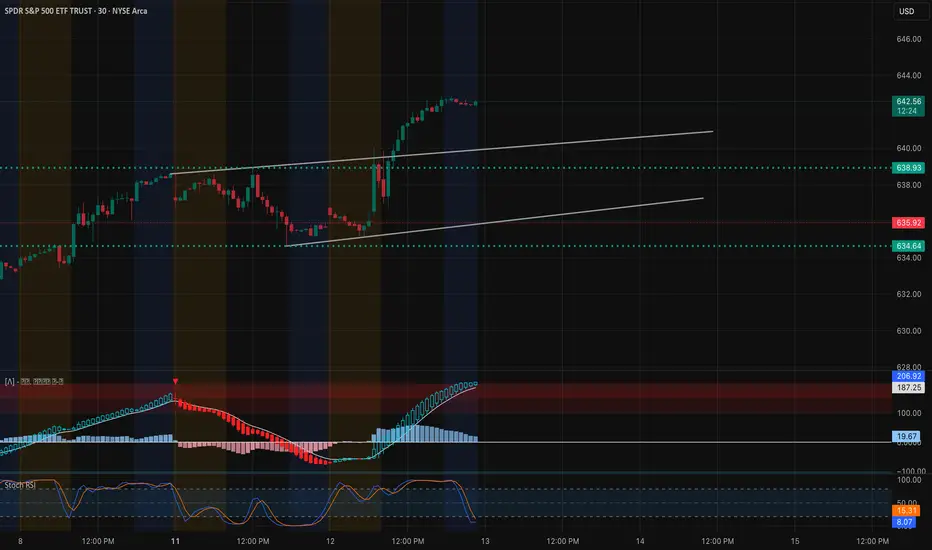

30-Minute Price Action

SPY is pushing higher within a rising channel after bouncing from $634.64 support.

* Resistance: $642.59 – current upper channel limit and intraday high.

* Support: $638.93 – breakout retest level; $635.92 – secondary support and lower channel trendline.

* Indicators:

* MACD remains strongly bullish with widening histogram, although it’s approaching overextended levels.

* Stoch RSI in oversold territory after a minor dip, suggesting potential for continued upside if momentum holds.

1-Hour GEX Insights

* Highest Positive NET GEX / Gamma Wall: $642 – aligns with 30m resistance and intraday high.

* Call Walls Above: $643 (2nd gamma wall) and $645 (major upside extension target).

* Put Support: $633 (first defense) and $631–$630 (secondary gamma floors).

* IVR: 11.2 – relatively low implied volatility rank, keeping long options affordable.

TA + GEX Combined Read

The $642 level is a dual confluence zone — it’s both the top of the 30m rising channel and the highest GEX wall on the 1h chart.

* A breakout above $642 with strong volume could fuel a quick push toward $643–$645, where heavy gamma resistance sits.

* Failure to break $642 convincingly could trigger a pullback toward $638.93, with deeper support at $635.92.

Trading Scenarios for August 13

* Bullish Breakout: Long calls or debit spreads above $642 targeting $643–$645.

* Bearish Rejection: Puts or put spreads if $642 rejects and $638.93 fails, targeting $635.92.

* Range Play: If price holds between $639–$642, short premium strategies could work given low IVR, but be prepared for breakout moves.

Reasoning The 30m rising channel structure and the 1h GEX map both highlight $642 as the decision point for tomorrow. A break above could trigger gamma-fueled upside, while a rejection keeps SPY in range or pulls it back to GEX-supported floors.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk appropriately before trading.

SPY is pushing higher within a rising channel after bouncing from $634.64 support.

* Resistance: $642.59 – current upper channel limit and intraday high.

* Support: $638.93 – breakout retest level; $635.92 – secondary support and lower channel trendline.

* Indicators:

* MACD remains strongly bullish with widening histogram, although it’s approaching overextended levels.

* Stoch RSI in oversold territory after a minor dip, suggesting potential for continued upside if momentum holds.

1-Hour GEX Insights

* Highest Positive NET GEX / Gamma Wall: $642 – aligns with 30m resistance and intraday high.

* Call Walls Above: $643 (2nd gamma wall) and $645 (major upside extension target).

* Put Support: $633 (first defense) and $631–$630 (secondary gamma floors).

* IVR: 11.2 – relatively low implied volatility rank, keeping long options affordable.

TA + GEX Combined Read

The $642 level is a dual confluence zone — it’s both the top of the 30m rising channel and the highest GEX wall on the 1h chart.

* A breakout above $642 with strong volume could fuel a quick push toward $643–$645, where heavy gamma resistance sits.

* Failure to break $642 convincingly could trigger a pullback toward $638.93, with deeper support at $635.92.

Trading Scenarios for August 13

* Bullish Breakout: Long calls or debit spreads above $642 targeting $643–$645.

* Bearish Rejection: Puts or put spreads if $642 rejects and $638.93 fails, targeting $635.92.

* Range Play: If price holds between $639–$642, short premium strategies could work given low IVR, but be prepared for breakout moves.

Reasoning The 30m rising channel structure and the 1h GEX map both highlight $642 as the decision point for tomorrow. A break above could trigger gamma-fueled upside, while a rejection keeps SPY in range or pulls it back to GEX-supported floors.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk appropriately before trading.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.