📅 Forecast Window: July 30 – August 30, 2025

📡 Powered by VolanX Protocol v3.0 | WaverVanir DSS

🏛️ MACRO SETUP – JULY 31 FOMC:

🏦 Fed Funds Rate: 5.50% (expected hold)

🧊 Inflation: Cooling but sticky (CPI ~3.2%, PCE ~2.6%)

💼 Labor Market: Slowing but not collapsing

📈 CME FedWatch: 91% odds of no hike, but tone may be hawkish

🧠 Key Risk: Liquidity compression or prolonged pause = risk-off conditions

🧠 VOLANX PROTOCOL FORECAST (30-Day):

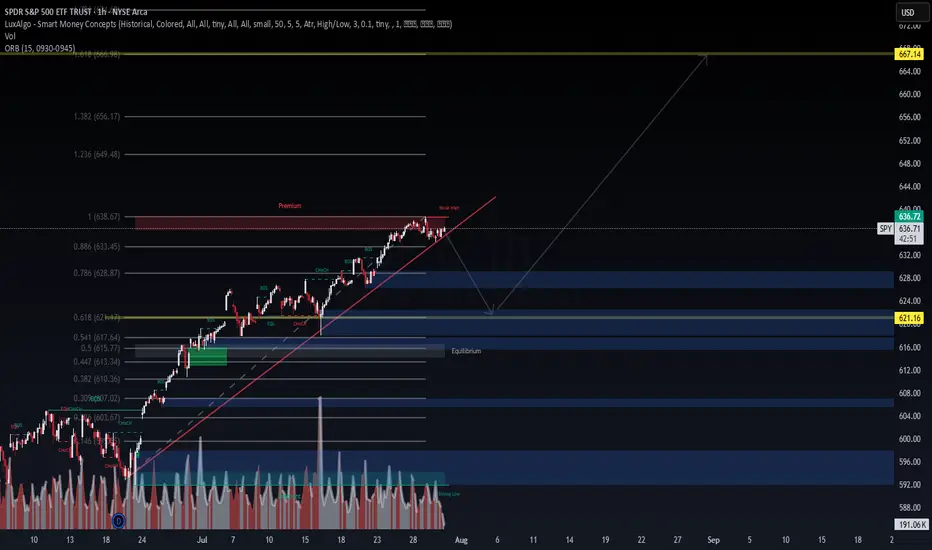

🔸 Current Price: $636.29

🔹 AI Target: $627.46 (−1.4%)

🟠 Signal: HOLD

🧮 Direction Accuracy: 85.5%

⚠️ Model Confidence: −2.049 (bearish drift)

📊 Volatility Forecast: Low (~1.36%) = slow bleed conditions

📉 WAVERVANIR DSS SIGNAL:

🔸 Sentiment Score: 78

🔻 15D Forecast: $630.49 (−0.8%)

🔻 30D Forecast: $616.68 (−2.9%)

📉 Bias: Mild Bearish

🛑 Signal: Hedge exposure, reduce risk, do not chase longs

🔥 OPTIONS FLOW SNAPSHOT:

🚨 $1.53M Call Sweep (645C, Aug 8) = Speculative breakout bet

📉 Multiple Put Sweeps (633–634P, Aug 4) = Institutional hedging

🟢 Mid-dated 638C/645C flows (Aug 15–22) show straddle-the-news positioning

📐 TECHNICAL ZONES TO WATCH:

📉 Support Levels:

$627 = Fib + VolanX AI Target

$616 = DSS Forecast + liquidity pivot

📈 Resistance Levels:

$639 → Gap close

$645 → Major breakout trigger (options magnet)

🕯️ Structure: Distribution bias → No clear momentum unless Fed surprises dovish

🎯 STRATEGIC OUTLOOK:

Scenario Probability SPY Reaction

🟡 Hawkish Hold 65% Pullback toward $627

⚪ Neutral Hold 25% Choppy → $639 max

🟢 Dovish Surprise 10% Spike to $645+

📌 VolanX Protocol Guidance:

"This is a defense window. AI models and options flow both suggest uncertainty, not conviction. Trim longs, hedge risk, and wait for post-FOMC confirmation."

#SPY #VolanX #WaverVanir #FOMC #MacroForecast #OptionsFlow #DSS #SMC #LiquidityTraps #SmartMoney #TradingSignals #AITrading #FederalReserve #TechEarnings #RiskWindow #HawkishFed #FedHold #MacroAI

📡 Powered by VolanX Protocol v3.0 | WaverVanir DSS

🏛️ MACRO SETUP – JULY 31 FOMC:

🏦 Fed Funds Rate: 5.50% (expected hold)

🧊 Inflation: Cooling but sticky (CPI ~3.2%, PCE ~2.6%)

💼 Labor Market: Slowing but not collapsing

📈 CME FedWatch: 91% odds of no hike, but tone may be hawkish

🧠 Key Risk: Liquidity compression or prolonged pause = risk-off conditions

🧠 VOLANX PROTOCOL FORECAST (30-Day):

🔸 Current Price: $636.29

🔹 AI Target: $627.46 (−1.4%)

🟠 Signal: HOLD

🧮 Direction Accuracy: 85.5%

⚠️ Model Confidence: −2.049 (bearish drift)

📊 Volatility Forecast: Low (~1.36%) = slow bleed conditions

📉 WAVERVANIR DSS SIGNAL:

🔸 Sentiment Score: 78

🔻 15D Forecast: $630.49 (−0.8%)

🔻 30D Forecast: $616.68 (−2.9%)

📉 Bias: Mild Bearish

🛑 Signal: Hedge exposure, reduce risk, do not chase longs

🔥 OPTIONS FLOW SNAPSHOT:

🚨 $1.53M Call Sweep (645C, Aug 8) = Speculative breakout bet

📉 Multiple Put Sweeps (633–634P, Aug 4) = Institutional hedging

🟢 Mid-dated 638C/645C flows (Aug 15–22) show straddle-the-news positioning

📐 TECHNICAL ZONES TO WATCH:

📉 Support Levels:

$627 = Fib + VolanX AI Target

$616 = DSS Forecast + liquidity pivot

📈 Resistance Levels:

$639 → Gap close

$645 → Major breakout trigger (options magnet)

🕯️ Structure: Distribution bias → No clear momentum unless Fed surprises dovish

🎯 STRATEGIC OUTLOOK:

Scenario Probability SPY Reaction

🟡 Hawkish Hold 65% Pullback toward $627

⚪ Neutral Hold 25% Choppy → $639 max

🟢 Dovish Surprise 10% Spike to $645+

📌 VolanX Protocol Guidance:

"This is a defense window. AI models and options flow both suggest uncertainty, not conviction. Trim longs, hedge risk, and wait for post-FOMC confirmation."

#SPY #VolanX #WaverVanir #FOMC #MacroForecast #OptionsFlow #DSS #SMC #LiquidityTraps #SmartMoney #TradingSignals #AITrading #FederalReserve #TechEarnings #RiskWindow #HawkishFed #FedHold #MacroAI

Pesanan dibatalkan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.