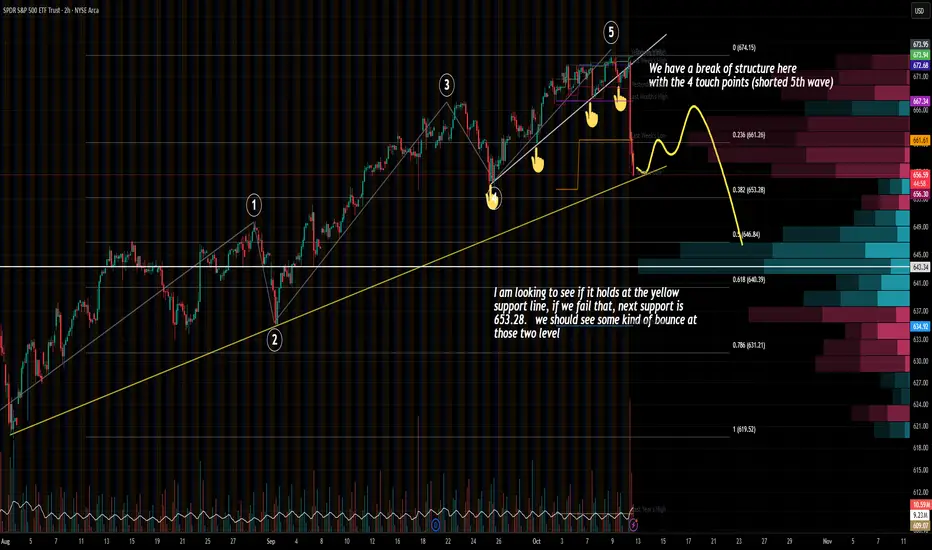

What a morning we had, I wish I would have caught the entire wave down, I did not expect a drop like this to happen, I was only able to capture maybe 20% of the drop in my short. Overall not a bad day. Usually after a drop we look to re-enter for a long. In order to avoid catching a falling knife, we are looking to break down out entry for long into 2.

1st Entry, right at the yellow support line, around 655.xx to 656

We would like to see a bounce then retest the yellow line and entry on the 2nd bounce.

2nd Entry would be at the Fib Level 0.382

I use E-wave pattern as a reference + fib retrace/ext to gauge most of my entry.

My biggest fear with this trade is that the pattern that I am expecting to happen end up finishing in ES before the market open on Monday.

So instead of buying 2 weeks out contract, I am going to buy calls closer to 4 weeks expiration in case I am wrong or ES movement on Sunday and I ended up missed out the entire structure.

TL:DR

Enter 1st long at $655.xx

If we dropped below $655

2nd Long is at 0382 FIB / $683.22

I will probably stop out if it dip below 0.5 FIB

I am not ruling out the possibility that we will go down further than 683.22 and head to 0.5 Fib or even 0.618 Fib.

As always trade with caution, always have a stop loss to prevent blowing up account.

1st Entry, right at the yellow support line, around 655.xx to 656

We would like to see a bounce then retest the yellow line and entry on the 2nd bounce.

2nd Entry would be at the Fib Level 0.382

I use E-wave pattern as a reference + fib retrace/ext to gauge most of my entry.

My biggest fear with this trade is that the pattern that I am expecting to happen end up finishing in ES before the market open on Monday.

So instead of buying 2 weeks out contract, I am going to buy calls closer to 4 weeks expiration in case I am wrong or ES movement on Sunday and I ended up missed out the entire structure.

TL:DR

Enter 1st long at $655.xx

If we dropped below $655

2nd Long is at 0382 FIB / $683.22

I will probably stop out if it dip below 0.5 FIB

I am not ruling out the possibility that we will go down further than 683.22 and head to 0.5 Fib or even 0.618 Fib.

As always trade with caution, always have a stop loss to prevent blowing up account.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.