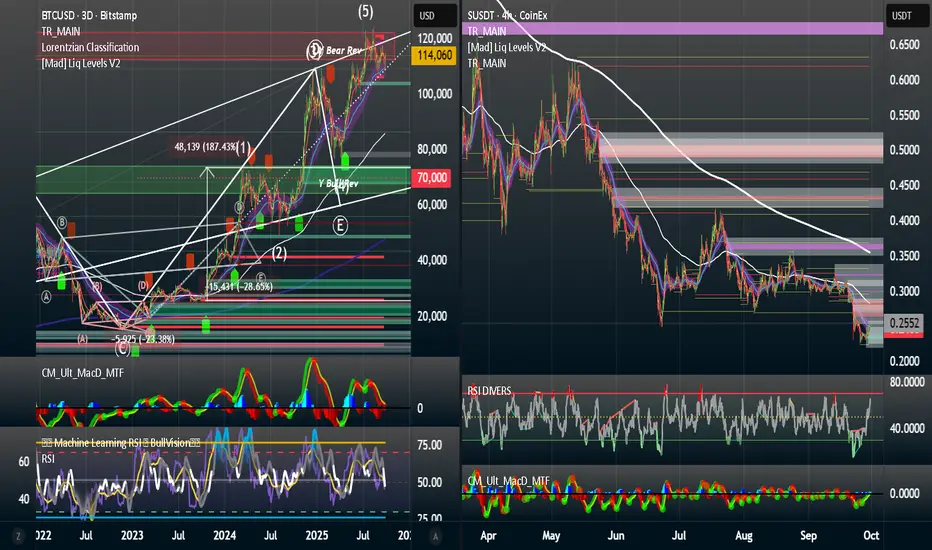

Sonic (SUSDT:COINEX) - Macro + TA

Context:

Macro drivers: USD showing softness, yields stable, equities firm.

Crypto majors holding higher ranges; sentiment neutral.

Key Levels:

Support zones: 0.300–0.305, 0.285, 0.270

Resistance zones: 0.335–0.350, 0.375–0.385, 0.400–0.410, 0.460

2H View:

A 2H close above 0.335 with RSI > 50 would suggest room toward 0.350 / 0.375 / 0.400.

A 2H close below 0.300 could open space toward 0.285 / 0.270 / 0.255.

4H View:

The 200EMA around 0.34–0.35 remains an important zone.

Sustained closes above 0.335–0.340 could leave upside potential to 0.350 / 0.375 / 0.400.

Rejections near 0.350 with momentum slowing may see a move back toward 0.335 / 0.322 / 0.305.

1D View:

Since July, price has ranged 0.30–0.35; supply sits at 0.40–0.46.

Closes around 0.300–0.305 with constructive candles may lead toward 0.335 / 0.350 / 0.375.

A daily close above 0.375 would highlight 0.400 / 0.430 / 0.460.

A daily close under 0.300 would refocus attention on 0.285 / 0.270 / 0.250.

1W Lens:

Market remains under weekly supply 0.40–0.46.

A weekly close above 0.46 would bring 0.50–0.55 into view.

0.30–0.32 may act as an accumulation range while USD stays soft and majors stable; stronger USD or yields could shift focus toward 0.285–0.270.

---

Risk Notes:

Macro events (CPI releases, DXY moves, yield spikes) can shift these dynamics quickly.

TL;DR:

Constructive bias if 0.335 is reclaimed and held.

Losing 0.300 would shift focus to 0.285 / 0.270.

---

*Educational purposes only. Not financial advice. I also warrant that the information created and published here is not prohibited, doesn't constitute investment advice, and isn't created solely for qualified investors.*

Context:

Macro drivers: USD showing softness, yields stable, equities firm.

Crypto majors holding higher ranges; sentiment neutral.

Key Levels:

Support zones: 0.300–0.305, 0.285, 0.270

Resistance zones: 0.335–0.350, 0.375–0.385, 0.400–0.410, 0.460

2H View:

A 2H close above 0.335 with RSI > 50 would suggest room toward 0.350 / 0.375 / 0.400.

A 2H close below 0.300 could open space toward 0.285 / 0.270 / 0.255.

4H View:

The 200EMA around 0.34–0.35 remains an important zone.

Sustained closes above 0.335–0.340 could leave upside potential to 0.350 / 0.375 / 0.400.

Rejections near 0.350 with momentum slowing may see a move back toward 0.335 / 0.322 / 0.305.

1D View:

Since July, price has ranged 0.30–0.35; supply sits at 0.40–0.46.

Closes around 0.300–0.305 with constructive candles may lead toward 0.335 / 0.350 / 0.375.

A daily close above 0.375 would highlight 0.400 / 0.430 / 0.460.

A daily close under 0.300 would refocus attention on 0.285 / 0.270 / 0.250.

1W Lens:

Market remains under weekly supply 0.40–0.46.

A weekly close above 0.46 would bring 0.50–0.55 into view.

0.30–0.32 may act as an accumulation range while USD stays soft and majors stable; stronger USD or yields could shift focus toward 0.285–0.270.

---

Risk Notes:

Macro events (CPI releases, DXY moves, yield spikes) can shift these dynamics quickly.

TL;DR:

Constructive bias if 0.335 is reclaimed and held.

Losing 0.300 would shift focus to 0.285 / 0.270.

---

*Educational purposes only. Not financial advice. I also warrant that the information created and published here is not prohibited, doesn't constitute investment advice, and isn't created solely for qualified investors.*

imaCŁ◎NΞ.x | TA & Market Analysis | x.com/DJC4ndyM4n | imacl.one | https://imaclone.x

PGP Public Key: pastebin.com/aYgSg6m6

PGP Public Key: pastebin.com/aYgSg6m6

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

imaCŁ◎NΞ.x | TA & Market Analysis | x.com/DJC4ndyM4n | imacl.one | https://imaclone.x

PGP Public Key: pastebin.com/aYgSg6m6

PGP Public Key: pastebin.com/aYgSg6m6

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.