Good Afternoon Everyone,

I hope all is well.

Remember to always implement a stop loss in your trading system. I always air on the side of 7% lower than my entry. Trading is an excellent way to grow your investment accounts and make safe income. It is not gambling.

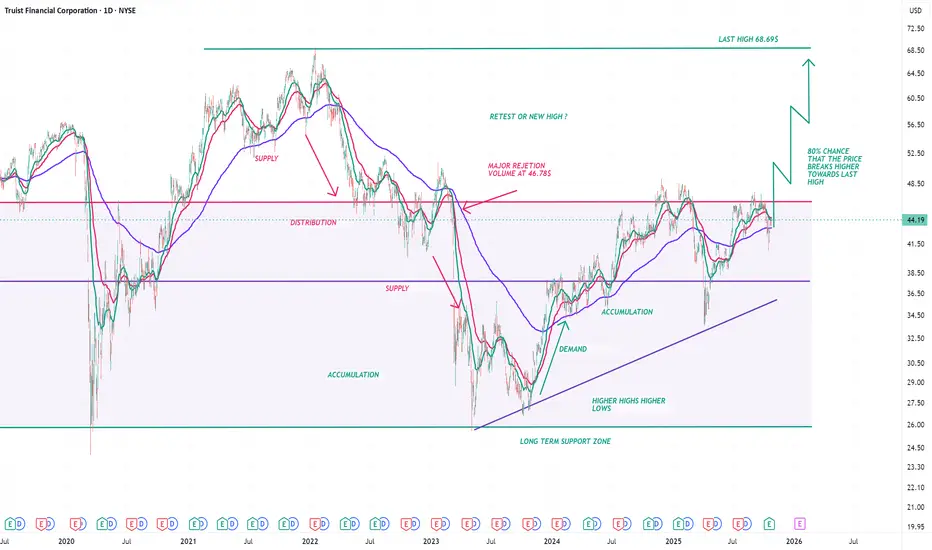

As of late October 2025, analysts hold a "Moderate Buy" consensus rating for Truist Financial Corporation (TFC), with an average price target of approximately $50.59

. The forecast suggests a potential upside of around 14.52% from the current price, with target prices ranging from $46.50 to $60.00.

Additional forecast highlights:

Analyst Ratings: On MarketBeat, the "Moderate Buy" rating is derived from a consensus of analyst opinions, including 2 Strong Buy ratings, 8 Buy ratings, and 8 Hold ratings. This consensus has remained relatively stable over the past few months. Zacks Investment Research reports a similar average brokerage recommendation.

Short-Term Price Movement: StockInvest.us, based on trends up to October 24, 2025, expects TFC to continue moving within a wide, horizontal trend over the next three months, likely trading between $40.76 and $46.54. The stock rose 1.33% on the last trading day, closing at $44.19.

Future Growth: Simply Wall St forecasts an increase in Truist's earnings and revenue over the next few years. They project earnings per share to grow by 10.7% annually, with revenue and earnings increasing by 7.7% and 6.6% per year, respectively. Return on equity is expected to reach 8.8% in three years.

Recent Performance: In October 2025, Truist reported third-quarter results that surpassed Wall Street's revenue and earnings expectations, leading to a temporary increase in share price. Despite a recent rally in financial stocks driven by positive economic outlooks, Truist is trading below its 52-week high from February 2025.

Trade Safe!

Enjoy!

I hope all is well.

Remember to always implement a stop loss in your trading system. I always air on the side of 7% lower than my entry. Trading is an excellent way to grow your investment accounts and make safe income. It is not gambling.

As of late October 2025, analysts hold a "Moderate Buy" consensus rating for Truist Financial Corporation (TFC), with an average price target of approximately $50.59

. The forecast suggests a potential upside of around 14.52% from the current price, with target prices ranging from $46.50 to $60.00.

Additional forecast highlights:

Analyst Ratings: On MarketBeat, the "Moderate Buy" rating is derived from a consensus of analyst opinions, including 2 Strong Buy ratings, 8 Buy ratings, and 8 Hold ratings. This consensus has remained relatively stable over the past few months. Zacks Investment Research reports a similar average brokerage recommendation.

Short-Term Price Movement: StockInvest.us, based on trends up to October 24, 2025, expects TFC to continue moving within a wide, horizontal trend over the next three months, likely trading between $40.76 and $46.54. The stock rose 1.33% on the last trading day, closing at $44.19.

Future Growth: Simply Wall St forecasts an increase in Truist's earnings and revenue over the next few years. They project earnings per share to grow by 10.7% annually, with revenue and earnings increasing by 7.7% and 6.6% per year, respectively. Return on equity is expected to reach 8.8% in three years.

Recent Performance: In October 2025, Truist reported third-quarter results that surpassed Wall Street's revenue and earnings expectations, leading to a temporary increase in share price. Despite a recent rally in financial stocks driven by positive economic outlooks, Truist is trading below its 52-week high from February 2025.

Trade Safe!

Enjoy!

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.