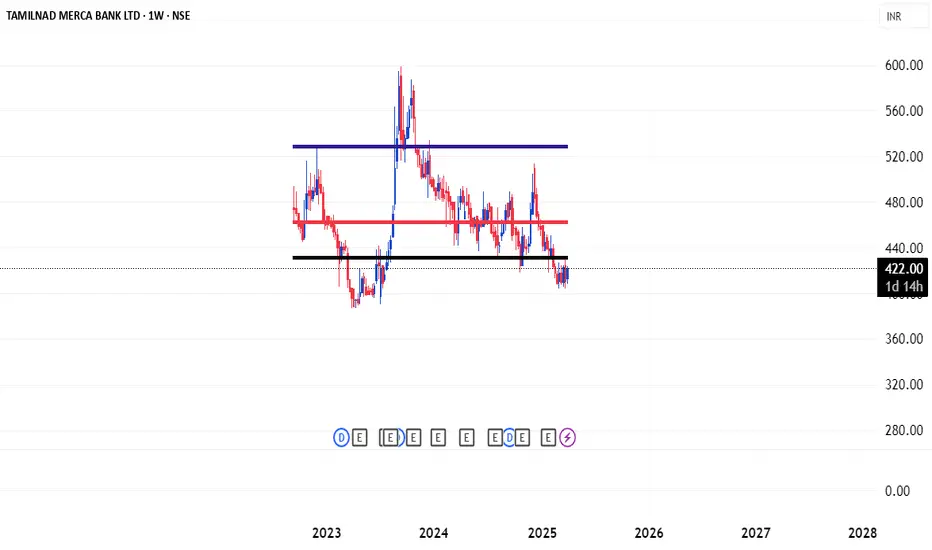

### **Tamilnad Mercantile Bank (TMB)**

**Tamilnad Mercantile Bank Limited (TMB)** is one of India's oldest and most trusted **private sector banks**, known for its strong presence in **Tamil Nadu** and growing footprint across India. The bank primarily serves **small businesses, traders, and the agricultural sector**, offering a range of retail and corporate banking services.

---

### **Key Details About Tamilnad Mercantile Bank (TMB)**

- **Founded:** 1921 (as Nadar Bank, renamed in 1962)

- **Headquarters:** Thoothukudi, Tamil Nadu, India

- **Industry:** Banking & Financial Services

- **Stock Listing:** **NSE & BSE (IPO in 2022)**

- **Total Branches:** 530+ across India

- **Revenue (2023-24):** ₹5,500+ crore (~$660 million)

- **Net Profit (2023-24):** ₹1,000+ crore (~$120 million)

---

### **Key Banking Services**

#### **1. Retail Banking**

- Savings & current accounts, fixed deposits (FDs), and personal loans.

- Gold loans, vehicle loans, and home loans.

#### **2. SME & Corporate Banking**

- Business loans, working capital, and trade finance solutions.

- Special focus on **small traders and MSMEs**.

#### **3. Agricultural Banking**

- Loans for farmers, agribusiness, and dairy farming.

- **Kisan Credit Card (KCC)** and agri-friendly schemes.

#### **4. Digital Banking**

- **TMB Mobile Banking App** & Net Banking.

- UPI, FASTag, and instant money transfers.

---

### **Key Strengths & Achievements**

✅ **One of the oldest private banks in India (100+ years of legacy).**

✅ Strong rural and semi-urban banking network.

✅ Consistently profitable and well-managed NPA (bad loan) levels.

✅ **Among the best capitalized private banks in India.**

✅ Expanding digital banking services to compete with new-age banks.

---

### **Recent Developments (2024)**

📌 **Increased focus on digital transformation** to attract younger customers.

📌 **Expansion of branch network** in North and West India.

📌 **Strengthening of SME and agri-loan portfolio.**

Would you like insights on **TMB stock performance, financials, or growth strategy**? 🚀

**Tamilnad Mercantile Bank Limited (TMB)** is one of India's oldest and most trusted **private sector banks**, known for its strong presence in **Tamil Nadu** and growing footprint across India. The bank primarily serves **small businesses, traders, and the agricultural sector**, offering a range of retail and corporate banking services.

---

### **Key Details About Tamilnad Mercantile Bank (TMB)**

- **Founded:** 1921 (as Nadar Bank, renamed in 1962)

- **Headquarters:** Thoothukudi, Tamil Nadu, India

- **Industry:** Banking & Financial Services

- **Stock Listing:** **NSE & BSE (IPO in 2022)**

- **Total Branches:** 530+ across India

- **Revenue (2023-24):** ₹5,500+ crore (~$660 million)

- **Net Profit (2023-24):** ₹1,000+ crore (~$120 million)

---

### **Key Banking Services**

#### **1. Retail Banking**

- Savings & current accounts, fixed deposits (FDs), and personal loans.

- Gold loans, vehicle loans, and home loans.

#### **2. SME & Corporate Banking**

- Business loans, working capital, and trade finance solutions.

- Special focus on **small traders and MSMEs**.

#### **3. Agricultural Banking**

- Loans for farmers, agribusiness, and dairy farming.

- **Kisan Credit Card (KCC)** and agri-friendly schemes.

#### **4. Digital Banking**

- **TMB Mobile Banking App** & Net Banking.

- UPI, FASTag, and instant money transfers.

---

### **Key Strengths & Achievements**

✅ **One of the oldest private banks in India (100+ years of legacy).**

✅ Strong rural and semi-urban banking network.

✅ Consistently profitable and well-managed NPA (bad loan) levels.

✅ **Among the best capitalized private banks in India.**

✅ Expanding digital banking services to compete with new-age banks.

---

### **Recent Developments (2024)**

📌 **Increased focus on digital transformation** to attract younger customers.

📌 **Expansion of branch network** in North and West India.

📌 **Strengthening of SME and agri-loan portfolio.**

Would you like insights on **TMB stock performance, financials, or growth strategy**? 🚀

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.