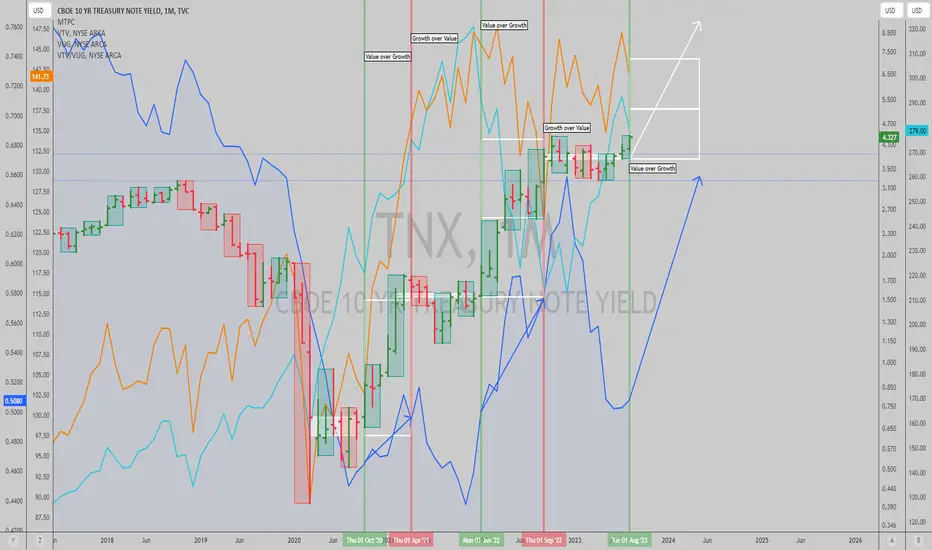

$TNX: Monthly trend in rates helps rotate effectively

Until recently, value stocks were underperforming, prompting questions about the relevance of the value factor. During the pandemic, growth stocks like Amazon and Tesla thrived, but as economies reopened, value stocks improved. However, the shift to value didn't materialize as both value and growth stocks have experienced alternating periods of strong performance and underperformance which we could track effectively monitoring Timemode trends in the monthly  TNX chart as shown in this publication.

TNX chart as shown in this publication.

Long-term interest rates, as indicated by the 10-year bond rate, play a significant role in determining the performance of these stocks. When rates rise, value stocks tend to do better because growth stocks, with longer-term cash flows, are discounted more heavily, making them appear less valuable.

We are entering a period of fast and substantial increases in interest rates, as per Timemode analysis of 10-year bond rates. Thus, I expect energy, value, coal and other names to perform well while this rally in yields lasts, relatively vs growth, biotech, and other rate sensitive names.

Best of luck!

Cheers,

Ivan Labrie.

Long-term interest rates, as indicated by the 10-year bond rate, play a significant role in determining the performance of these stocks. When rates rise, value stocks tend to do better because growth stocks, with longer-term cash flows, are discounted more heavily, making them appear less valuable.

We are entering a period of fast and substantial increases in interest rates, as per Timemode analysis of 10-year bond rates. Thus, I expect energy, value, coal and other names to perform well while this rally in yields lasts, relatively vs growth, biotech, and other rate sensitive names.

Best of luck!

Cheers,

Ivan Labrie.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.