Recent Dip & What It Means for the Trojan Cycle: Fact Check

1. Stablecoin Capital Flow — Not a Typical Sell-Off

On August 14–15, Binance saw $1.82 billion in net stablecoin inflows, one of the highest recent figures.

Simultaneously, Tether and Circle minted a combined $9.5 billion in stablecoins over the past 30 days, signaling significant on-ramp activity.

These patterns contradict what we'd expect in a pure capitulation. Instead, they suggest capital is being positioned to buy into dips, not exit markets—hallmarks of the positioning-reset phase in the Trojan Cycle.

2. Institutional Accumulation Aligns with Thesis

Spot Ether ETFs just recorded over $1 billion in net inflows in one day (led by BlackRock’s ETHA and Fidelity’s FETH), bringing total ETF inflows to $10.8 billion.

Two whales accumulated $150 million in ETH, reinforcing institutional interest at these levels.

This indicates institutional players are using the dip as an opportunity to accumulate—consistent with the Trojan framework's “Trojan vehicles” mechanics.

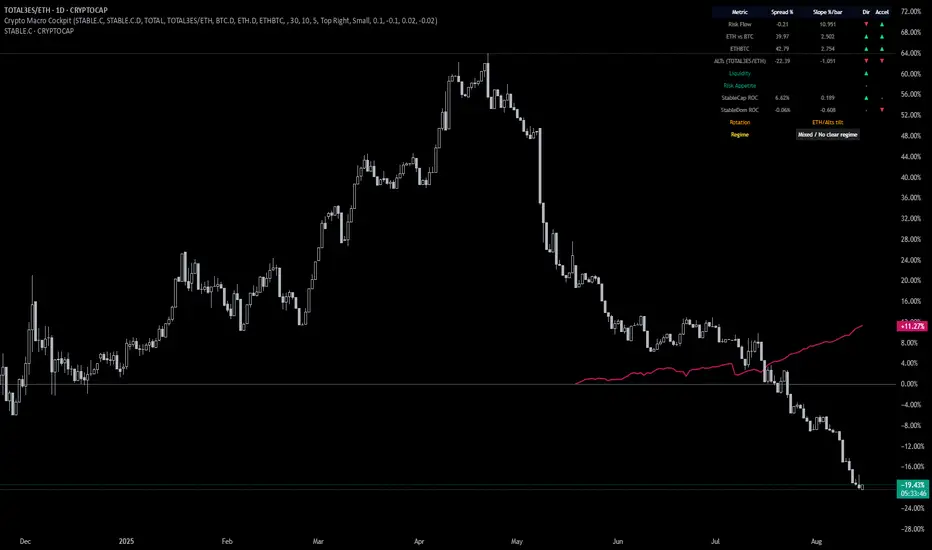

3. Market Structural Trends Support Rotation Setup

Ethereum price dipped ~3%, suggesting short-term weakness but providing a potential entry zone.

Network activity remains robust: ETH daily on-chain transactions recently neared all-time highs at ~1.87 million, driven primarily by stablecoin transfers.

Strong on-chain activity alongside stablecoin flow indicates capital preparation for a rotation phase, rather than a breakdown.

Trojan Cycle Thesis — Data Review

Aspect --> What Trojan Cycle Predicts --> What Data Shows

Stablecoin Inflows --> Increases ahead of rotation --> Binance saw $1.82B in inflows; $9.5B minted overall

Institutional Buying --> Accumulation during dips --> $1B+ ETF inflows; $150M ETH whales buying

Network Activity --> Pre-rotation buildup --> High ETH txn volume, stablecoin activity peaking

Conclusion: All three key indicators align with the Trojan Cycle model. This dip appears to be a positioning flush, not the start of a structural downturn.

On August 14–15, Binance saw $1.82 billion in net stablecoin inflows, one of the highest recent figures.

Simultaneously, Tether and Circle minted a combined $9.5 billion in stablecoins over the past 30 days, signaling significant on-ramp activity.

These patterns contradict what we'd expect in a pure capitulation. Instead, they suggest capital is being positioned to buy into dips, not exit markets—hallmarks of the positioning-reset phase in the Trojan Cycle.

2. Institutional Accumulation Aligns with Thesis

Spot Ether ETFs just recorded over $1 billion in net inflows in one day (led by BlackRock’s ETHA and Fidelity’s FETH), bringing total ETF inflows to $10.8 billion.

Two whales accumulated $150 million in ETH, reinforcing institutional interest at these levels.

This indicates institutional players are using the dip as an opportunity to accumulate—consistent with the Trojan framework's “Trojan vehicles” mechanics.

3. Market Structural Trends Support Rotation Setup

Ethereum price dipped ~3%, suggesting short-term weakness but providing a potential entry zone.

Network activity remains robust: ETH daily on-chain transactions recently neared all-time highs at ~1.87 million, driven primarily by stablecoin transfers.

Strong on-chain activity alongside stablecoin flow indicates capital preparation for a rotation phase, rather than a breakdown.

Trojan Cycle Thesis — Data Review

Aspect --> What Trojan Cycle Predicts --> What Data Shows

Stablecoin Inflows --> Increases ahead of rotation --> Binance saw $1.82B in inflows; $9.5B minted overall

Institutional Buying --> Accumulation during dips --> $1B+ ETF inflows; $150M ETH whales buying

Network Activity --> Pre-rotation buildup --> High ETH txn volume, stablecoin activity peaking

Conclusion: All three key indicators align with the Trojan Cycle model. This dip appears to be a positioning flush, not the start of a structural downturn.

Penerbitan berkaitan

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Penerbitan berkaitan

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.