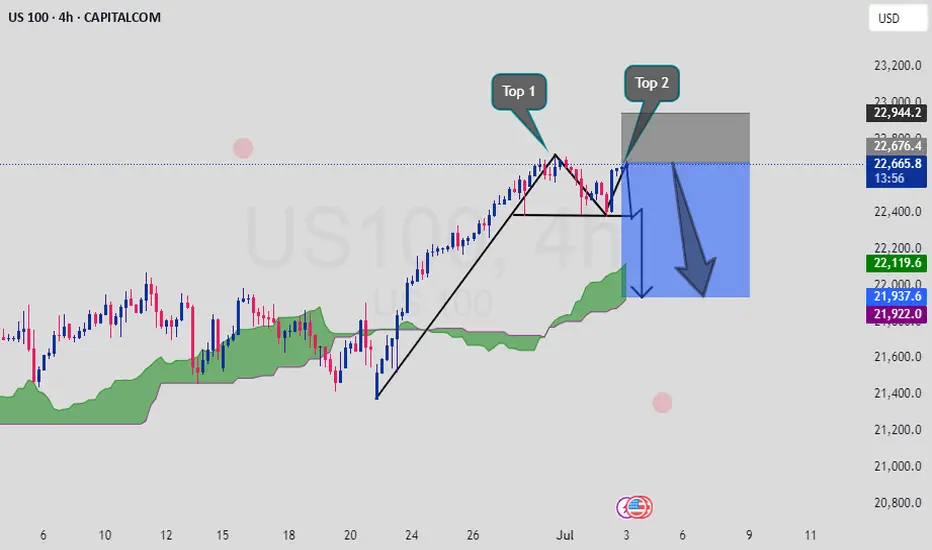

US100 has formed a Double Top on the 4H chart near the 22,944 resistance zone, suggesting potential trend exhaustion after a strong rally. A break below the neckline would confirm a bearish reversal, with room to decline toward the next support level.

🔹 Pattern: Double Top (Reversal)

🔹 Current Price: ~22,662

🔹 Resistance: 22,944

🔹 Support/Target Zone: 22,100 – 21,922

🔹 Technical Outlook: Price rejected near prior highs with Ichimoku cloud support being tested

🔹 Fundamental Context: Tech-heavy index faces pressure amid rising bond yields and valuation concerns

Short setup building – confirmation below neckline could accelerate downside. Monitor for break and follow-through. 📉📊

Note :If you found this helpful, like and follow for more trade ideas!

Share My Idea With Your Firends Mention Your Feed back Comment Section

This is not financial advice. Please conduct your own research and manage risk accordingly.

🔹 Pattern: Double Top (Reversal)

🔹 Current Price: ~22,662

🔹 Resistance: 22,944

🔹 Support/Target Zone: 22,100 – 21,922

🔹 Technical Outlook: Price rejected near prior highs with Ichimoku cloud support being tested

🔹 Fundamental Context: Tech-heavy index faces pressure amid rising bond yields and valuation concerns

Short setup building – confirmation below neckline could accelerate downside. Monitor for break and follow-through. 📉📊

Note :If you found this helpful, like and follow for more trade ideas!

Share My Idea With Your Firends Mention Your Feed back Comment Section

This is not financial advice. Please conduct your own research and manage risk accordingly.

Dagangan aktif

TRADE Active in Sell Position Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.