Forecast for Next Week

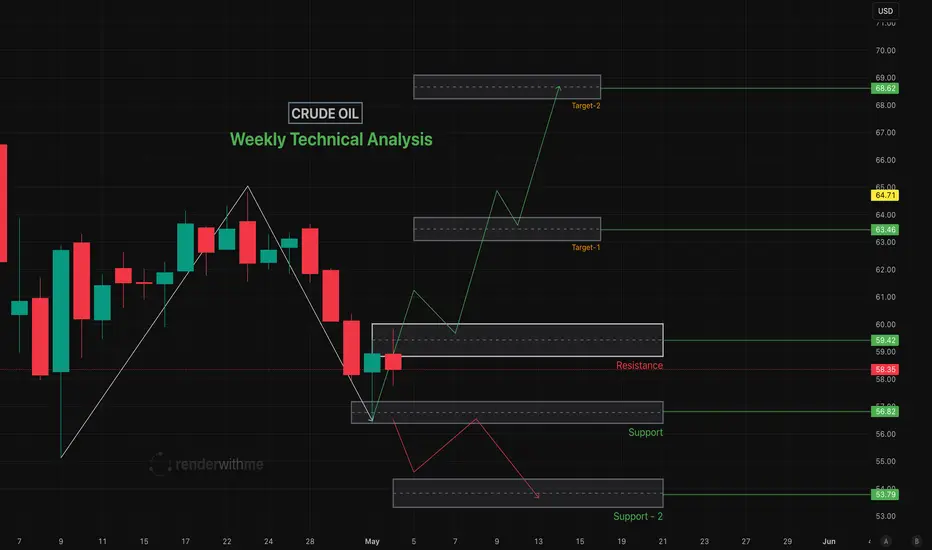

Bearish Scenario (Higher Probability):

Trigger: Failure to reclaim $61.60 or a break below $56.

Targets: $55.05 (April 9 low), $52.53, or $49-$43 if the 4-year support at $64 breaks.

Rationale: Bearish MACD cross, descending channel, and OPEC+ production increase fears.

Bullish Scenario (Lower Probability):

Trigger: A hold above $57.08-$56.53 with a bullish reversal pattern (e.g., Bullish Engulfing) or OPEC+ signalling tighter supply.

Targets: $63.90, $65.81 or $68 (14-day forecast).

Rationale: Oversold RSI and potential demand zone support.

Range-Bound Scenario: If prices stay between $57.00-$60.60, expect choppy trading as the market awaits clarity from OPEC+ and economic data.

Bearish Scenario (Higher Probability):

Trigger: Failure to reclaim $61.60 or a break below $56.

Targets: $55.05 (April 9 low), $52.53, or $49-$43 if the 4-year support at $64 breaks.

Rationale: Bearish MACD cross, descending channel, and OPEC+ production increase fears.

Bullish Scenario (Lower Probability):

Trigger: A hold above $57.08-$56.53 with a bullish reversal pattern (e.g., Bullish Engulfing) or OPEC+ signalling tighter supply.

Targets: $63.90, $65.81 or $68 (14-day forecast).

Rationale: Oversold RSI and potential demand zone support.

Range-Bound Scenario: If prices stay between $57.00-$60.60, expect choppy trading as the market awaits clarity from OPEC+ and economic data.

renderwithme

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

renderwithme

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.