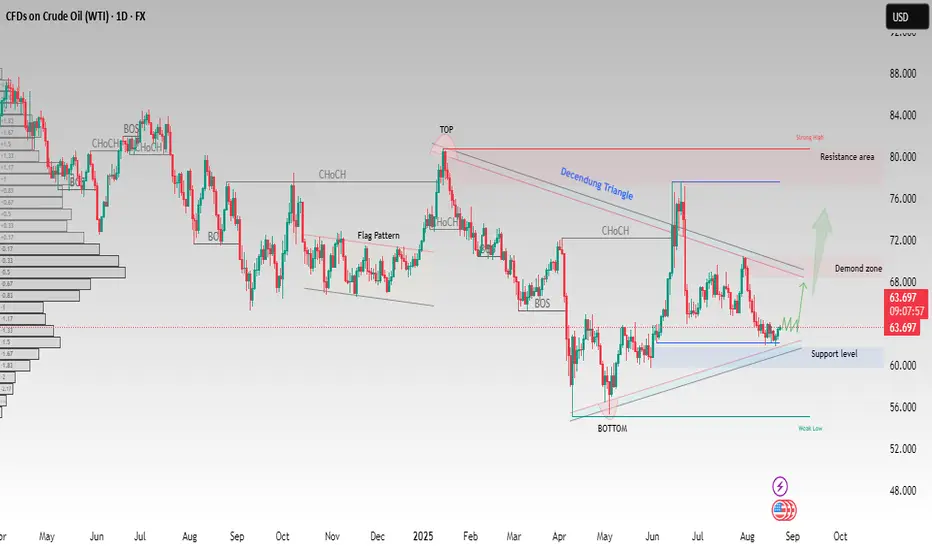

USOIL(WTI) – Demand Zone Tested,Potential Bullish Reversal Ahead

Crude Oil (WTI) is showing signs of strength after respecting the support level near $60–62 and forming a clear demand zone. Price has been consolidating within a descending structure and is now attempting to push higher.

Key observations:

✅ Support level held strongly near $60.

✅ Multiple Change of Character (CHoCH) signals indicating momentum shift.

✅ A potential breakout above the descending triangle may open the path toward the $70–72 demand zone.

📈 If bullish momentum continues, next targets lie around $76–80 resistance area.

On the downside, a break below $60 would invalidate the bullish setup and expose a move toward $56–54.

This structure highlights a possible trend reversal from the bottom toward higher levels, as long as buyers maintain control above support.

This analysis is for educational purposes only. It is not financial advice. Please trade responsibly and manage your risk

Key observations:

✅ Support level held strongly near $60.

✅ Multiple Change of Character (CHoCH) signals indicating momentum shift.

✅ A potential breakout above the descending triangle may open the path toward the $70–72 demand zone.

📈 If bullish momentum continues, next targets lie around $76–80 resistance area.

On the downside, a break below $60 would invalidate the bullish setup and expose a move toward $56–54.

This structure highlights a possible trend reversal from the bottom toward higher levels, as long as buyers maintain control above support.

This analysis is for educational purposes only. It is not financial advice. Please trade responsibly and manage your risk

Dagangan aktif

Trade has been activate " Risk mange has properlyDagangan ditutup secara manual

$ FOREX / GOLD / BTC | Real Trades,Real Result | Risk-managed strategiesn &VIP Signal {My Personal Entries} Join Telegram _ Trade smater ||

📬 Join Free Channel:

t.me/profitmagnetpro12

📬 Join Free Channel:

t.me/profitmagnetpro12

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

$ FOREX / GOLD / BTC | Real Trades,Real Result | Risk-managed strategiesn &VIP Signal {My Personal Entries} Join Telegram _ Trade smater ||

📬 Join Free Channel:

t.me/profitmagnetpro12

📬 Join Free Channel:

t.me/profitmagnetpro12

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.