📉Wave Analysis

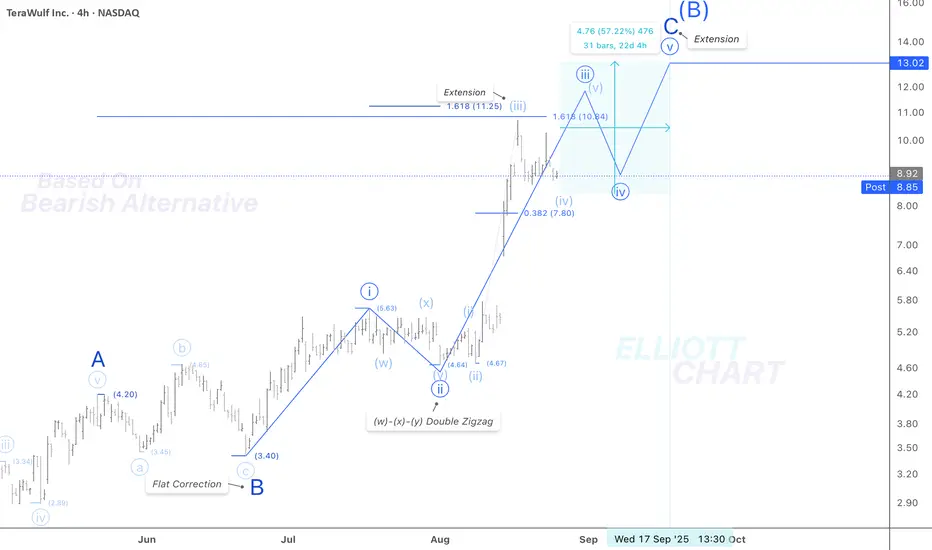

The extending impulsive Minor Wave C may have completed subwave (iii) of Minute Wave iii(circled), peaking just above the 10.50 Fibonacci extension target. As expected, a retracement in Wave (iv) of iii(circled) is unfolding, with price pulling back toward the 0.382 Fibonacci retracement level near 7.80.

📈Trend Analysis

The upward trend — with a potential final rise of 60% and a technical target 🎯near $13 — is expected to continue into mid-September. Once the structure of Minor Wave C completes, the countertrend advance of Intermediate Wave (B) — the second leg of a developing flat correction in Primary Wave ②, in progress since April 9 — will likely give way to a similarly graded decline in Wave (C), possibly extending through year-end.

#CryptoStocks #WULF #BTCMining #BitcoinMining #BTC

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.