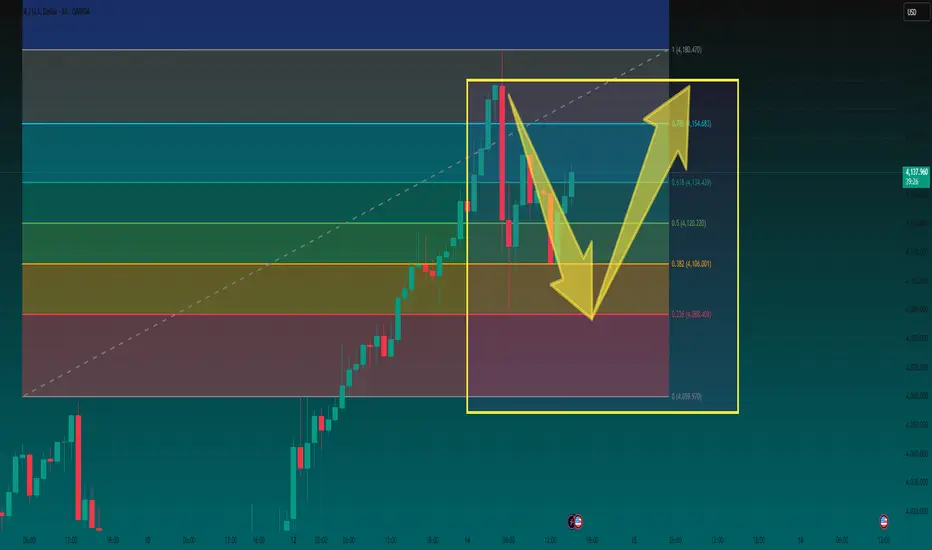

Gold: Scaling Back at 4090 - Awaiting Key Dip-Buying Entry

Federal Reserve Chair Powell is scheduled to speak at 16:20 GMT on Wednesday, addressing the National Association for Business Economics on the Economic Outlook and Monetary Policy.

This speech comes at a time of heightened global market volatility, driven by renewed trade tensions and sharp corrections in digital asset markets. Powell’s remarks may shape expectations around the pace of rate cuts and broader monetary policy, influencing whether the current downward trend in crypto deepens or stabilizes.

Gold pushed to extreme highs during the Asian and European sessions, reinforcing our stance: it’s wise to remain bullish but avoid chasing the rally. Instead, wait for pullbacks to establish long positions.

With the retracement we’re now observing, the timing to enter long positions appears opportune.

After a day of observation, we can now align with the overall uptrend by using these two levels as references.

Execute repeated long positions near 4090, with an initial target of 10–15 points for partial closing. Let remaining positions run toward further highs.

This approach allows you to build long exposure from a solid base — avoiding the risk of buying at extreme highs or getting whipsawed in volatile intermediate price zones.

🟡 Trading Strategy

This speech comes at a time of heightened global market volatility, driven by renewed trade tensions and sharp corrections in digital asset markets. Powell’s remarks may shape expectations around the pace of rate cuts and broader monetary policy, influencing whether the current downward trend in crypto deepens or stabilizes.

Gold pushed to extreme highs during the Asian and European sessions, reinforcing our stance: it’s wise to remain bullish but avoid chasing the rally. Instead, wait for pullbacks to establish long positions.

With the retracement we’re now observing, the timing to enter long positions appears opportune.

- 4090 serves as the key intraday support and trend-defending level

- 4060 acts as the broader swing bullish/bearish divider

After a day of observation, we can now align with the overall uptrend by using these two levels as references.

Execute repeated long positions near 4090, with an initial target of 10–15 points for partial closing. Let remaining positions run toward further highs.

This approach allows you to build long exposure from a solid base — avoiding the risk of buying at extreme highs or getting whipsawed in volatile intermediate price zones.

🟡 Trading Strategy

- Enter long on dips toward 4090

- Add on retests near 4060 if reached

- Partial take profit at +10/15 points

- Let runners advance toward new highs

Dagangan aktif

Stay disciplined and patient — in trending markets, entry timing separates consistent performers from the reactive crowd.✅ Receive 7–10 high-quality signals daily for Forex, Gold, and Bitcoin

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+y9iLG9EHrWs0OTk0

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+y9iLG9EHrWs0OTk0

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

✅ Receive 7–10 high-quality signals daily for Forex, Gold, and Bitcoin

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+y9iLG9EHrWs0OTk0

✅ Fast updates, accurate alerts

✅ Suitable for both beginners and experienced traders

👉 Join now by clicking this link:

t.me/+y9iLG9EHrWs0OTk0

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.