XAUUSD – Intraday Trading Plan | by Ryan_TitanTrader

________________________________________

📈 Market Context

Gold prices remain steady around $3,975, as traders await the U.S. CPI data release later today — a key event that could shape expectations for the Fed’s next rate move.

If inflation cools, the dovish sentiment may boost gold’s safe-haven appeal; however, a hotter CPI print could trigger renewed dollar strength and short-term pressure on XAUUSD.

Market volatility is expected to spike near the release, so liquidity grabs and false breaks are likely before the true direction forms.

________________________________________

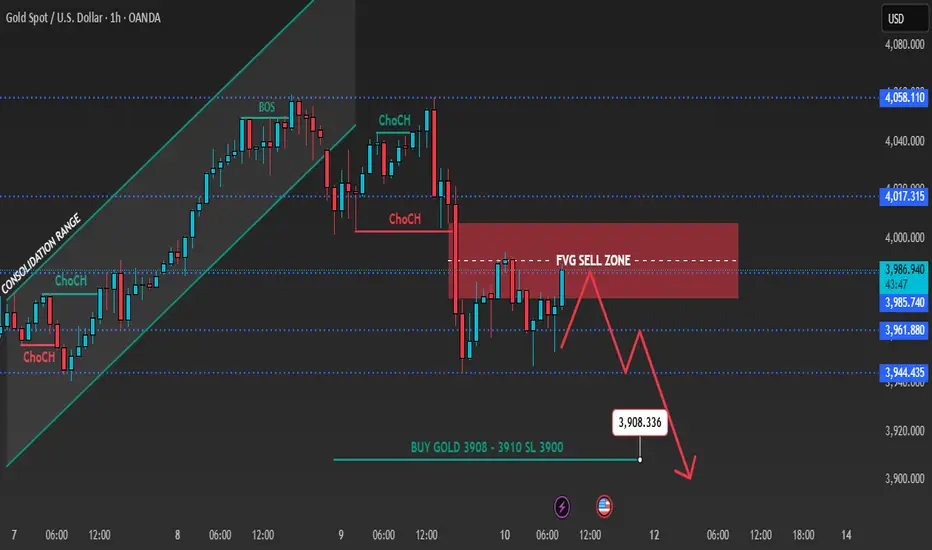

🔎 Technical Analysis (H1 / SMC Style)

• The recent Change of Character (ChoCH) confirms short-term bearish control after breaking the bullish structure near 4017.

• FVG Sell Zone (4015–4017) aligns with premium imbalance and prior liquidity — ideal for short setups if price retests that zone.

• BOS to the downside was confirmed at 3960, showing sellers in control.

• The discount zone 3908–3910 is a strong demand area where buyers may step in after liquidity sweep below 3910.

________________________________________

🟢 Buy Zone: 3908–3910

SL: 3900

TP targets: 3920 → 3940 → 3960+

🔴 Sell Zone: 4015–4017

SL: 4022

TP targets: 4000 → 3985 → 3970

________________________________________

⚠️ Risk Management Tips

• Wait for M15 ChoCH / BOS confirmation before entering either side.

• Use partial position sizing around CPI release — volatility may cause large wicks.

• Watch for liquidity hunts near 3980–3990 before CPI, then confirm structure direction.

________________________________________

✅ Summary

Gold is consolidating below key resistance while awaiting U.S. inflation data.

Smart money may engineer a liquidity sweep toward 4015–4017 (FVG) before resuming the bearish leg into 3910.

However, if CPI comes in softer than expected, buyers may defend 3908–3910, sparking a recovery back toward 3980+.

🔔 Stay alert around CPI release hours — expect manipulative price action and confirm structure breaks before committing to directional trades.

________________________________________

📈 Market Context

Gold prices remain steady around $3,975, as traders await the U.S. CPI data release later today — a key event that could shape expectations for the Fed’s next rate move.

If inflation cools, the dovish sentiment may boost gold’s safe-haven appeal; however, a hotter CPI print could trigger renewed dollar strength and short-term pressure on XAUUSD.

Market volatility is expected to spike near the release, so liquidity grabs and false breaks are likely before the true direction forms.

________________________________________

🔎 Technical Analysis (H1 / SMC Style)

• The recent Change of Character (ChoCH) confirms short-term bearish control after breaking the bullish structure near 4017.

• FVG Sell Zone (4015–4017) aligns with premium imbalance and prior liquidity — ideal for short setups if price retests that zone.

• BOS to the downside was confirmed at 3960, showing sellers in control.

• The discount zone 3908–3910 is a strong demand area where buyers may step in after liquidity sweep below 3910.

________________________________________

🟢 Buy Zone: 3908–3910

SL: 3900

TP targets: 3920 → 3940 → 3960+

🔴 Sell Zone: 4015–4017

SL: 4022

TP targets: 4000 → 3985 → 3970

________________________________________

⚠️ Risk Management Tips

• Wait for M15 ChoCH / BOS confirmation before entering either side.

• Use partial position sizing around CPI release — volatility may cause large wicks.

• Watch for liquidity hunts near 3980–3990 before CPI, then confirm structure direction.

________________________________________

✅ Summary

Gold is consolidating below key resistance while awaiting U.S. inflation data.

Smart money may engineer a liquidity sweep toward 4015–4017 (FVG) before resuming the bearish leg into 3910.

However, if CPI comes in softer than expected, buyers may defend 3908–3910, sparking a recovery back toward 3980+.

🔔 Stay alert around CPI release hours — expect manipulative price action and confirm structure breaks before committing to directional trades.

⚜️ Daily 4 - 6 Swing SIGNALS

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

⚜️ Daily 4 - 6 Swing SIGNALS

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

⚜️ Daily 9 - 15 Scalping SIGNALS

⚜️ SMC - ICT | Document and Real Trade Logic

⚜️ Forex & Crypto & Gold | SIGNALS

Join Real - Time Signals Here: t.me/+pi-w7HQsxw03YWNl

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.