SPDR's Heavy Outflows Signal Institutional Exit – Is Gold Losing Momentum?

📉 SPDR Gold Trust Overview (Apr 24 – May 14, 2025):

🔻 Continuous Net Selling:

From April 30 to May 14, SPDR saw 10 consecutive sessions of net selling, unloading over 18.5 tons of gold.

📌 Key Selling Days:

May 2: -4.87 tons

May 6: -2.29 tons

May 14: -2.58 tons

👉 SPDR's gold holdings dropped from ~948.56 tons to ~936.51 tons — a decrease of over 12 tons in just 3 weeks, signaling that institutional capital is exiting gold ETFs. This reflects waning confidence in gold’s short-term upside.

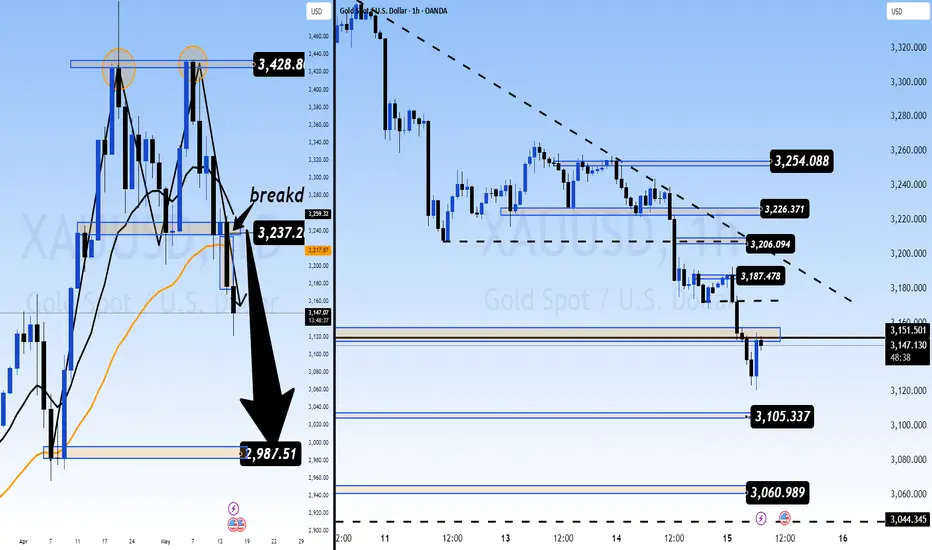

🕯️ Technical Breakdown:

Gold's price has broken below the $3200 support zone on the D1 chart, invalidating the bullish defense zone.

The Double Top pattern is now around 80% completed, signaling a possible deeper drop unless a strong recovery occurs.

Momentum remains strongly bearish, making it difficult to time SELL entries unless lower timeframe resistance shows up.

🧭 Macro Pressures:

Optimism around US economic growth and expectations of prolonged high interest rates are weighing on gold.

The PPI report and Fed Chair's speech today could trigger further volatility, especially if the rhetoric remains hawkish.

CPI earlier this week painted a mixed picture, with sticky inflation — which is bearish for gold.

🧠 What Smart Money Is Doing:

Big funds are rotating out of gold and back into risk-on assets like equities and crypto.

This shift is not just a technical correction; it reflects a broader macro-driven sentiment change.

Gold is currently lacking institutional support.

🎯 Trading Strategy for Today:

🔴 SELL SCALP:

Entry: 3186 – 3188

SL: 3192

TP: 3182 → 3178 → 3174 → 3170 → 3166 → 3160 → 3150 → 3140

🔴 SELL ZONE (High-Probability Resistance):

Entry: 3226 – 3228

SL: 3232

TP: 3220 → 3216 → 3210 → 3206 → 3200 → 3196 → 3190 → ???

🔺 Key Resistance Levels:

3154

3174

3188

3206

3226

3254

⚠️ What to Watch Today:

US PPI and Fed speech could trigger extreme volatility in the NY session.

Wait for price to pull back toward resistance before SELLING — don’t chase.

BUY only if a confirmed D1 reversal or high-volume reaction occurs.

🔚 Final Thoughts:

With SPDR aggressively dumping gold and price breaking below critical support, institutional flows are no longer supporting the bull case. As long as price stays under $3200, SELL remains the primary strategy. A break below $3150 opens the path to $3000.

📣 Stay tuned — AD will update real-time strategies as we approach the US session. Follow, trade smart, and always respect your TP/SL. Good luck!

📉 SPDR Gold Trust Overview (Apr 24 – May 14, 2025):

🔻 Continuous Net Selling:

From April 30 to May 14, SPDR saw 10 consecutive sessions of net selling, unloading over 18.5 tons of gold.

📌 Key Selling Days:

May 2: -4.87 tons

May 6: -2.29 tons

May 14: -2.58 tons

👉 SPDR's gold holdings dropped from ~948.56 tons to ~936.51 tons — a decrease of over 12 tons in just 3 weeks, signaling that institutional capital is exiting gold ETFs. This reflects waning confidence in gold’s short-term upside.

🕯️ Technical Breakdown:

Gold's price has broken below the $3200 support zone on the D1 chart, invalidating the bullish defense zone.

The Double Top pattern is now around 80% completed, signaling a possible deeper drop unless a strong recovery occurs.

Momentum remains strongly bearish, making it difficult to time SELL entries unless lower timeframe resistance shows up.

🧭 Macro Pressures:

Optimism around US economic growth and expectations of prolonged high interest rates are weighing on gold.

The PPI report and Fed Chair's speech today could trigger further volatility, especially if the rhetoric remains hawkish.

CPI earlier this week painted a mixed picture, with sticky inflation — which is bearish for gold.

🧠 What Smart Money Is Doing:

Big funds are rotating out of gold and back into risk-on assets like equities and crypto.

This shift is not just a technical correction; it reflects a broader macro-driven sentiment change.

Gold is currently lacking institutional support.

🎯 Trading Strategy for Today:

🔴 SELL SCALP:

Entry: 3186 – 3188

SL: 3192

TP: 3182 → 3178 → 3174 → 3170 → 3166 → 3160 → 3150 → 3140

🔴 SELL ZONE (High-Probability Resistance):

Entry: 3226 – 3228

SL: 3232

TP: 3220 → 3216 → 3210 → 3206 → 3200 → 3196 → 3190 → ???

🔺 Key Resistance Levels:

3154

3174

3188

3206

3226

3254

⚠️ What to Watch Today:

US PPI and Fed speech could trigger extreme volatility in the NY session.

Wait for price to pull back toward resistance before SELLING — don’t chase.

BUY only if a confirmed D1 reversal or high-volume reaction occurs.

🔚 Final Thoughts:

With SPDR aggressively dumping gold and price breaking below critical support, institutional flows are no longer supporting the bull case. As long as price stays under $3200, SELL remains the primary strategy. A break below $3150 opens the path to $3000.

📣 Stay tuned — AD will update real-time strategies as we approach the US session. Follow, trade smart, and always respect your TP/SL. Good luck!

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+1rXbCGqCUAoyMmU9

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+1rXbCGqCUAoyMmU9

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+1rXbCGqCUAoyMmU9

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+1rXbCGqCUAoyMmU9

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.