✅ Fundamental Analysis

🔹 Fed Rate Cut Expectations

The Federal Reserve is almost certain to cut rates by 25 basis points in September, which is the market consensus. The recent rally in gold has been primarily driven by “rate cut expectations” rather than purely safe-haven demand. As the rate decision approaches, market volatility is expected to increase.

🔹 Geopolitical Risk Support

Ongoing global geopolitical risks continue to provide additional safe-haven support, keeping gold prices within a strong range.

🔹 “Buy the Rumor, Sell the Fact” Logic

Before the rate decision: Market sentiment dominates, with gold maintaining a high-level bullish consolidation.

After the rate decision: If the rate cut is delivered and Powell does not sound excessively dovish, a short-term pullback could occur on “sell the fact” behavior.

✅ Technical Analysis

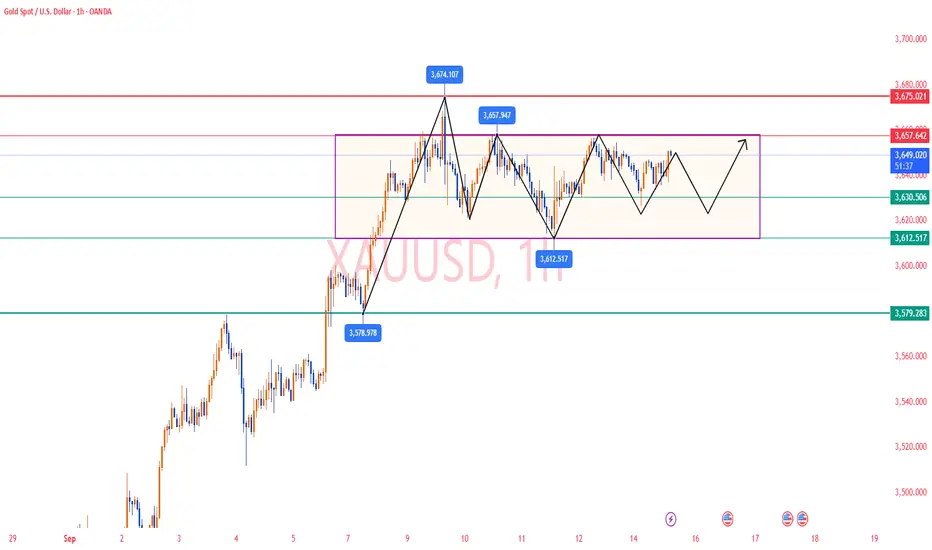

🔸 From a structural perspective, gold broke out of a four-month consolidation range and formed a strong unilateral uptrend, reaching as high as $3674. Based on the principle of “the longer the base, the higher the move,” the trend remains strong, with no clear topping signal yet. However, the rapid rise has caused short-term overextension, suggesting a need for technical correction.

🔸 On the 4-hour chart, the current candles are trading near the Bollinger Band midline (around $3640), showing balanced forces between bulls and bears. The narrowing Bollinger Bands indicate a consolidation phase. A strong breakout above the upper band ($3660) could lead to a retest of $3675–3680. The MA5, MA10, and MA20 are converging, showing that the market is waiting for a directional breakout. As long as prices hold above MA20 ($3640–3620), the bullish structure remains intact.

🔴 Resistance Levels: 3657–3660 / 3675–3680

🟢 Support Levels: 3625–3630 / 3605–3610

✅ Trading Strategy Reference:

🔰 Short-Term Idea: Focus on buying on dips near the 3625–3630 support zone. Light short positions may be considered if the price stalls near 3657–3660.

🔰 Medium-Term Idea: If gold breaks and holds above 3675–3680, the rally could extend toward 3700 or even new highs. If it falls below 3620–3610, a deeper correction may unfold, targeting 3595–3580.

🔥Trading Reminder: Trading strategies are time-sensitive, and market conditions can change rapidly. Please adjust your trading plan based on real-time market conditions. If you have any questions , feel free to contact me🤝

🔹 Fed Rate Cut Expectations

The Federal Reserve is almost certain to cut rates by 25 basis points in September, which is the market consensus. The recent rally in gold has been primarily driven by “rate cut expectations” rather than purely safe-haven demand. As the rate decision approaches, market volatility is expected to increase.

🔹 Geopolitical Risk Support

Ongoing global geopolitical risks continue to provide additional safe-haven support, keeping gold prices within a strong range.

🔹 “Buy the Rumor, Sell the Fact” Logic

Before the rate decision: Market sentiment dominates, with gold maintaining a high-level bullish consolidation.

After the rate decision: If the rate cut is delivered and Powell does not sound excessively dovish, a short-term pullback could occur on “sell the fact” behavior.

✅ Technical Analysis

🔸 From a structural perspective, gold broke out of a four-month consolidation range and formed a strong unilateral uptrend, reaching as high as $3674. Based on the principle of “the longer the base, the higher the move,” the trend remains strong, with no clear topping signal yet. However, the rapid rise has caused short-term overextension, suggesting a need for technical correction.

🔸 On the 4-hour chart, the current candles are trading near the Bollinger Band midline (around $3640), showing balanced forces between bulls and bears. The narrowing Bollinger Bands indicate a consolidation phase. A strong breakout above the upper band ($3660) could lead to a retest of $3675–3680. The MA5, MA10, and MA20 are converging, showing that the market is waiting for a directional breakout. As long as prices hold above MA20 ($3640–3620), the bullish structure remains intact.

🔴 Resistance Levels: 3657–3660 / 3675–3680

🟢 Support Levels: 3625–3630 / 3605–3610

✅ Trading Strategy Reference:

🔰 Short-Term Idea: Focus on buying on dips near the 3625–3630 support zone. Light short positions may be considered if the price stalls near 3657–3660.

🔰 Medium-Term Idea: If gold breaks and holds above 3675–3680, the rally could extend toward 3700 or even new highs. If it falls below 3620–3610, a deeper correction may unfold, targeting 3595–3580.

🔥Trading Reminder: Trading strategies are time-sensitive, and market conditions can change rapidly. Please adjust your trading plan based on real-time market conditions. If you have any questions , feel free to contact me🤝

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.