GOLD EASES FROM RECORD HIGHS AHEAD OF U.S. INFLATION DATA

1/7

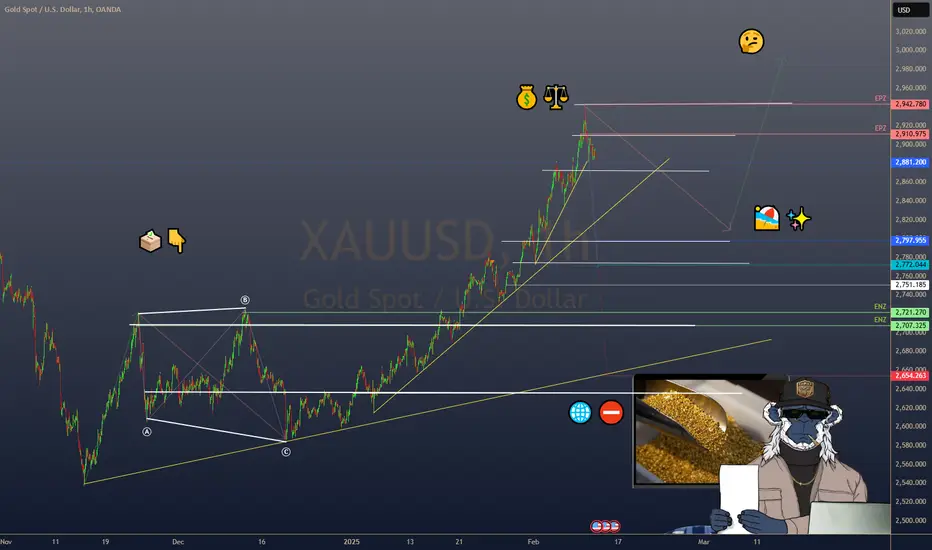

Gold hit a record high of $2,942.70/oz on Feb 11, fueled by safe-haven demand amid fresh U.S. tariffs. Today, it’s dipped 0.2% to $2,892.50 as investors take profits and watch U.S. inflation data. Let’s dig in! 💰⚖️

2/7 – RECENT PRICE ACTION

• All-time high at $2,942.70/oz—sparked by President Trump’s 25% tariffs on steel & aluminum

• Spot gold now at $2,892.50 (↓0.2%), with futures at $2,931.40 (↓0.1%)

• The rally’s paused—are we in for a short breather or a bigger correction? 🤔

3/7 – TARIFF TENSIONS

• 25% tariffs raise global trade war fears, boosting gold’s safe-haven appeal

• Markets worried about inflation, as import costs could climb

• Gold remains a hedge against economic uncertainty and currency devaluation 🌐⛔️

4/7 – MACROECONOMIC DRIVERS

• Fed Chair Powell’s hawkish comments on rate policy sent gold lower—higher rates often weigh on non-yielding assets

• U.S. inflation data (due soon) could shape the Fed’s next move—any upside surprise might strengthen the dollar, pressuring gold further

5/7 – INVESTOR SENTIMENT

• Profit-taking: After a massive run-up, traders might lock in gains

• Safe Haven: Still an underlying bullish sentiment if tariffs escalate

• The $2,900–$2,950 range is in focus—will gold consolidate or stage another breakout?

6/7 Where’s gold heading next?

1️⃣ Above $3,000—safe haven demand remains strong ✨

2️⃣ Sideways around $2,900—pausing for data 🏖️

3️⃣ Back under $2,850—hawkish Fed sinks gold ⬇️

Vote below! 🗳️👇

7/7 – STRATEGY WATCH

• Short-Term: Watch U.S. inflation data & dollar moves—gold typically moves opposite the greenback

• Long-Term: If tariffs stoke inflationary pressure, gold may shine even brighter. Keep an eye on geopolitical developments! 🌎

1/7

Gold hit a record high of $2,942.70/oz on Feb 11, fueled by safe-haven demand amid fresh U.S. tariffs. Today, it’s dipped 0.2% to $2,892.50 as investors take profits and watch U.S. inflation data. Let’s dig in! 💰⚖️

2/7 – RECENT PRICE ACTION

• All-time high at $2,942.70/oz—sparked by President Trump’s 25% tariffs on steel & aluminum

• Spot gold now at $2,892.50 (↓0.2%), with futures at $2,931.40 (↓0.1%)

• The rally’s paused—are we in for a short breather or a bigger correction? 🤔

3/7 – TARIFF TENSIONS

• 25% tariffs raise global trade war fears, boosting gold’s safe-haven appeal

• Markets worried about inflation, as import costs could climb

• Gold remains a hedge against economic uncertainty and currency devaluation 🌐⛔️

4/7 – MACROECONOMIC DRIVERS

• Fed Chair Powell’s hawkish comments on rate policy sent gold lower—higher rates often weigh on non-yielding assets

• U.S. inflation data (due soon) could shape the Fed’s next move—any upside surprise might strengthen the dollar, pressuring gold further

5/7 – INVESTOR SENTIMENT

• Profit-taking: After a massive run-up, traders might lock in gains

• Safe Haven: Still an underlying bullish sentiment if tariffs escalate

• The $2,900–$2,950 range is in focus—will gold consolidate or stage another breakout?

6/7 Where’s gold heading next?

1️⃣ Above $3,000—safe haven demand remains strong ✨

2️⃣ Sideways around $2,900—pausing for data 🏖️

3️⃣ Back under $2,850—hawkish Fed sinks gold ⬇️

Vote below! 🗳️👇

7/7 – STRATEGY WATCH

• Short-Term: Watch U.S. inflation data & dollar moves—gold typically moves opposite the greenback

• Long-Term: If tariffs stoke inflationary pressure, gold may shine even brighter. Keep an eye on geopolitical developments! 🌎

⚡️ Request a trial or subscribe to our premium🛠️tools at ➡️DCAlpha.net

All scripts & content provided by DCAChampion are for informational & educational purposes only.

All scripts & content provided by DCAChampion are for informational & educational purposes only.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

⚡️ Request a trial or subscribe to our premium🛠️tools at ➡️DCAlpha.net

All scripts & content provided by DCAChampion are for informational & educational purposes only.

All scripts & content provided by DCAChampion are for informational & educational purposes only.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.