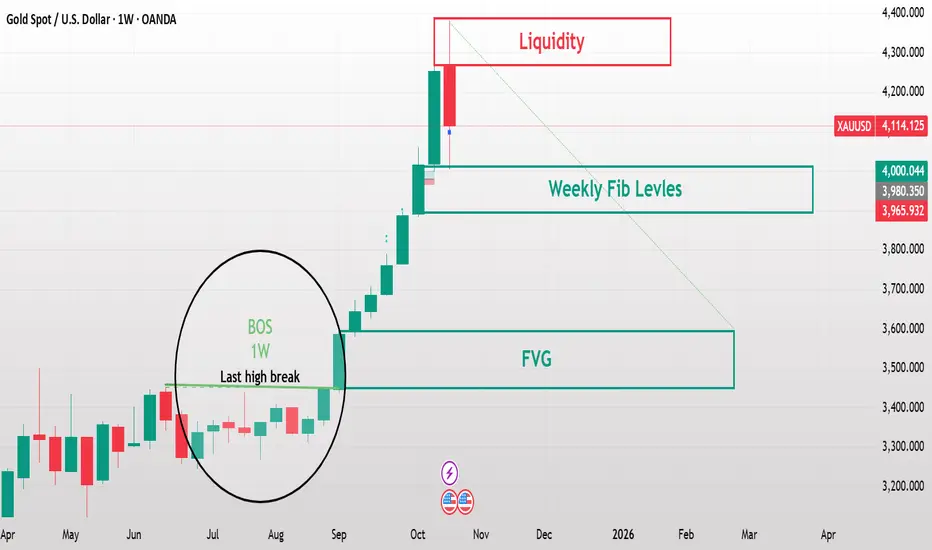

Gold Weekly Forecast Liquidity Retest or Correction Phase Ahead

Gold is showing early signs of a technical slowdown after a strong bullish wave that tested the 4200–4300 resistance zone. Price may attempt a mild retest of this area early in the week, but if rejection continues, a deeper correction toward the 4000–3900 demand zone could follow. A clear weekly close above 4300, however, may trigger renewed bullish strength toward the 4400 region.

Key Levels:

Resistance: 4200 – 4300

Support: 4000 – 3900

Next Bullish Target (on break): 4400

Reasoning:

Technically, the market structure shows a possible liquidity sweep near 4300, followed by bearish rejection candles, signaling weakening momentum. The Fibonacci retracement between 4000–3960 aligns with the Fair Value Gap, suggesting potential liquidity attraction before another bullish continuation.

Fundamentally, the upcoming U.S. GDP, Core PCE, and FOMC remarks may drive volatility. Strong U.S. data or hawkish commentary could strengthen the dollar and pressure gold lower, while softer readings might offer temporary support to buyers.

Disclaimer:

This analysis is for educational and informational purposes only and does not constitute financial advice. Always perform your own research and manage risk responsibly.

Key Levels:

Resistance: 4200 – 4300

Support: 4000 – 3900

Next Bullish Target (on break): 4400

Reasoning:

Technically, the market structure shows a possible liquidity sweep near 4300, followed by bearish rejection candles, signaling weakening momentum. The Fibonacci retracement between 4000–3960 aligns with the Fair Value Gap, suggesting potential liquidity attraction before another bullish continuation.

Fundamentally, the upcoming U.S. GDP, Core PCE, and FOMC remarks may drive volatility. Strong U.S. data or hawkish commentary could strengthen the dollar and pressure gold lower, while softer readings might offer temporary support to buyers.

Disclaimer:

This analysis is for educational and informational purposes only and does not constitute financial advice. Always perform your own research and manage risk responsibly.

Dagangan aktif

More Market updates : Join my telegram channel

t.me/+T-DmNW7QW0k5MTdk

My telegram contact for direct reach to me @swing_trader24

t.me/+T-DmNW7QW0k5MTdk

My telegram contact for direct reach to me @swing_trader24

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

More Market updates : Join my telegram channel

t.me/+T-DmNW7QW0k5MTdk

My telegram contact for direct reach to me @swing_trader24

t.me/+T-DmNW7QW0k5MTdk

My telegram contact for direct reach to me @swing_trader24

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.