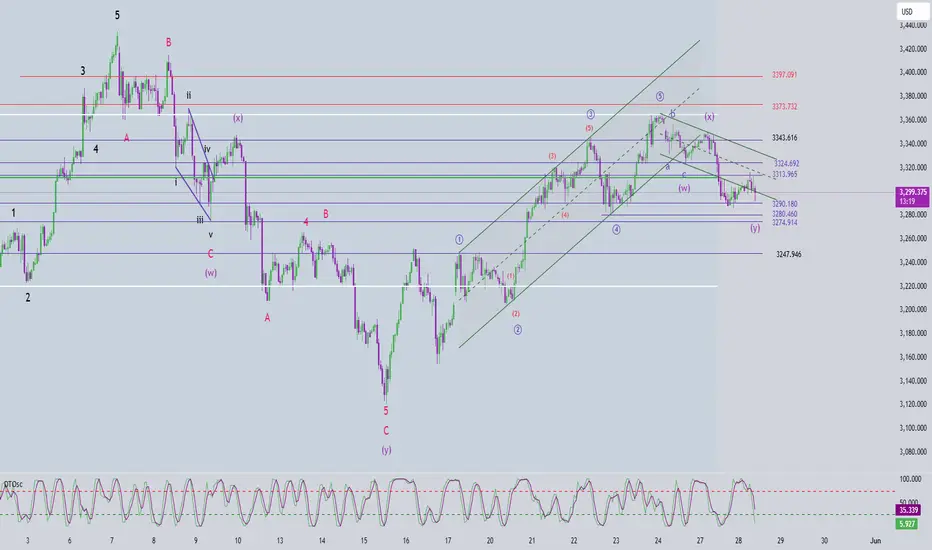

Elliott Wave Analysis – XAUUSD Trading Plan – 28th May 2025

🔍 Current Wave Structure

After a sharp drop yesterday, price has mildly recovered and is now consolidating around the 3314 zone. The correction has nearly reached the target of wave C (green). However, the current rebound is weak, marked by small, overlapping H1 candles — suggesting the bullish structure is not yet convincing.

At this point, we’re tracking two main scenarios:

✅ Scenario 1 – Correction Completed

Wave C seems complete, and price might be starting a new bullish trend.

That said, the overlapping candles on H1 could also indicate the formation of a leading diagonal for wave 1.

In this case, wave 2 is likely to be a strong retracement — typically forming as a zigzag or flat correction.

📌 Strategy:

Wait for wave 2 to complete before looking for a better buy opportunity.

🌀 Scenario 2 – Correction Still in Progress

If the price continues to move slowly or goes sideways, we could be in wave b of a double zigzag correction (wave Y).

🎯 Wave c within wave Y may target 3324.

However, if price breaks below 3284 before hitting 3324, it would likely mean wave c has started, with an expected end near 3280–3274.

📈 Momentum Outlook

D1: Momentum remains bearish ⇒ primary trend still points downward.

H4: Momentum is currently rising ⇒ we may see a temporary recovery today.

H1: Approaching oversold ⇒ if reversal signals appear, short-term buy setups may emerge.

🎯 Trade Plan for Today (28/05/2025)

🔹 Buy Scalp

Entry: 3292 – 3289

SL: 3282

TP1: 3313

TP2: 3324

🔹 Buy Swing

Entry: 3280 – 3277

SL: 3270

TP1: 3290

TP2: 3313

TP3: 3324

🕰️ Expected timing: From London session through New York close

🔸 Sell Zone

Entry: 3324 – 3327

SL: 3334

TP1: 3313

TP2: 3290

TP3: 3280

🕰️ Ideal entry: If price hits resistance during US session or late London

📌 All scenarios will be updated as soon as wave 2 completes or if price clearly breaks below 3284.

Be patient — let the market confirm before taking action.

Dagangan aktif

🕵️♂️ H4 Chart Observation – XAUUSDOn the H4 timeframe, we’re seeing bullish candles with short bodies, indicating a lack of strong momentum behind the move.

📈 H4 momentum is approaching overbought territory —

If the current candle closes and the next one follows through, we could start seeing signs of a potential bearish reversal.

🔍 Our plan:

Keep monitoring H4 momentum. Once it enters the overbought zone, we’ll shift to the H1 timeframe to look for Sell setups with confirmation.

📢 Sometimes signals appear on TradingView with a slight delay!

🚀 Join our Telegram channel to get instant updates and real-time scalping signals:

👉 t.me/+xkFQ95yHVOEwNDc1

🚀 Join our Telegram channel to get instant updates and real-time scalping signals:

👉 t.me/+xkFQ95yHVOEwNDc1

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

📢 Sometimes signals appear on TradingView with a slight delay!

🚀 Join our Telegram channel to get instant updates and real-time scalping signals:

👉 t.me/+xkFQ95yHVOEwNDc1

🚀 Join our Telegram channel to get instant updates and real-time scalping signals:

👉 t.me/+xkFQ95yHVOEwNDc1

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.