Gold Price Update – Neutral Trend with Key Breakout Levels Ahead

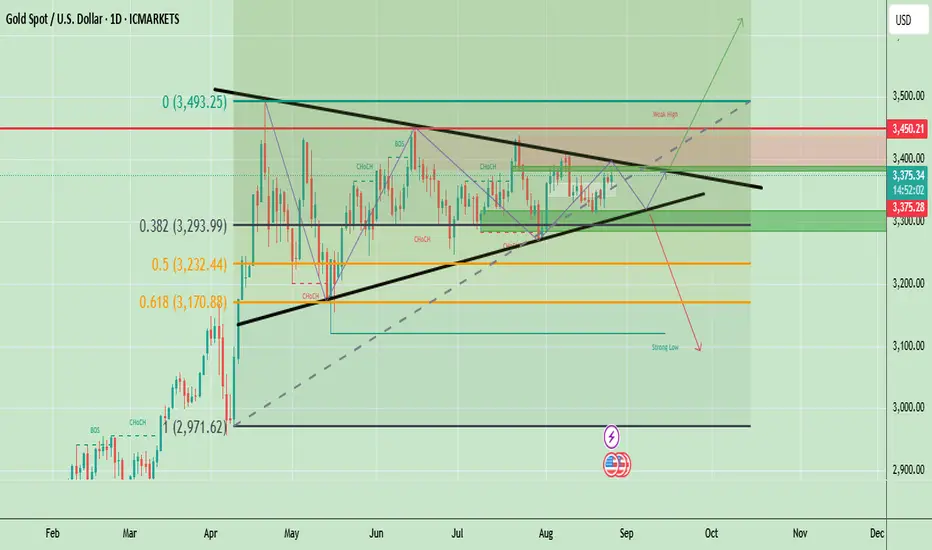

As of August 26, 2025, gold (XAU/USD) is trading around $3,375 and remains in a consolidation phase inside a symmetrical triangle. Price is holding between $3,170 support and $3,450 resistance, with $3,493 as a major supply zone. A breakout above $3,450–$3,493 could extend the rally toward $3,600, while a breakdown below $3,293–$3,170 may trigger a decline toward $3,000. Until a clear breakout occurs, the overall trend is neutral with a slight bullish bias due to the long-term uptrend still intact.

🔑 Key Levels to Watch

- Resistance: $3,383 → $3,450 → $3,493

- Support: $3,317 → $3,293 → $3,232

- Breakout Zones: Below $3,293: Opens room to $3,170. Above $3,390: May lead to fresh highs toward $3,450+

Price has been ranging for months between $3,170 (Fib 0.618) support and $3,493 (supply/weak high) resistance. Market structure shows multiple CHoCH (Change of Character) signals, indicating indecision and sideways consolidation.

Gold 1hr Chart

Gold is in an uptrend, but watch $3,378 resistance for breakout confirmation; otherwise, expect a dip toward $3,345–$3,357 before resuming higher.

Buy Zone: $3,345 – $3,357 (ideal retracement support)

Buy Trigger: Break and close above $3,378 (confirmation for upside move)

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

🔑 Key Levels to Watch

- Resistance: $3,383 → $3,450 → $3,493

- Support: $3,317 → $3,293 → $3,232

- Breakout Zones: Below $3,293: Opens room to $3,170. Above $3,390: May lead to fresh highs toward $3,450+

Price has been ranging for months between $3,170 (Fib 0.618) support and $3,493 (supply/weak high) resistance. Market structure shows multiple CHoCH (Change of Character) signals, indicating indecision and sideways consolidation.

Gold 1hr Chart

Gold is in an uptrend, but watch $3,378 resistance for breakout confirmation; otherwise, expect a dip toward $3,345–$3,357 before resuming higher.

Buy Zone: $3,345 – $3,357 (ideal retracement support)

Buy Trigger: Break and close above $3,378 (confirmation for upside move)

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Dagangan aktif

XAUUSD is still trading inside an upward channel after bouncing strongly from the 3,350 support area. Price is currently holding near 3,390 but facing resistance just below 3,400. As long as 3,360 support holds, the bullish momentum remains intact with the potential to test 3,400–3,410 resistance. However, if price breaks below 3,360, it could signal weakness and open room for a deeper pullback.

Dagangan ditutup: sasaran tercapai

Target achieved successfully$38=380 Pips Booked ($3375-$3,413 Target)

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.