🔍 Technical Breakdown:

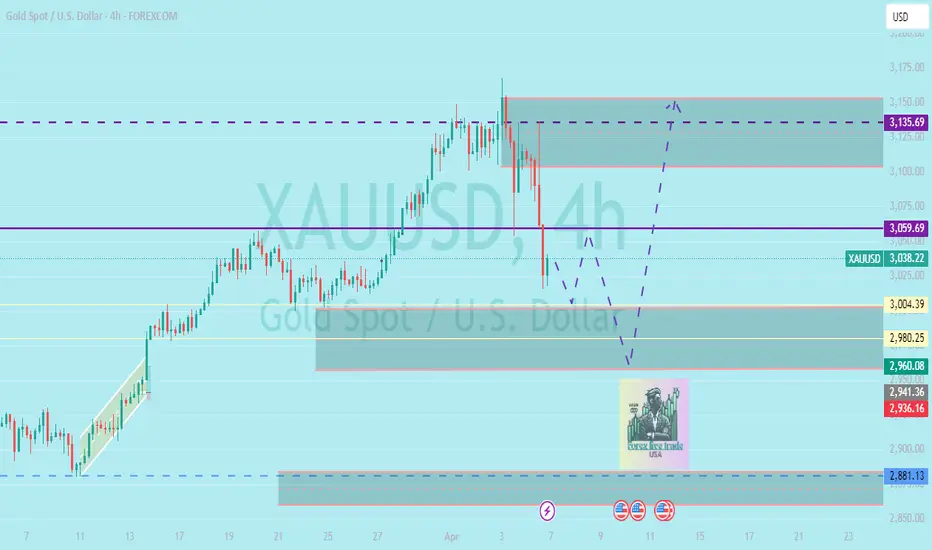

Gold (XAUUSD) has recently shown signs of weakness after rejecting the major supply zone near $3,135, followed by a sharp sell-off breaking through mid-range support around $3,059.

📉 Price Action Summary:

After printing a swing high around $3,135, price formed a distribution range with lower highs indicating selling pressure.

A strong bearish candle broke structure and pushed price below $3,059, confirming a short-term shift in market sentiment.

Price is now hovering around a high-probability demand zone between $3,004 and $2,980, where past accumulation was observed.

📈 Key Zones to Watch:

🔻 Support / Demand Zones:

$3,004 – $2,980: Key intraday demand zone, where buyers may step in.

$2,960 – $2,936: Additional support; if broken, opens up a path to:

$2,881: Weekly demand zone; potential for major reversal or bounce.

🔺 Resistance / Supply Zones:

$3,059: Previous structure support, now turned resistance.

$3,135: Higher time frame supply zone where price faced strong rejection.

$3,175 – $3,200: Weekly targets if bullish reversal plays out.

🧠 Fundamental Outlook (April 8–12, 2025):

This week is event-heavy, especially for the USD:

🔥 Key Events:

April 10 (Wednesday): 🔴 US CPI Data

A hot CPI print = Fed may stay hawkish → bearish for gold.

A soft CPI = weakening USD → bullish for gold.

April 11 (Thursday): 🟡 US PPI & Unemployment Claims

Could confirm or contradict CPI direction.

April 12 (Friday): 🟡 FOMC Member Speeches

Watch tone: Hawkish = USD strength; dovish = gold upside.

Gold (XAUUSD) has recently shown signs of weakness after rejecting the major supply zone near $3,135, followed by a sharp sell-off breaking through mid-range support around $3,059.

📉 Price Action Summary:

After printing a swing high around $3,135, price formed a distribution range with lower highs indicating selling pressure.

A strong bearish candle broke structure and pushed price below $3,059, confirming a short-term shift in market sentiment.

Price is now hovering around a high-probability demand zone between $3,004 and $2,980, where past accumulation was observed.

📈 Key Zones to Watch:

🔻 Support / Demand Zones:

$3,004 – $2,980: Key intraday demand zone, where buyers may step in.

$2,960 – $2,936: Additional support; if broken, opens up a path to:

$2,881: Weekly demand zone; potential for major reversal or bounce.

🔺 Resistance / Supply Zones:

$3,059: Previous structure support, now turned resistance.

$3,135: Higher time frame supply zone where price faced strong rejection.

$3,175 – $3,200: Weekly targets if bullish reversal plays out.

🧠 Fundamental Outlook (April 8–12, 2025):

This week is event-heavy, especially for the USD:

🔥 Key Events:

April 10 (Wednesday): 🔴 US CPI Data

A hot CPI print = Fed may stay hawkish → bearish for gold.

A soft CPI = weakening USD → bullish for gold.

April 11 (Thursday): 🟡 US PPI & Unemployment Claims

Could confirm or contradict CPI direction.

April 12 (Friday): 🟡 FOMC Member Speeches

Watch tone: Hawkish = USD strength; dovish = gold upside.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.