Gold in Tight Range | Waiting for the Big BreakOut After FOMC!

Gold is currently consolidating within a narrow range, building momentum for a potential major BreakOut.

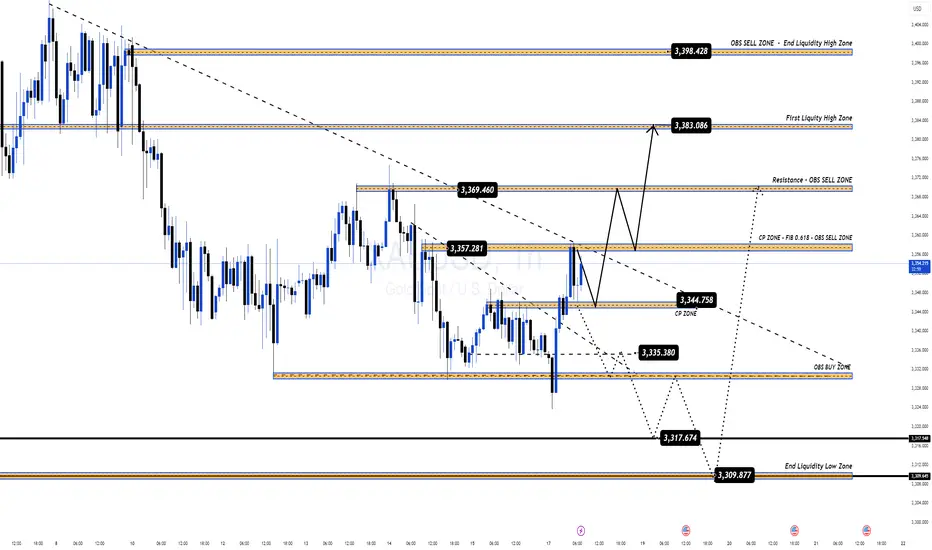

After Monday’s liquidity sweep, price has been moving strongly between 332x – 335x, but on the H1 timeframe it still remains locked in a descending channel.

Last week’s CPI & PPI data failed to set a clear direction, which is why this week’s focus will shift to the FOMC meeting. This is expected to deliver the decisive signal for gold’s next big move.

⏳ Early–Mid Week: With fewer major events, gold is likely to continue sideways within the narrow range or remain under mild selling pressure until the FOMC release.

🔑 Key Market Levels

Resistance: 3357 – 3369 – 3383 – 3398

Support: 3335 – 3317 – 3309

📌 Trading Setup

✅ BUY Zone: 3334 – 3332

SL: 3328

TP: 3338 – 3342 – 3346 – 3350 – 3355 – 3360 – 3370 – 3380

👉 A breakout above 336x could trigger a strong rally towards 3383 – 3398.

✅ SELL Zone: 3383 – 3385

SL: 3390

TP: 3378 – 3374 – 3370 – 3360 – 3350

👉 If gold fails at high resistance and reverses, it could sweep liquidity back to 333x – 331x, and potentially deeper towards 329x.

⚠️ Summary

Gold is at a critical decision point: BreakOut or BreakDown.

Before FOMC: expect sideways / mild downside inside H1 channel.

After FOMC: anticipate a strong Pump or Dump that will set the next trend.

🔥 Watch key levels 333x – 336x – 338x closely for market reactions and adjust strategy accordingly.

After Monday’s liquidity sweep, price has been moving strongly between 332x – 335x, but on the H1 timeframe it still remains locked in a descending channel.

Last week’s CPI & PPI data failed to set a clear direction, which is why this week’s focus will shift to the FOMC meeting. This is expected to deliver the decisive signal for gold’s next big move.

⏳ Early–Mid Week: With fewer major events, gold is likely to continue sideways within the narrow range or remain under mild selling pressure until the FOMC release.

🔑 Key Market Levels

Resistance: 3357 – 3369 – 3383 – 3398

Support: 3335 – 3317 – 3309

📌 Trading Setup

✅ BUY Zone: 3334 – 3332

SL: 3328

TP: 3338 – 3342 – 3346 – 3350 – 3355 – 3360 – 3370 – 3380

👉 A breakout above 336x could trigger a strong rally towards 3383 – 3398.

✅ SELL Zone: 3383 – 3385

SL: 3390

TP: 3378 – 3374 – 3370 – 3360 – 3350

👉 If gold fails at high resistance and reverses, it could sweep liquidity back to 333x – 331x, and potentially deeper towards 329x.

⚠️ Summary

Gold is at a critical decision point: BreakOut or BreakDown.

Before FOMC: expect sideways / mild downside inside H1 channel.

After FOMC: anticipate a strong Pump or Dump that will set the next trend.

🔥 Watch key levels 333x – 336x – 338x closely for market reactions and adjust strategy accordingly.

Dagangan aktif

📊 Daily Plan Update | +250 Pips Locked from MMF KeyLevelsGold has once again respected our KeyLevels with perfect reactions 🔥

🔑 3356 – 3358 → SELL +120 Pips | Full TP

🔑 3346 – 3344 → BUY +70 Pips | Scalping

🔑 3334 – 3332 → BUY +60 Pips

👉 Total: +250 Pips ✅

Once again, KeyLevels = Profits. Stay sharp and keep watching for the next golden opportunities! ✨

Updated chart:

⚜️ Trade with Money Market Flow, logic, Price action 📉📈

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+1rXbCGqCUAoyMmU9

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+1rXbCGqCUAoyMmU9

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

⚜️ Trade with Money Market Flow, logic, Price action 📉📈

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+1rXbCGqCUAoyMmU9

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+1rXbCGqCUAoyMmU9

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.