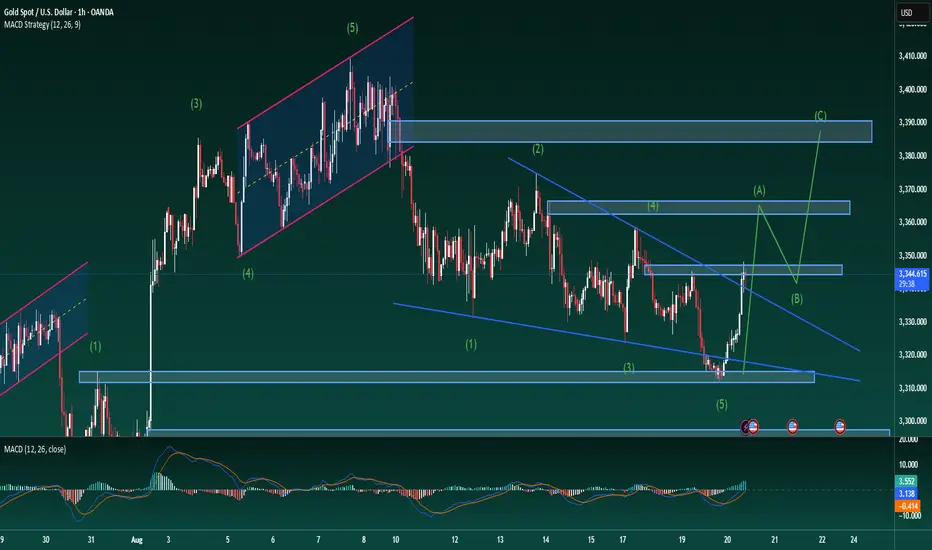

Gold Structure Shift – ABC Wave Taking Shape

Gold has completed its 5-wave decline under Elliott Wave theory and is now showing signs of recovery. This rebound is expected to mark the start of an ABC corrective phase, completing the overall Elliott structure.

The descending trendline has been broken, and medium-term timeframes have confirmed the move with strong closing candles, adding weight to the shift in market structure.

Attention now turns to the upcoming FOMC announcement. Traders are waiting for Chair Powell’s comments to see whether interest rate policy will shift in the midst of current market tensions.

The strategy remains to favour long positions. The newly formed H4 candle may retest 40–50% before continuing higher, providing an opportunity to enter fresh buys. Medium-term targets are set around the 3370–3380 zone.

Those holding long positions from earlier entries near 3316, as discussed in the previous update, should consider maintaining them. The recovery trend is strengthening, and well-managed positions could capture significant upside.

When market structure changes, new opportunities often follow. Staying patient and aligned with the corrective trend can offer the best results during this phase.

#XAUUSD #Gold #TechnicalAnalysis #PriceAction #ElliottWave #Fibonacci #Trendline #Forex #FOMC

Gold has completed its 5-wave decline under Elliott Wave theory and is now showing signs of recovery. This rebound is expected to mark the start of an ABC corrective phase, completing the overall Elliott structure.

The descending trendline has been broken, and medium-term timeframes have confirmed the move with strong closing candles, adding weight to the shift in market structure.

Attention now turns to the upcoming FOMC announcement. Traders are waiting for Chair Powell’s comments to see whether interest rate policy will shift in the midst of current market tensions.

The strategy remains to favour long positions. The newly formed H4 candle may retest 40–50% before continuing higher, providing an opportunity to enter fresh buys. Medium-term targets are set around the 3370–3380 zone.

Those holding long positions from earlier entries near 3316, as discussed in the previous update, should consider maintaining them. The recovery trend is strengthening, and well-managed positions could capture significant upside.

When market structure changes, new opportunities often follow. Staying patient and aligned with the corrective trend can offer the best results during this phase.

#XAUUSD #Gold #TechnicalAnalysis #PriceAction #ElliottWave #Fibonacci #Trendline #Forex #FOMC

💠Accurate signals 🥉 a standardised trading system.

🍑Free training and daily sharing of market experience.

t.me/+9B0zBuS1rboxZTY1

🍑Free training and daily sharing of market experience.

t.me/+9B0zBuS1rboxZTY1

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

💠Accurate signals 🥉 a standardised trading system.

🍑Free training and daily sharing of market experience.

t.me/+9B0zBuS1rboxZTY1

🍑Free training and daily sharing of market experience.

t.me/+9B0zBuS1rboxZTY1

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.