Gold 1H | Bullish Structure Supported by Safe-Haven Demand.

Analysis:

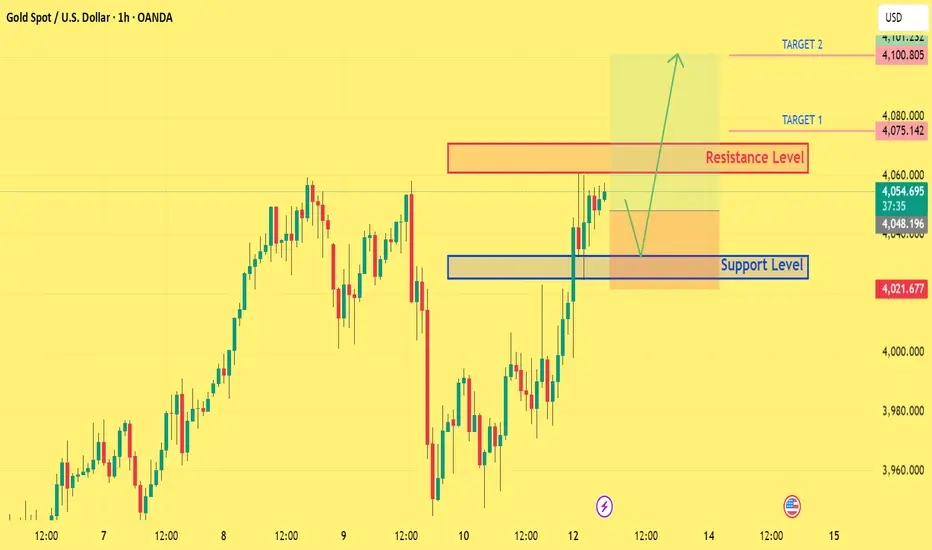

Gold is currently trading around 4054, maintaining a bullish market structure on the 1-hour timeframe. The price continues to create higher highs and higher lows, indicating sustained bullish momentum.

I’ve identified key support and resistance zones on the chart:

Support: 4032

Resistance: 4060

Targets (Observation Levels): 4075 and 4100

From a technical perspective, the bullish trend remains intact as long as the 4032 support area holds. A break above the 4060 resistance could open the path for the next leg higher.

Fundamental Context:

Recent tariff-related tensions introduced by President Trump have contributed to increased demand for safe-haven assets like gold, further supporting the bullish bias in the short term.

🕓 Timeframe: 1H

📊 Trend Bias: Bullish

📈 Technical Basis: Higher highs formation, support-resistance structure, and continuation pattern

💬 If you find this analysis useful, feel free to like, comment, and share your thoughts below!

Regards: Forex Insights Pro.

#Gold #XAUUSD #TechnicalAnalysis #MarketStructure #SafeHaven #TradingView #PriceAction #Forex #Commodities

Gold is currently trading around 4054, maintaining a bullish market structure on the 1-hour timeframe. The price continues to create higher highs and higher lows, indicating sustained bullish momentum.

I’ve identified key support and resistance zones on the chart:

Support: 4032

Resistance: 4060

Targets (Observation Levels): 4075 and 4100

From a technical perspective, the bullish trend remains intact as long as the 4032 support area holds. A break above the 4060 resistance could open the path for the next leg higher.

Fundamental Context:

Recent tariff-related tensions introduced by President Trump have contributed to increased demand for safe-haven assets like gold, further supporting the bullish bias in the short term.

🕓 Timeframe: 1H

📊 Trend Bias: Bullish

📈 Technical Basis: Higher highs formation, support-resistance structure, and continuation pattern

💬 If you find this analysis useful, feel free to like, comment, and share your thoughts below!

Regards: Forex Insights Pro.

#Gold #XAUUSD #TechnicalAnalysis #MarketStructure #SafeHaven #TradingView #PriceAction #Forex #Commodities

Dagangan aktif

Price moved as anticipated from the 4054 area, reaching the 4075 zone successfully. Market continues to respect the bullish structure, with momentum still supported by safe-haven demand amid tariff tensions. Watching price behavior for continuation toward higher resistance zones.#Gold #XAUUSD #MarketUpdate #TechnicalAnalysis #MarketStructure #SafeHaven #PriceAction #TradingView

Dagangan ditutup: sasaran tercapai

Gold maintained its bullish momentum from the 4054 zone and reached the 4100 level, as the move remained supported by global market turmoil and rising Fed rate-cut expectations. The trend continues to reflect strong safe-haven demand and positive sentiment.join our free signal channel t.me/ForexGoldpips81

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

join our free signal channel t.me/ForexGoldpips81

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.