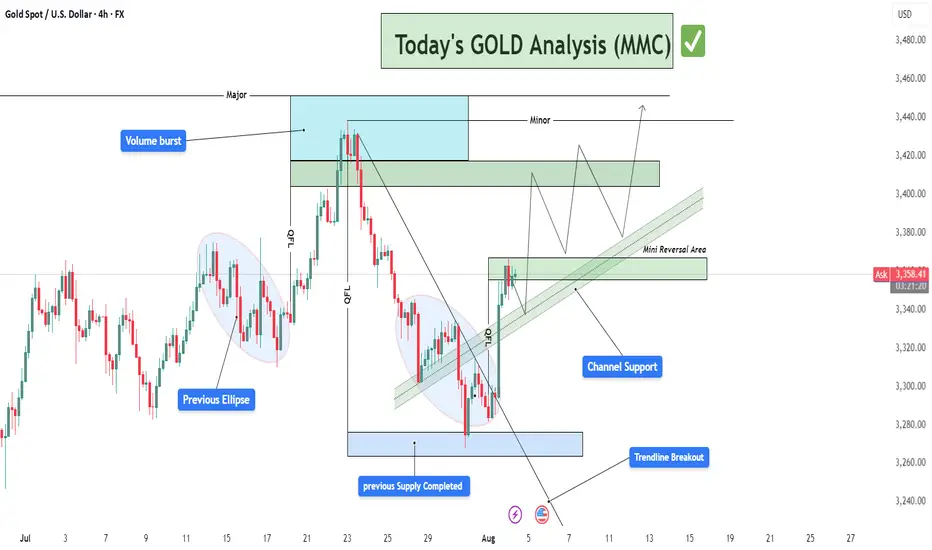

This analysis is rooted in MMC – Mirror Market Concepts, a framework designed to track institutional behavior through liquidity patterns, QFL (Quick Flip Levels), trendline shifts, and volume bursts. The current 4H Gold chart demonstrates a smart money footprint that provides actionable insight for intraday and swing traders.

🔍 Detailed Technical Breakdown:

🟦 1. Previous Supply Completed | Demand Zone Reversal

At the lower end of the chart, price entered a key blue zone around $3,250–$3,280, previously a supply zone now flipped into demand. This zone represents where institutional buyers absorbed liquidity, forming the base for a bullish impulse.

The strong reaction from this zone, marked by long-wick candles and immediate reversal, indicates exhaustion of selling pressure.

This reversal is confirmed by a QFL structure, meaning price created a fast liquidity sweep before flipping direction.

MMC recognizes this as a high-probability area of reversal, a point where smart money typically enters.

📈 2. Trendline Breakout & Structure Shift

A descending trendline, representing bearish market control, was decisively broken to the upside. This shift marks:

End of the corrective phase

Beginning of a bullish structural change

Buyers now control the short-term narrative

The breakout was not only clean but also supported by a volume burst, which is a classic MMC indicator that institutional traders are entering the market.

🔶 3. Volume Burst Confirmation

Volume behavior plays a critical role in MMC. We see a clear volume spike post-breakout. This suggests that:

The breakout is not false

Buyers were aggressively positioned

A sustainable move is in development

This supports the validity of the trendline breakout and confirms the idea that price is ready to test higher liquidity zones.

🟢 4. Current Price Structure: Bullish Channel

After the breakout, the market formed a bullish channel, where price is steadily climbing while respecting parallel boundaries.

The channel support line acts as a dynamic entry point for retracement buys

MMC strategy uses this structure to identify scaling entries at channel lows or after successful pullbacks into key reversal zones

🟩 5. Mini Reversal Area (Short-Term Resistance Zone)

Price is currently testing a minor supply zone or what MMC defines as a "Mini Reversal Area". This is a reaction zone before continuing toward the major target above.

There are two possible reactions:

Short-term rejection, leading to a pullback into the lower channel support zone

Minor consolidation, forming a base for a breakthrough toward major resistance

🟦 6. Major & Minor Supply Zones Above

Marked in light blue and green, these zones represent areas where previous selling volume and distribution occurred.

The major supply zone (approx. $3,440–$3,470) is the next institutional target

The minor zone sits between $3,400–$3,420 and may cause initial resistance or a base for another impulse

These levels are prime for partial profit-taking or scouting short-term reversal trades.

📊 Trade Management Insights:

🛒 Buy Opportunities (Long Bias):

On pullback into channel support near $3,340–$3,350

On bullish confirmation from mini reversal area

On break and retest above minor resistance at $3,420

🛑 Stop-Loss Suggestion:

Below the channel support or below the blue demand zone (approx. $3,245)

🎯 Profit Targets:

TP1: $3,400 (first resistance)

TP2: $3,420 (minor supply)

TP3: $3,450–$3,470 (major institutional level)

🧠 Mirror Market Concepts (MMC) Highlights:

QFL Structures = Institutional Reversal Points

Volume Burst = Confirmation of Breakout Validity

Trendline Breakout = Momentum Shift

Channel Structure = Controlled Climb Pattern

Mini Reversal Zone = Key Decision Point Before Continuation

🧭 TradingView Summary for Minds Community:

This GOLD chart beautifully aligns with the MMC method — spotting smart money involvement early and aligning with their flow. After confirming structural reversal via trendline and QFL, the setup now looks poised for continuation toward the $3,440–$3,470 zone, making it a perfect chart to watch for buy-the-dip setups.

🔍 Detailed Technical Breakdown:

🟦 1. Previous Supply Completed | Demand Zone Reversal

At the lower end of the chart, price entered a key blue zone around $3,250–$3,280, previously a supply zone now flipped into demand. This zone represents where institutional buyers absorbed liquidity, forming the base for a bullish impulse.

The strong reaction from this zone, marked by long-wick candles and immediate reversal, indicates exhaustion of selling pressure.

This reversal is confirmed by a QFL structure, meaning price created a fast liquidity sweep before flipping direction.

MMC recognizes this as a high-probability area of reversal, a point where smart money typically enters.

📈 2. Trendline Breakout & Structure Shift

A descending trendline, representing bearish market control, was decisively broken to the upside. This shift marks:

End of the corrective phase

Beginning of a bullish structural change

Buyers now control the short-term narrative

The breakout was not only clean but also supported by a volume burst, which is a classic MMC indicator that institutional traders are entering the market.

🔶 3. Volume Burst Confirmation

Volume behavior plays a critical role in MMC. We see a clear volume spike post-breakout. This suggests that:

The breakout is not false

Buyers were aggressively positioned

A sustainable move is in development

This supports the validity of the trendline breakout and confirms the idea that price is ready to test higher liquidity zones.

🟢 4. Current Price Structure: Bullish Channel

After the breakout, the market formed a bullish channel, where price is steadily climbing while respecting parallel boundaries.

The channel support line acts as a dynamic entry point for retracement buys

MMC strategy uses this structure to identify scaling entries at channel lows or after successful pullbacks into key reversal zones

🟩 5. Mini Reversal Area (Short-Term Resistance Zone)

Price is currently testing a minor supply zone or what MMC defines as a "Mini Reversal Area". This is a reaction zone before continuing toward the major target above.

There are two possible reactions:

Short-term rejection, leading to a pullback into the lower channel support zone

Minor consolidation, forming a base for a breakthrough toward major resistance

🟦 6. Major & Minor Supply Zones Above

Marked in light blue and green, these zones represent areas where previous selling volume and distribution occurred.

The major supply zone (approx. $3,440–$3,470) is the next institutional target

The minor zone sits between $3,400–$3,420 and may cause initial resistance or a base for another impulse

These levels are prime for partial profit-taking or scouting short-term reversal trades.

📊 Trade Management Insights:

🛒 Buy Opportunities (Long Bias):

On pullback into channel support near $3,340–$3,350

On bullish confirmation from mini reversal area

On break and retest above minor resistance at $3,420

🛑 Stop-Loss Suggestion:

Below the channel support or below the blue demand zone (approx. $3,245)

🎯 Profit Targets:

TP1: $3,400 (first resistance)

TP2: $3,420 (minor supply)

TP3: $3,450–$3,470 (major institutional level)

🧠 Mirror Market Concepts (MMC) Highlights:

QFL Structures = Institutional Reversal Points

Volume Burst = Confirmation of Breakout Validity

Trendline Breakout = Momentum Shift

Channel Structure = Controlled Climb Pattern

Mini Reversal Zone = Key Decision Point Before Continuation

🧭 TradingView Summary for Minds Community:

This GOLD chart beautifully aligns with the MMC method — spotting smart money involvement early and aligning with their flow. After confirming structural reversal via trendline and QFL, the setup now looks poised for continuation toward the $3,440–$3,470 zone, making it a perfect chart to watch for buy-the-dip setups.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.