One of my favorite setups that I love to trade is the range day's New York High of Day dump buying Low of Day. This setup does not require ANY "top down" analysis and only requires the 15-minute chart. All you need is to wait a couple hours after NY opened and run its course.

By waiting, you accomplish a few things

1. Avoid getting faked out

2. Get to see the day's ATR

3. Ability to calculate the day's position size better

4. Buy near the low of day, targeting the full daily range

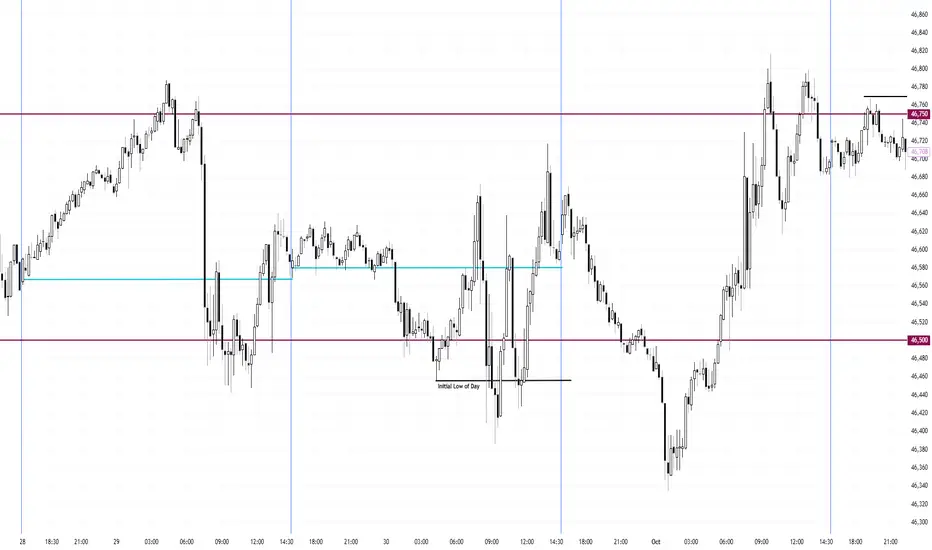

Below is the setup and the ideal entry point. One thing I have learned over the years is to never chase giant candles. The market will always give the best entry with the smallest possible candle.

Step One: 30 minutes before the open of New York

Mark the Daily Opening Price

Find and mark the initial low of day

Since you want to be buying the low of day, don't worry too much about the initial high of day. You are looking for the New York's high of day.

Initial HOD/LOD = Highs and Lows placed before NY

New York HOD/LOD = Highs and Lows made by NY

Step Two: Let NY open and do its thing. You are waiting for the NY HOD to be put in place.

How do you know when NY has put in it's High of Day? You wait for a swing point.

Step Three: Mark NY's High of Day

Step Four: Wait until price dumps down and takes out the initial Low of Day. You want to be buying as close to the lows as you can. Never get caught buying the highs of day.

Step Five: Mark the new NY Low of Day

Step Six: Wait for your entry

How will you know what the specific entry will be to enter? You won't 100% but what will help guide you is to not enter on giant bars.

Step Seven: Plan and Execute the trade

There are many variations of this setup and it is up to you to study and recognize the small differences. The market is not going to make it easy for you.

Two biggest tips is one, buy near the NY low of day and two, never chase giant candles. Wait for small bull candles near the low.

Another tip. If your high of day target has not been hit before NY closes, the best course of action is to set up a Good till Canceled bracket order and hold overnight until target hit. Taking small, partial profits will blow your account. You need full winners. The edge holding overnight is too good to close your trade at the NY close. Hold overnight.

By waiting, you accomplish a few things

1. Avoid getting faked out

2. Get to see the day's ATR

3. Ability to calculate the day's position size better

4. Buy near the low of day, targeting the full daily range

Below is the setup and the ideal entry point. One thing I have learned over the years is to never chase giant candles. The market will always give the best entry with the smallest possible candle.

Step One: 30 minutes before the open of New York

Mark the Daily Opening Price

Find and mark the initial low of day

Since you want to be buying the low of day, don't worry too much about the initial high of day. You are looking for the New York's high of day.

Initial HOD/LOD = Highs and Lows placed before NY

New York HOD/LOD = Highs and Lows made by NY

Step Two: Let NY open and do its thing. You are waiting for the NY HOD to be put in place.

How do you know when NY has put in it's High of Day? You wait for a swing point.

Step Three: Mark NY's High of Day

Step Four: Wait until price dumps down and takes out the initial Low of Day. You want to be buying as close to the lows as you can. Never get caught buying the highs of day.

Step Five: Mark the new NY Low of Day

Step Six: Wait for your entry

How will you know what the specific entry will be to enter? You won't 100% but what will help guide you is to not enter on giant bars.

Step Seven: Plan and Execute the trade

There are many variations of this setup and it is up to you to study and recognize the small differences. The market is not going to make it easy for you.

Two biggest tips is one, buy near the NY low of day and two, never chase giant candles. Wait for small bull candles near the low.

Another tip. If your high of day target has not been hit before NY closes, the best course of action is to set up a Good till Canceled bracket order and hold overnight until target hit. Taking small, partial profits will blow your account. You need full winners. The edge holding overnight is too good to close your trade at the NY close. Hold overnight.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.