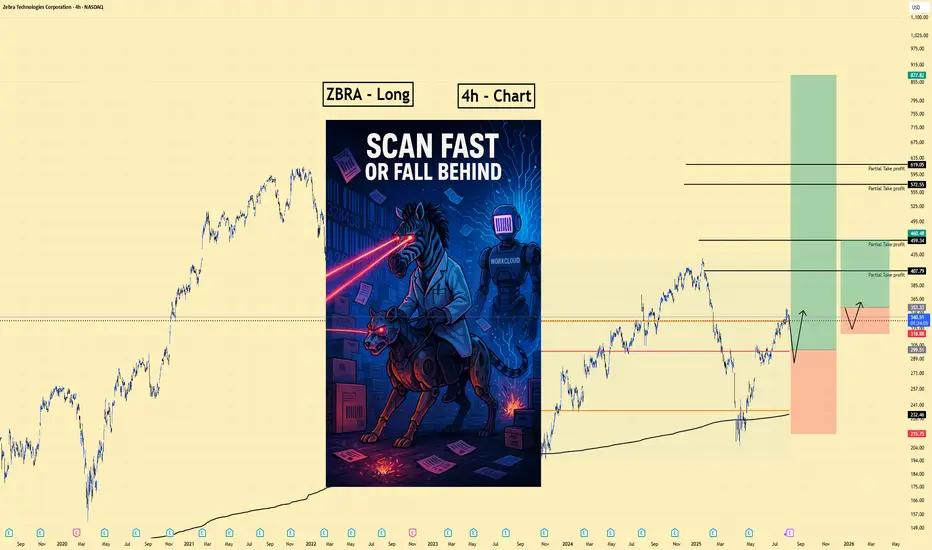

ZBRA | Long | Software-Led Breakout Setup | (Aug 2025)

1️⃣ Short Insight Summary:

ZBRA looks ready for a powerful move if it reclaims the $215 zone after a retest. With strong product momentum and a growing software/services business, this could be a breakout opportunity in the making.

2️⃣ Trade Parameters:

Bias: Long

Primary Entry: $215 (confirmed breakout and hold above)

Alternate Entry (Pullback Buy): Around $200–209 if price dips before continuation

Stop Loss: $190–195 (tight risk control under structure)

TP1: $247

TP2: $459

TP3: $572

TP4: $619

TP5: $800+ (multi-year structural upside)

3️⃣ Key Notes:

✅ Strong bounce potential if price reclaims $215 after recent weakness

✅ Long-term bullish structure with AI/software tailwinds (Workcloud, Google Cloud partnerships, new AI retail suite)

✅ Financials remain solid despite macro pressure (EPS beat, double-digit segment growth, 80% Fortune 500 clients)

❌ If price runs past $215 without retest, I won’t chase—waiting for setup confirmation

❌ Slow YoY revenue growth still a concern vs peers (watch how software rollout performs in H2 2025)

4️⃣ 💡 If this idea reaches 10+ likes 👍, I’ll post a detailed follow-up chart analysis with volume and risk management overlays!

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Every interaction helps keep the content free, pushes it to more traders, and motivates me to post deeper analysis here on TradingView.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

1️⃣ Short Insight Summary:

ZBRA looks ready for a powerful move if it reclaims the $215 zone after a retest. With strong product momentum and a growing software/services business, this could be a breakout opportunity in the making.

2️⃣ Trade Parameters:

Bias: Long

Primary Entry: $215 (confirmed breakout and hold above)

Alternate Entry (Pullback Buy): Around $200–209 if price dips before continuation

Stop Loss: $190–195 (tight risk control under structure)

TP1: $247

TP2: $459

TP3: $572

TP4: $619

TP5: $800+ (multi-year structural upside)

3️⃣ Key Notes:

✅ Strong bounce potential if price reclaims $215 after recent weakness

✅ Long-term bullish structure with AI/software tailwinds (Workcloud, Google Cloud partnerships, new AI retail suite)

✅ Financials remain solid despite macro pressure (EPS beat, double-digit segment growth, 80% Fortune 500 clients)

❌ If price runs past $215 without retest, I won’t chase—waiting for setup confirmation

❌ Slow YoY revenue growth still a concern vs peers (watch how software rollout performs in H2 2025)

4️⃣ 💡 If this idea reaches 10+ likes 👍, I’ll post a detailed follow-up chart analysis with volume and risk management overlays!

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Every interaction helps keep the content free, pushes it to more traders, and motivates me to post deeper analysis here on TradingView.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

2 Ways I Help Serious Traders Win | Real Trades. Ruthless Edge.

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

2 Ways I Help Serious Traders Win | Real Trades. Ruthless Edge.

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.