ZM Earnings (QuantSignals V3 | 2025-11-24)

Direction: BUY CALLS

Confidence: 58%

Expiry: 2025-11-28 (4 days)

Strike Focus: $80.00

Entry Range: $2.82 – $3.05 (mid: $2.93)

Target 1: $4.23 (50% gain)

Target 2: $5.49 (95% gain)

Stop Loss: $2.05 (30% loss)

Position Size: 2.5% of portfolio

Implied Move: $6.08 (~7.6%)

24h Price Move: –5.52%

Put/Call Ratio: 0.83 (Neutral)

Flow Intel: Neutral

Risk Level: 🔴 High Risk — small size recommended

Earnings Date: 2025-11-24 | Estimate: $1.48

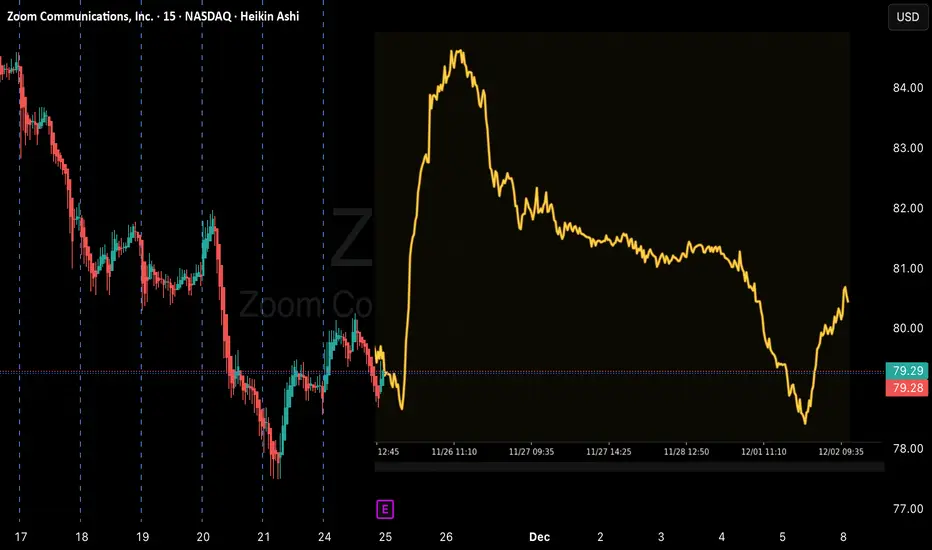

📈 Technical Overview

Current Price: ~$79.87

Support: $77.42

Resistance: $84.46

RSI: Oversold / bounce potential

Volume: 1.6× average → elevated pre-earnings activity

Trend: Moderate bullish momentum after selloff

Chart Tips:

Draw support at $77.42 and resistance at $84.46

Highlight option entry band $2.82–$3.05

Mark targets $4.23 / $5.49 and stop $2.05

Monitor RSI and post-earnings volatility

📰 Fundamental / Sentiment Notes

Earnings released today

Revenue growth: +1250%

Fed dovish remarks support tech

Neutral news sentiment but oversold technicals provide bounce opportunity

⚠️ Risk Notes

High implied volatility (VIX 23.43)

Moderate conviction due to pre-earnings selloff

Break below support $77.42 invalidates bullish thesis

Direction: BUY CALLS

Confidence: 58%

Expiry: 2025-11-28 (4 days)

Strike Focus: $80.00

Entry Range: $2.82 – $3.05 (mid: $2.93)

Target 1: $4.23 (50% gain)

Target 2: $5.49 (95% gain)

Stop Loss: $2.05 (30% loss)

Position Size: 2.5% of portfolio

Implied Move: $6.08 (~7.6%)

24h Price Move: –5.52%

Put/Call Ratio: 0.83 (Neutral)

Flow Intel: Neutral

Risk Level: 🔴 High Risk — small size recommended

Earnings Date: 2025-11-24 | Estimate: $1.48

📈 Technical Overview

Current Price: ~$79.87

Support: $77.42

Resistance: $84.46

RSI: Oversold / bounce potential

Volume: 1.6× average → elevated pre-earnings activity

Trend: Moderate bullish momentum after selloff

Chart Tips:

Draw support at $77.42 and resistance at $84.46

Highlight option entry band $2.82–$3.05

Mark targets $4.23 / $5.49 and stop $2.05

Monitor RSI and post-earnings volatility

📰 Fundamental / Sentiment Notes

Earnings released today

Revenue growth: +1250%

Fed dovish remarks support tech

Neutral news sentiment but oversold technicals provide bounce opportunity

⚠️ Risk Notes

High implied volatility (VIX 23.43)

Moderate conviction due to pre-earnings selloff

Break below support $77.42 invalidates bullish thesis

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.