Why Is Bitcoin Going Up? Weak Dollar, ETF Inflows and Trump Support Propel It to $118K

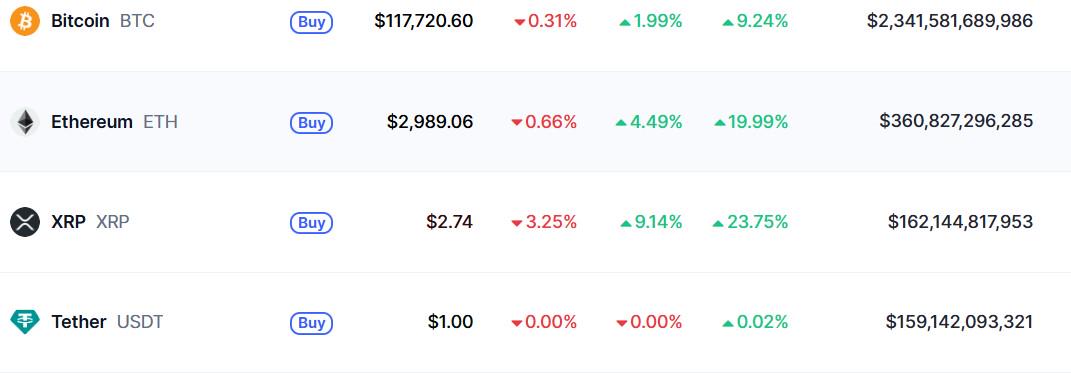

Bitcoin has once again hit a new milestone, soaring above $118,000 for the first time and shaking off months of sideways trading. As traders scrambled to cover short positions, institutional demand jumped via ETFs.

Behind the surge lies a confluence of forces. The weakening U.S. dollar, political support from the Trump administration, and favorable technical signals have created a bullish backdrop for the crypto sector.

The launch of spot bitcoin exchange-traded funds opened the floodgates to retail and institutional money alike, helping to push BTC into record territory.

BTCUSD daily price chart, source: TradingView

Trump Administration’s Crypto-Friendly Tone Plays a Role

Market participants have pointed to President Trump’s perceived support for digital assets as a key tailwind. The current administration’s posture, combined with recent legislative activity, is energizing the industry.

Just last month, the U.S. Senate passed the GENIUS Act, the first significant bill aimed at regulating stablecoins. The legislation is expected to provide clearer rules for dollar-pegged cryptocurrencies and build consumer confidence.

The House is set to review the bill next week, continuing what appears to be a coordinated effort to integrate digital assets more fully into the U.S. financial system. The crypto industry, one of the largest political donors during the 2024 campaign, has clearly carved out a place on Capitol Hill.

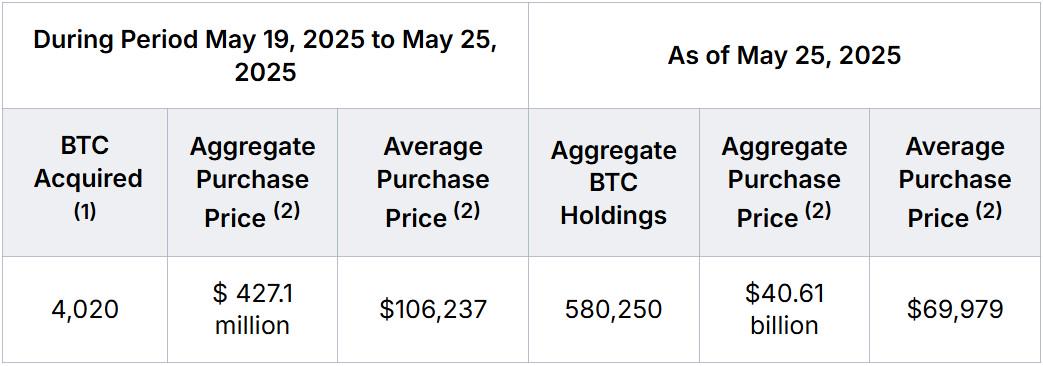

The rally isn’t confined to Bitcoin alone. Shares of crypto-related companies are climbing as well. Software firm Strategy (MSTR), which holds more bitcoin than any other publicly listed company, saw its stock rise nearly 3%. Miners such as MARA Holdings and Riot Platforms also booked gains, advancing 4% and 2% respectively.

Bitcoin’s year-to-date gain now stands at 26%, and its 12-month return exceeds 100%. The momentum has reignited interest in a sector that had struggled to regain its footing after previous bear markets.

Ethereum Trails Bitcoin

While Bitcoin basks in the spotlight, Ethereum is underperforming. ETH traded at $2,989 as of Friday, up 4% over 24 hours and nearly 20% in the past week. It continues to lag behind Bitcoin in both narrative and performance as investor attention remains focused on BTC’s breakout.

Source: CoinMarketCap

Bitcoin’s powerful surge to an all-time high failed to create a universal lift for crypto stocks, revealing a more nuanced investor response to the digital asset’s momentum. While some firms tied closely to bitcoin’s balance sheet or trading infrastructure rallied, others, including major exchanges and miners, fell behind.

Read more: Bitcoin Hits Another Record High, Tops $113,800 on Institutional Inflows

Winners: Strategy, Galaxy, and Bitcoin-Heavy Firms

Strategy (MSTR), known for holding the largest bitcoin position among public companies, advanced 3.2%. Galaxy Digital (GLXY), a provider of institutional crypto services, followed with a 4% gain.

Source: Strategy

Miners Ride and Stumble on BTC Gains

Several bitcoin miners saw their stocks rise as the value of mined coins increased. MARA Holdings (MARA) added 4%, Hive Digital (HIVE) gained 2%, and Riot Platforms (RIOT) edged up 1.5%.

Surprisingly, some high-profile names struggled. Coinbase (COIN) fell 1% despite broader crypto enthusiasm. Circle Internet (CRCL), the issuer of the USDC stablecoin, slid by 8%. Still, Circle’s stock remains elevated, over six times its IPO price of $31 just a month ago.