Canada maps out widening strait to LNG riches

Canada is ready to ride the energy-security wave. U.S. attacks on Iran and sabotaged pipelines in the Baltic Sea have intensified fears about the fragility of sea routes and supply chains. Financial and logistical edges open a potentially lucrative strait from the Great White North.

LNG Canada, a $32 billion joint venture among Shell, Malaysia’s Petronas and others, set sail into the murky liquified natural gas waters with its first shipment last week. Combined with other projects, the country is on track to represent nearly a fifth of LNG production capacity being constructed worldwide, according to the International Gas Union trade group. The Alberta government estimated it could become a top-five producer and exporter over the next decade.

Canada has some natural advantages in a market whose demand Wood Mackenzie analysts expect to grow about 60% – slower than solar, but faster than oil – over the next 25 years. Shell said in May that it is targeting 4% to 5% LNG sales increases annually through 2030. Colder weather also helps lower the price of cooling the gas into liquid form for transport to Asian buyers, even though they are geographically closer to Australian producers.

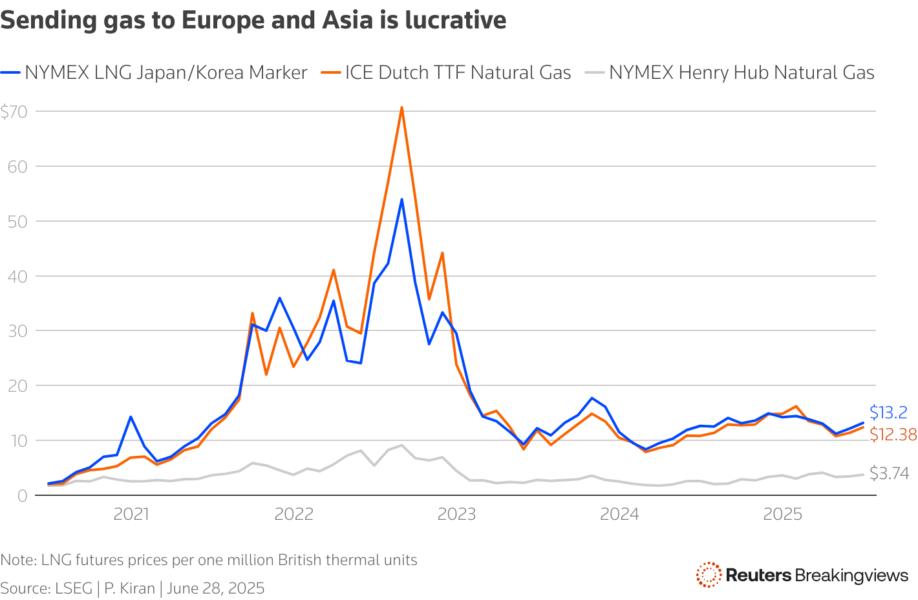

Exporting LNG from Canada to places such as South Korea and Japan can cost between $8.10 and $9.56 per thousand cubic feet, a significant discount to the $8.90 and $10.80 range for U.S. projects in the Gulf of Mexico, Albertan officials reckon, using data from Rystad Energy. Canadian shipments also avoid frequent chokepoints like the Panama Canal. Qatar, a major Asian supplier responsible for a fifth of global LNG trade, depends on the narrow Strait of Hormuz.

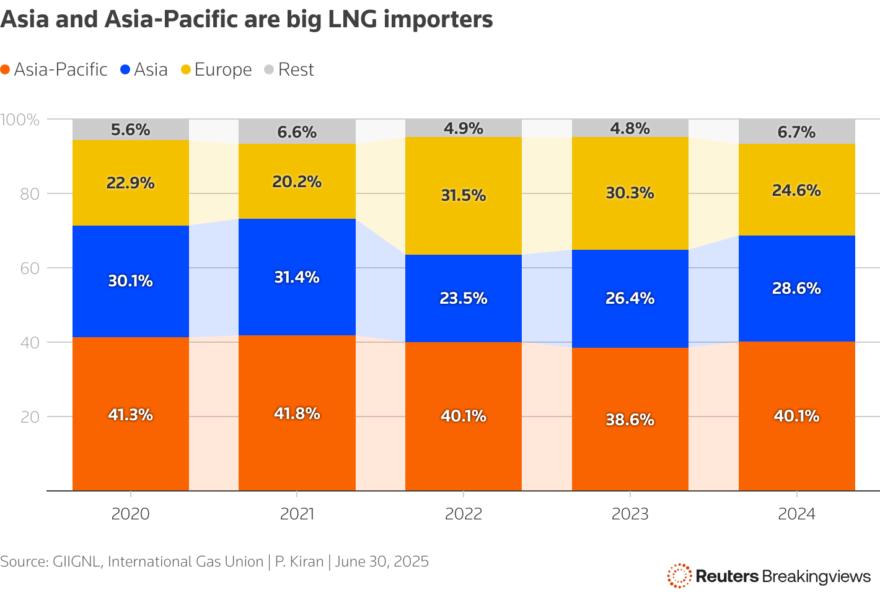

These impediments facing rivals add up, especially because gas prices are typically far higher outside the United States. Although demand in Europe is shrinking, India and China thirst for ever-growing amounts of LNG to help power their faster-growing economies. About 180 million more people will have access to the gas grid in those two countries alone by 2030, Shell says.

LNG is only becoming more strategically and geopolitically significant. Russian President Vladimir Putin’s attempts to weaponize Nord Stream conduits to Europe tilted the industry axis toward North America. Transitioning to renewable energy sources depends on affordable gas as a bridge. Electricity-guzzling artificial intelligence also will keep companies and utilities actively hunting for all types of fuel. The world’s pain is Canada’s gain.

CONTEXT NEWS

Shell Canada Energy said on June 30 that the first shipment of liquefied natural gas had left the LNG Canada facility, a joint venture among Shell, Petronas, PetroChina and others.

When fully operational, the site will have capacity to export 14 million metric tonnes per year, Shell Canada said.