Meta’s buy-and-build AI merger lacks synergy

Mark Zuckerberg’s latest merger will be incredibly hard to engineer successfully. The Meta Platforms META boss is trying to combine buying and building to turbocharge his ambitions in artificial intelligence. Although he created the social media empire using both approaches independently, there also have been flops along the way. It helps explain the challenge, evident in the company’s valuation, of uniting the best parts of each growth strategy.

Seeking an edge in AI makes sense given the technology’s promise, but it’s an expensive quest. Like Microsoft and other rivals, Zuckerberg is deploying vast sums of money to construct the data centers and all that goes with them to develop and operate large-language models processing massive volumes of information. Meta also has invested heavily in startups and splashed out to recruit engineers and researchers.

The company last month paid some $14 billion for a 49% stake in Scale AI that valued the “humanity first” venture at $29 billion, according to media reports. As part of the deal, founder Alexandr Wang joined Meta to head up a new Superintelligence Labs AI division. Zuckerberg also is personally reaching out to the industry’s best and brightest with pay packages exceeding $200 million, poaching at least 11 new hires from the likes of Apple, Google and OpenAI.

Meta’s capital expenditures are on track to reach nearly $70 billion this year, based on estimates compiled by Visible Alpha, more than triple the amount four years ago. And despite having about $40 billion in net cash, Zuckerberg is considering borrowing almost $30 billion from buyout shops Apollo Global Management, KKR and others to help fund AI initiatives, the Financial Times reported.

The profligacy involved in amassing staff, taking stakes at up-and-coming competitors, and redirecting Meta’s resources yet again reflects an effort to both keep up and catch up. Thus far, machine learning at the company that prides itself on an ability to “move fast and break things” has been hobbled by developmental delays and a lackluster reception in April to the fourth iteration of its cornerstone Llama project. One AI team member complained of a lack of vision and scattershot approach in an internal memo after he resigned, according to The Information.

With so much at stake, it’s no wonder Zuckerberg wants to somehow stitch together a highlight reel of past achievements to replicate. He spun Facebook into existence from his Harvard dorm room in 2004 and made it the backbone of a sprawling operation with 3.4 billion daily active users. It will be a case study on building something from scratch for years to come, especially after defying skeptics to successfully pivot the service from PCs to mobile and its advertising riches.

Buying Instagram for $1 billion in 2012 showcased Zuckerberg’s M&A skills. The photo-sharing app represented more than a quarter of Meta’s overall advertising revenue four years ago, according to court filings in the U.S. Federal Trade Commission’s lawsuit accusing the company of being a monopoly. If it now contributes about 36% of total ad sales, it would equate to some $65 billion. On the company’s 40% operating profit margin, it works out to be one heck of a deal.

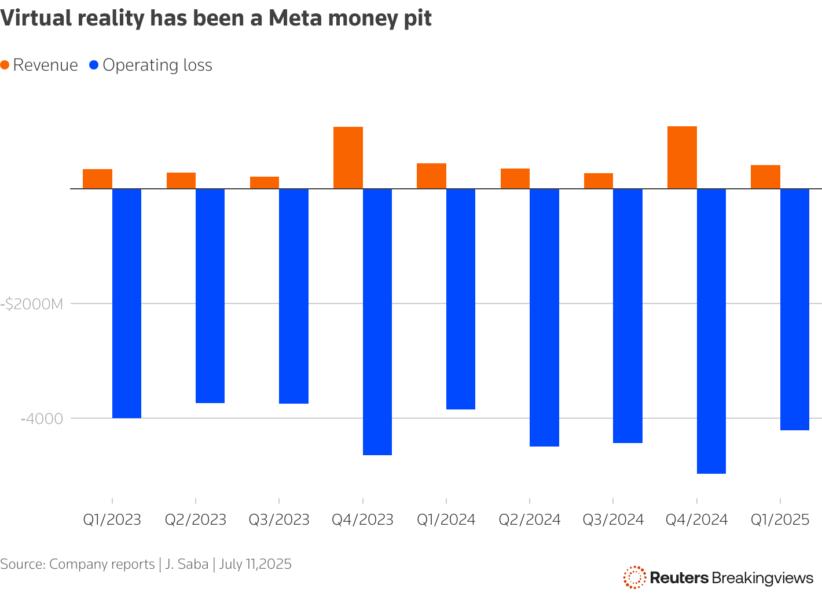

Zuckerberg has had notable duds in both categories, too. In 2021, he restructured the entire company around the metaverse, even going so far as to rebrand under the banner of virtual and augmented reality. Some $60 billion allocated to developing the software in its Reality Labs division has mostly just created operating losses. They widened to $4.2 billion in the first quarter alone from a year earlier.

The acquisition of WhatsApp is also hard to stack up financially. Despite increasing its popularity worldwide, there’s little return to show for the $19 billion spent on the messaging app more than a decade ago. Meta rolled out some ads in June, but the entire premise is a hard sell given how little the company knows about its estimated 2 billion encrypted users. Rival Signal is organized as a nonprofit and backed by WhatsApp co-founder Brian Acton.

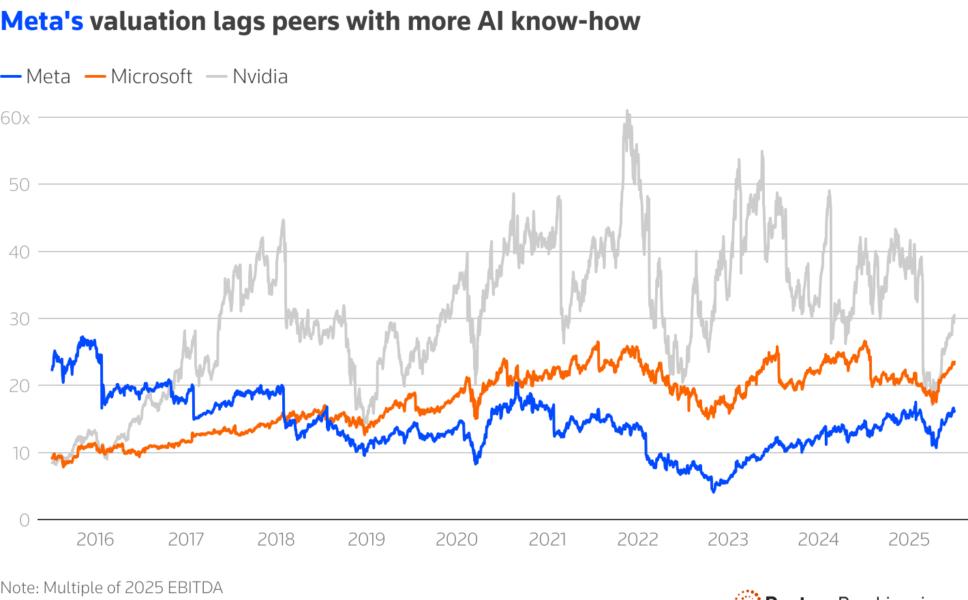

This checkered history makes Meta’s future in AI murky. Zuckerberg’s entire enterprise trades at 16 times its expected $109 billion in EBITDA for this year, per Visible Alpha, a discount to smaller peers Reddit and Pinterest.

Annualized growth of 24% at the flagship social network between 2018 and 2021 was impressive but half the pace of Instagram’s. Assuming similar trajectories for the ensuing four years, applying the company’s 58% EBITDA margin and putting Facebook on the same 12 times multiple as Google parent Alphabet would make it worth about $800 billion. Faster-expanding Instagram’s $38 billion of estimated EBITDA, using Breakingviews estimates, at a richer 18 times, imputes a $700 billion figure. On that basis, the apps family unit accounts for more than 80% of Meta’s value.

The remaining $300 billion is what investors are effectively ascribing to WhatsApp, the metaverse and Meta’s AI prospects. It’s a paltry sum considering the potential shifts to come in advertising and implies weaker faith in the promise of new developments than what’s embedded in the valuations of, say, Tesla under Elon Musk or Nvidia with Jensen Huang at the helm. Like so many traditional corporate marriages, merging Meta’s buy and build blueprints will probably create a jumbled mess lacking the necessary synergies to justify all the expense.

Follow Jennifer Saba on Bluesky and LinkedIn.

CONTEXT NEWS

Meta Platforms poached one of Apple’s top artificial intelligence executives, Ruoming Pang, with a pay package that exceeded $200 million, Bloomberg reported on July 9, citing unnamed sources.

Data-labelling startup Scale AI said on June 12 that the owner of social media apps Facebook and Instagram had invested in it at a $29 billion valuation, with Reuters citing unnamed sources that the amount invested was about $14 billion. Founder and CEO Alexandr Wang is joining Meta’s AI team as part of the transaction.