OPEN-SOURCE SCRIPT

Telah dikemas kini Trade Ladder Pro: Compounding & Risk Manager

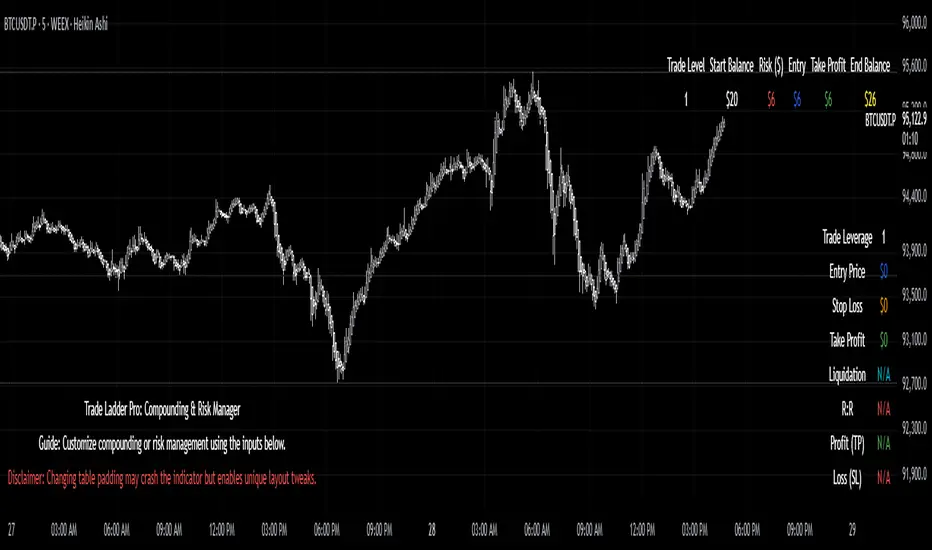

Trade Ladder Pro: Compounding & Risk Manager

Inspired by the popular $20 to $52,000 trading challenge, this tool is designed to help you scale your trading account using systematic compounding and enhanced risk management techniques. Whether you’re aiming for disciplined growth or fine-tuning your risk/reward, Trade Ladder Pro offers a flexible approach to visualizing your trade levels.

How to Use:

Inputs:

Compounding Mode:

Set your starting balance, final balance goal, number of trades, and current trade level. You can move to the next trade after a successful trade in settings. The entries are not signals. They are there to help manage risk.

The script calculates the necessary compounding factor to grow your balance across the defined trades.

Risk Management Mode:

In addition to the above, specify a risk percentage and risk/reward ratio.

Input an entry price (or leave it at 0 to use the current price) to automatically compute the stop loss and take profit levels.

Display Options:

Choose the table’s position on the chart (e.g., Top Right, Top Left, Bottom Right, Bottom Left).

Pick between a vertical or horizontal layout for a display that suits your workflow.

Results:

The table will display the trade level, starting balance, risk amount, entry price, take profit, and (if in Risk Management mode) stop loss along with the projected ending balance.

Community & Feedback:

Your feedback is invaluable! Please share any tips or report any errors you encounter so we can continue to improve this tool. Happy trading!

Inspired by the popular $20 to $52,000 trading challenge, this tool is designed to help you scale your trading account using systematic compounding and enhanced risk management techniques. Whether you’re aiming for disciplined growth or fine-tuning your risk/reward, Trade Ladder Pro offers a flexible approach to visualizing your trade levels.

How to Use:

Inputs:

Compounding Mode:

Set your starting balance, final balance goal, number of trades, and current trade level. You can move to the next trade after a successful trade in settings. The entries are not signals. They are there to help manage risk.

The script calculates the necessary compounding factor to grow your balance across the defined trades.

Risk Management Mode:

In addition to the above, specify a risk percentage and risk/reward ratio.

Input an entry price (or leave it at 0 to use the current price) to automatically compute the stop loss and take profit levels.

Display Options:

Choose the table’s position on the chart (e.g., Top Right, Top Left, Bottom Right, Bottom Left).

Pick between a vertical or horizontal layout for a display that suits your workflow.

Results:

The table will display the trade level, starting balance, risk amount, entry price, take profit, and (if in Risk Management mode) stop loss along with the projected ending balance.

Community & Feedback:

Your feedback is invaluable! Please share any tips or report any errors you encounter so we can continue to improve this tool. Happy trading!

Nota Keluaran

Trade Ladder Pro: Compounding & Risk ManagerAn advanced Pine Script tool designed to help you systematically scale your account and manage risk—with support for both long and short trades!

What It Does

Trade Ladder Calculations:

Calculate trade levels for both compounding and risk management strategies.

• In Compounding mode, it shows how your starting balance grows over a series of trades.

• In Risk Management mode, it computes your risk per trade, stop loss, take profit, ending balance, and a liquidation estimate based on your inputs.

Dual-Table Display:

The Main Table displays calculated trade metrics, while an Optional User Trade Data Table lets you input your own trade parameters (such as trade size, fees, entry, stop loss, and take profit) to estimate net profit/loss and risk-reward ratio.

Trade Direction & Leverage:

Choose between Long or Short trade strategies. Leverage (from 1x to 200x) is applied globally, affecting all calculations.

Price Update Flexibility:

In Risk Management mode, if you leave the Entry Price as zero, the indicator will update the price based on your chosen timeframe (Realtime, 1m, 5m, etc.), ensuring you see stable values on confirmed bar closes.

How to Use

Setup Your Parameters:

Set your Current Trade Level, Starting Balance, Final Balance Goal, and Number of Trades.

Select the global Trade Direction (Long/Short) and adjust your Leverage.

Choose Your Mode:

Compounding Mode: Best for tracking systematic account growth.

Risk Management Mode: Input your risk percentage and risk/reward ratio, and let the tool compute your stop loss, take profit, and liquidation levels.

Configure Price Updates:

Under Risk Management, if you don’t manually enter an Entry Price, the indicator will automatically fetch the close from your chosen timeframe (e.g., 5m).

Adjust the Price Update Timeframe to suit your trading style.

Review the Tables:

The Main Table shows calculated trade data based on your settings.

Optionally, enable the User Trade Data Table to input your own trade details (like trade size and fees) and view additional metrics such as net profit/loss and risk:reward ratio.

Experiment & Refine:

Tweak the inputs to see how different scenarios affect your risk management and potential outcomes.

Use both tables to compare calculated strategies versus your actual trade data.

Your Feedback & Support

Your input is invaluable! If you have suggestions or spot any issues, please let me know.

If you enjoy this creation, consider donating TradingView coins as a token of appreciation—your support helps me continue developing useful tools for the trading community.

Happy Trading!

Nota Keluaran

Trade Ladder Pro: Compounding & Risk ManagerInspired by the popular $20 → $52,000 trading challenge, Trade Ladder Pro is a Pine Script tool built to put exact dollar-risk control at the forefront of your workflow—while still offering a compounding path when desired.

Risk Management Mode (Primary)

Define Your Risk Percentage and Risk/Reward Ratio

Enter Your Price (or let the indicator auto-update from your chosen timeframe)

Set Leverage (1×–200×)

Output:

Dollar Amount at Risk

Stop-Loss Price

Take-Profit Price

Liquidation Estimate (if leveraged)

Projected Ending Balance

By locking in every dollar at risk and reward level before you send your order, you eliminate guesswork and maintain consistent capital preservation.

Compounding Mode

Starting Balance, Final Balance Goal (e.g. $20 → $50 000), Number of Trades

Calculates the uniform growth factor per trade

Displays incremental start balance, risk amount, entry/TP levels and anticipated end-balance

Ideal for visualizing disciplined exponential progression with precise dollar-risk transparency on each rung.

Display & Customization

Table Position: Top Right, Top Left, Bottom Right (default), Bottom Left

Layout: Vertical (default main table) or Horizontal

Table Padding: Adjust blank rows above data for unique layouts

Background Opacity: 50 % by default, with full color/opacity control

Welcome Message & Disclaimer: On-chart guide and warning about padding settings

How to Use

Select Risk Management (default) or Compounding mode.

Enter your parameters in the indicator settings.

Review the on-chart table to confirm your exact risk/reward levels before execution.

Release Notes

v1.1 introduces fully customizable table padding, background opacity settings, and an on-chart welcome guide/disclaimer—while preserving every feature from version 1.0.

Your feedback drives continuous improvement. Please report any issues or suggestions so we can keep refining this tool.

Happy trading!

Nota Keluaran

Trade Ladder Pro: Compounding & Risk ManagerInspired by the popular $20 → $52,000 trading challenge, Trade Ladder Pro is a Pine Script tool built to put exact dollar-risk control at the forefront of your workflow—while still offering a compounding path when desired.

Risk Management Mode (Primary)

Define Your Risk Percentage and Risk/Reward Ratio

Enter Your Price (or let the indicator auto-update from your chosen timeframe)

Set Leverage (1×–200×)

Output:

Dollar Amount at Risk

Stop-Loss Price

Take-Profit Price

Liquidation Estimate (if leveraged)

Projected Ending Balance

By locking in every dollar at risk and reward level before you send your order, you eliminate guesswork and maintain consistent capital preservation.

Compounding Mode

Starting Balance, Final Balance Goal (e.g. $20 → $50 000), Number of Trades

Calculates the uniform growth factor per trade

Displays incremental start balance, risk amount, entry/TP levels and anticipated end-balance

Ideal for visualizing disciplined exponential progression with precise dollar-risk transparency on each rung.

Display & Customization

Table Position: Top Right, Top Left, Bottom Right (default), Bottom Left

Layout: Vertical (default main table) or Horizontal

Table Padding: Adjust blank rows above data for unique layouts

Background Opacity: 50 % by default, with full color/opacity control

Welcome Message & Disclaimer: On-chart guide and warning about padding settings

How to Use

Select Risk Management (default) or Compounding mode.

Enter your parameters in the indicator settings.

Review the on-chart table to confirm your exact risk/reward levels before execution.

Release Notes

v1.1 introduces fully customizable table padding, background opacity settings, and an on-chart welcome guide/disclaimer—while preserving every feature from version 1.0.

Your feedback drives continuous improvement. Please report any issues or suggestions so we can keep refining this tool.

Happy trading!

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.