OPEN-SOURCE SCRIPT

Telah dikemas kini MACD Multi-MA Strategy

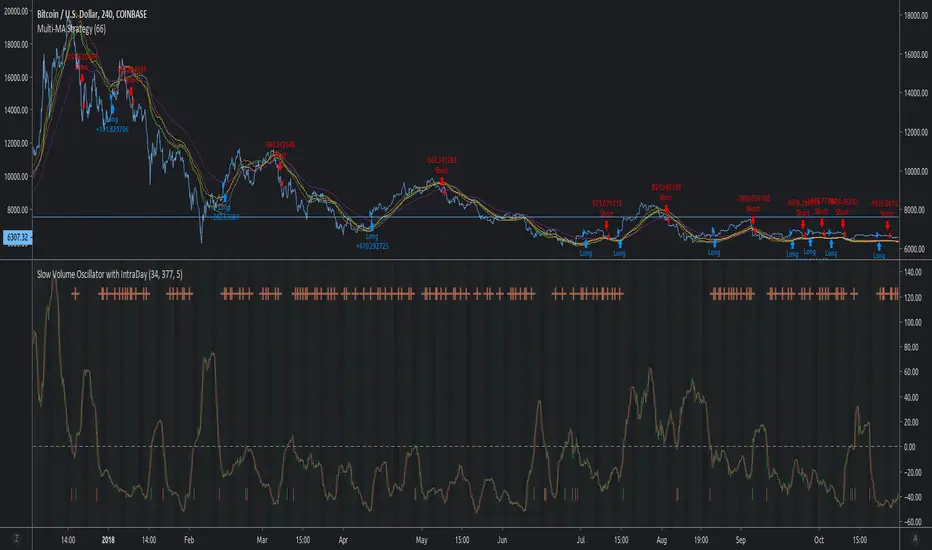

This script applies the average of each major MA (SMA, RMA, EMA, WVMA, WMA) to the MACD formula.

The logic is simple. When all 5 MA's are in agreement in direction, then then script will notify users of change.

I posted this as a strategy to help show how logic does in back test. If you use my simple yet effective solution to find take profit locations, you can blow this back testing out of the water!!!

To set alerts simply turn script into study

//version=2

study(title="MACD Multi-MA Study", overlay=false)

src = close

len1 = input(8, "FAST LOOKBACK")

len2 = input(144, "SLOW LOOKBACK")

/////////////////////////////////////////////

length = len2-len1

ma = vwma(src, length)

plot(ma, title="VWMA", color=lime)

length1 = len2-len1

ma1 = rma(src, length1)

plot(ma1, title="RMA", color=purple)

length2 = len2-len1

ma2 = sma(src, length2)

plot(ma2, title="SMA", color=red)

length3 = len2-len1

ma3 = wma(src, length3)

plot(ma3, title="WMA", color=orange)

length4 = len2-len1

ma4 = ema(src, length4)

plot(ma4, title="EMA", color=yellow)

long = ma > ma[1] and ma1 > ma1[1] and ma2 > ma2[1] and ma3 > ma3[1] and ma4 > ma4[1]

short = ma < ma[1] and ma1 < ma1[1] and ma2 < ma2[1] and ma3 < ma3[1] and ma4 < ma4[1]

alertcondition(long == true, title='MACD LONG SIGNAL', message='MACD LONG!')

alertcondition(short == true, title='MACD SHORT SIGNAL', message='MACD SHORT!')

The logic is simple. When all 5 MA's are in agreement in direction, then then script will notify users of change.

I posted this as a strategy to help show how logic does in back test. If you use my simple yet effective solution to find take profit locations, you can blow this back testing out of the water!!!

To set alerts simply turn script into study

//version=2

study(title="MACD Multi-MA Study", overlay=false)

src = close

len1 = input(8, "FAST LOOKBACK")

len2 = input(144, "SLOW LOOKBACK")

/////////////////////////////////////////////

length = len2-len1

ma = vwma(src, length)

plot(ma, title="VWMA", color=lime)

length1 = len2-len1

ma1 = rma(src, length1)

plot(ma1, title="RMA", color=purple)

length2 = len2-len1

ma2 = sma(src, length2)

plot(ma2, title="SMA", color=red)

length3 = len2-len1

ma3 = wma(src, length3)

plot(ma3, title="WMA", color=orange)

length4 = len2-len1

ma4 = ema(src, length4)

plot(ma4, title="EMA", color=yellow)

long = ma > ma[1] and ma1 > ma1[1] and ma2 > ma2[1] and ma3 > ma3[1] and ma4 > ma4[1]

short = ma < ma[1] and ma1 < ma1[1] and ma2 < ma2[1] and ma3 < ma3[1] and ma4 < ma4[1]

alertcondition(long == true, title='MACD LONG SIGNAL', message='MACD LONG!')

alertcondition(short == true, title='MACD SHORT SIGNAL', message='MACD SHORT!')

Nota Keluaran

Sorry for the confusion. I stumbled upon good results thinking I was using MACD formula. Turns out I was only using partial formula. The mistake just goes to show how uncomplicated a script needs to be to give good back testing results even on a line chart.

Nota Keluaran

Updated version with 4H setting at 66 just to show better backtest. See comment section below to test other lookback periods for other timeframesI also changed overlay to true to save space on your screen

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.