OPEN-SOURCE SCRIPT

Telah dikemas kini [blackcat] L3 Swing Trading Zones

Level 3

Background

For swing trading, I consider a combination of multiple technical indicators to indicate periods of long and short positions.

Function

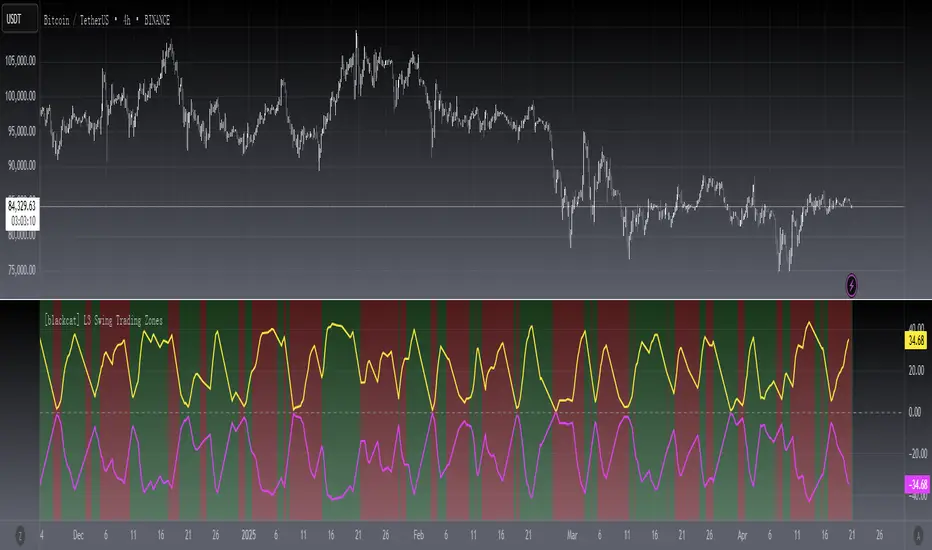

First, judge the daily-level long and short recommendations by the J value of the KDJ indicator in the weekly cycle. in addition. Second, draw bull-bear lines by integrating existing technical indicators such as rsi, adx, cci, dmi, etc. The bull line is above 0, the bear line is below 0, and the other is offsetting each other. When both are relatively close to the zero axis, it means that the strength is equal, and there will be signs of sideways.

Remarks

"D" timeframe ONLY.

Feedbacks are appreciated.

Background

For swing trading, I consider a combination of multiple technical indicators to indicate periods of long and short positions.

Function

First, judge the daily-level long and short recommendations by the J value of the KDJ indicator in the weekly cycle. in addition. Second, draw bull-bear lines by integrating existing technical indicators such as rsi, adx, cci, dmi, etc. The bull line is above 0, the bear line is below 0, and the other is offsetting each other. When both are relatively close to the zero axis, it means that the strength is equal, and there will be signs of sideways.

Remarks

"D" timeframe ONLY.

Feedbacks are appreciated.

Nota Keluaran

OVERVIEWThe [blackcat] L3 Swing Trading Zones indicator is designed to help traders identify potential swing trading opportunities by analyzing various technical factors. This script combines multiple indicators and algorithms to highlight key zones where price movements are likely to reverse or continue. By plotting these zones on the chart, traders can make more informed decisions about entering and exiting trades 📈💹.

FEATURES

Combines several technical indicators for comprehensive analysis:

KDJ: A momentum oscillator similar to Stochastic.

RSI-based calculations: Relative Strength Index variations.

CCI-based calculations: Commodity Channel Index variations.

DMI-based calculations: Directional Movement Index variations.

Swing Alpha/Beta: Custom indicators for identifying swing points.

Plots key zones on the chart using distinct colors:

Yellow lines indicate potential buy zones.

Fuchsia lines indicate potential sell zones.

Uses background coloring to highlight bullish and bearish trends:

Green background for bullish trends.

Red background for bearish trends.

HOW TO USE

Add the indicator to your TradingView chart by selecting it from the indicators list.

Adjust the parameters (n1, n2, n3) as needed to fine-tune the sensitivity of the indicator ⚙️.

Observe the plotted yellow and fuchsia lines on the chart to identify potential swing trading zones.

Use the background coloring as additional context for market sentiment analysis.

Combine this indicator with other forms of analysis for more reliable trading decisions.

LIMITATIONS

The indicator may generate false signals in highly volatile or ranging markets 🌪️.

Users should always confirm signals with other tools before making trading decisions.

The effectiveness of the indicator may vary depending on the asset and timeframe being analyzed.

NOTES

Ensure that you have sufficient historical data available for accurate calculations.

Test the indicator thoroughly on demo accounts before applying it to live trading 🔍.

Customize the appearance and parameters as needed to fit your trading strategy.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.